The Polish gaming sector worth ~€1.3B has captured the attention of gamers, investors, and enthusiasts worldwide. From international recognition of its hit titles like The Witcher to a rising esports scene and ecosystem for gaming startups, the gaming industry in Poland has undergone a significant transformation in the past 30 years, leading the way in the CEE region and securing a strong position in the global stage.

In the following article, The Recursive dives into the roots of the Polish gamedev success, highlighting the most notable companies, the market’s strengths, and rising startups.

Gaming industry in Poland in numbers

Poland holds a significant position in the global video game market, boasting one of the largest video game sectors worldwide. According to a 2023 game industry report by the Polish Agency for Enterprise Development (PARP), Poland is home to nearly 500 game production and publishing studios and employs over 15,000 individuals. Out of the studios, 16 employ 200+ people, and about third hires up to 5 people.

In 2022, the Polish game industry generated a revenue of nearly €1.29B, as reported by PARP. However, despite experiencing a 250% growth over the past five years, the country’s earnings were surpassed not only by the UK and France, Europe’s largest gaming markets, but also by Germany, Finland, and Sweden.

In terms of the workforce, Poland positions itself in the top three European markets, following the UK and France and outperforming significant ecosystems like Germany, Spain, or Sweden. Notably, approximately one-fourth of the employees are female (24%) — which is among the highest shares worldwide.

The report highlights that 17-20M (47% women) Poles identify as gamers, representing nearly half of the population.

Warsaw Stock Exchange (WSE)

In 2019, recognizing the increasing significance of the gaming industry in the country, the Warsaw Stock Exchange introduced a dedicated index known as the WIG Games Index. This move was part of the exchange’s strategy to attract technology firms. By 2020, the number of gaming companies listed on the WSE was 54 (today nearly 90), surpassing the Tokyo Stock Exchange, which was the previous global leader in this aspect.

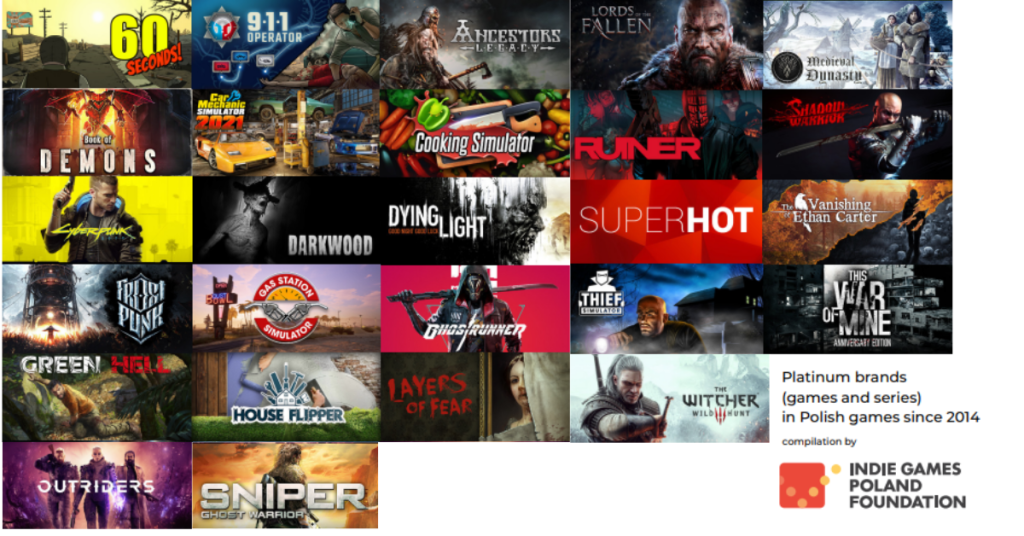

Polish gaming development and legends

The roots of the Polish gamedev sector can be traced to the 1990s when personal computers became more accessible. However, it wasn’t until the 2000s that Poland started to make its mark on the global gaming industry with the country’s two most renowned studios CD Projekt and Techland.

Founded in 1994, CD Projekt shook the gaming sector with the AAA game The Witcher (2007) and its sequels, including The Witcher 3: Wild Hunt (2015) which won over 260 game-of-the-year awards and is considered one of the greatest games of the generation. In 2020, CD Projekt released another prominent video game Cyberpunk 2077. Notably, the company’s revenue accounted for 1/3 of total Poland’s gaming revenue in 2020 (€480M) and ranks in the top 10 largest gaming companies worldwide.

Furthermore, the second most popular gamedev studio Techland established in 1991 released the popular games Call of Juarez (2006) with a prequel in 2009, as well as Dead Island (2011) and Dying Light (2015). In 2018, Techland recorded a revenue of €41M. In July 2023, Techland announced its majority stake was acquired by the Chinese tech giant Tencent to boost the execution of future games.

Other notable Polish gaming companies include 11 bit studios (This War of Mine, 2014; Frostpunk, 2018) founded by former CD Projekt developers in 2010 and People Can Fly known for its releases of Gears of War: Judgement (2013) and Outriders (2021). In 2020, the Polish government marked a significant milestone by including 11-bit studios’ This War of Mine in the official school reading list, establishing it as the inaugural video game to receive such recognition from a national government.

In 2022, Polish gaming companies released over 530 titles, most commonly in the PC, mobile, and Switch game categories. Polish game development studios have been proactive in expanding their market reach, translating games into multiple languages. This practice has contributed to the success of the industry, with over 65% of games produced in Poland being translated into more than two languages, a higher percentage compared to games from outside Poland.

Gamedev education in Poland

The gamedev education sector in Poland, while relatively young within the higher education system, has played a significant role in the growth of employment within the game industry. Over the past decade, educational offerings have expanded, providing a diverse range of training options. Currently, there are 65 gaming-related courses at 52 universities. A considerable portion of these courses focuses on programming, building on Poland’s reputation for producing skilled programmers.

When compared to other European countries, Poland’s gamedev education offerings are on par with Western countries. Moreover, Poland offers non-degree courses and developments at high schools. These initiatives aim to nurture skills and talents at an earlier stage, contributing to a pipeline of aspiring game developers for the industry. Additionally, a strong focus on math education in Polish schools has also played a role in the industry’s achievements.

Esports

Esports, as a form of competition using video games, has gained substantial traction in Poland, hosting prominent events like the Intel Extreme Masters Katowice with 23.3M hours watched in 2023 and average viewership of 234K. In 2022, the esports market value in Poland reached $12.6M.

As of recent reports, popular games among Polish esports enthusiasts include FIFA, League of Legends, and Counter-Strike. The country’s strong gaming culture, competitive teams, and active player and viewer base showcase a vibrant esports scene with growing recognition and potential for further development.

Polish gaming startups on the rise

IndieBI

Established: 2021, Lodz

Founders: Tom Kaczmarczyk, Callum Underwood

About: IndieBI is a sales and business intelligence platform designed to help video game developers and publishers gather, analyze, and understand their sales, marketing, and financial data, leading to better-informed decisions, more effective planning.

Highlight: In 2021, IndieBI closed a ~€2.7M seed round.

Gamesture

Established: 2014, Krakow

Founders: Tom Drozdzynski, Łukasz Lato

About: Gamesture is a mobile game developer known for creating mobile games including Questland, Slash & Roll, and The Gang that blend modern innovation with a nostalgic touch, reflecting the creators’ passion for the games that influenced them in their childhood.

Highlight: In 2023, Gamesture raised ~€2.5M corporate round from a Polish mobile and browser games developer, Ten Square Games.

GGPredict

Established: 2019, Warsaw

Founders: Przemysław Siemaszko, Daniel Zawadzki, Mateusz Kamola

About: GGPredict is an AI-driven coaching platform for esports enthusiasts, utilizing a sophisticated data extraction tool to analyze players’ performance, offering personalized training plans, and creating a cohesive training environment through game servers, while fostering a growing community around esports development.

Highlight: GGPredict secured a ~€910K seed round from ff Venture Capital and a ~€730K grant in 2021.

inSTREAMLY

Established: 2018, Warsaw

Founders: Maciej Sawicki, Szymon Kubiak, Wiktoria Wójcik, Damian Konopka

About: InSTREAMLY is an automated platform for esports organizations, MCNs, agencies, and tournament organizers connecting brands and streamers, allowing streamers to monetize their content through micro-sponsorships while providing brands an innovative way to engage with Generation Z.

Highlight: In 2021, inSTREAMLY secured a seed round of €1.1M led by UK-based Supernode Global venture capital.

Immersion Games

Established: 2020, Warsaw

Founder: Piotr Baczyński

About: Immersion Games is a PC and VR game developer, part of an international VR studio, focusing on creating original AR/VR titles that aim to be distinctive and immersive, with a strong emphasis on the latest portable headset technology.

Highlight: Immersion Games raised a ~€1.1M pre-seed round in 2020.

The article presents a selection of rising Polish gaming startups, featuring solutions from various areas.