This week, the results of the Venture Capital Survey 2024, conducted yearly by the European Investment Fund (EIF) with the support of Invest Europe, were announced. With 624 GPs (398 VC; 226 PE) contributing, it is the largest of its kind in Europe.

As the VC market faces a complex mix of challenges and opportunities, the insights presented in the EIF Venture Capital Survey 2024 are highly anticipated. This comprehensive study not only examines recent developments but also captures the prevailing market sentiment among fund managers and investors.

A common pattern across all survey results is that even though current market conditions have slightly improved compared to a year ago, they are still perceived as difficult. Expectations going forward, however, are now much more optimistic.

Let’s dive in…

3 out of the top 4 challenges in the VC business are related to fundraising

While more than 60% of VC fund managers still perceive a challenging fundraising climate, expectations for improvement are emerging. In fact, half of the surveyed VCs anticipate a more favorable fundraising environment in the next 12 months, marking the highest optimism since the survey began in 2018.

In light of ongoing issues, VC fund managers report that portfolio companies performed worse than expected. Securing equity financing and recruiting high-quality professionals have consistently been the foremost challenges for founders, while customer acquisition and retention re-gained importance on the list.

Despite these obstacles, there is a flicker of optimism, with many fund managers expecting positive net asset value (NAV) evolution in the coming year. One-third of VCs anticipate NAV increases between 10% and 25%, suggesting that some portfolio companies are set for growth.

Weaknesses within the European VC market

Fundraising difficulties are especially increased by structural weaknesses within the European VC market.

A significant scale-up financing gap limits growth opportunities for VC-backed companies, with approximately 60% of fund managers deeming the financing conditions inadequate. This shortage is partly due to a lack of private domestic limited partners (LPs) and large institutional investors.

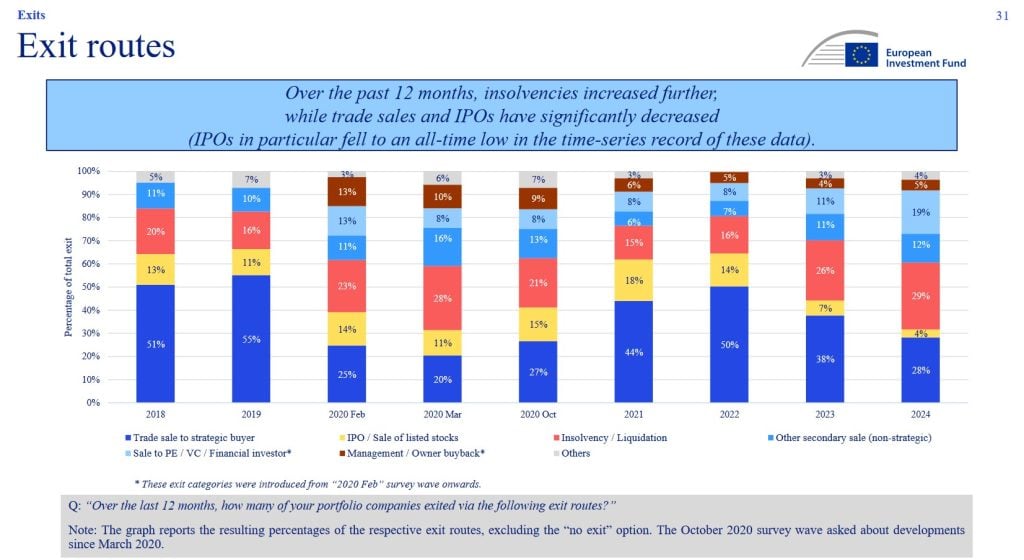

When it comes to exits, prices have decreased for three years, and insolvencies have reached record highs. Trade sales and IPOs have also declined significantly, with IPOs in particular falling to an all-time low in the survey record of these data.

Furthermore, the trend of trade sales and IPOs increasingly involving non-EU buyers highlights the limited domestic exit options available to European startups. These structural limitations not only hinder the growth potential of portfolio companies but also restrict VCs from realizing returns.

Areas of interest

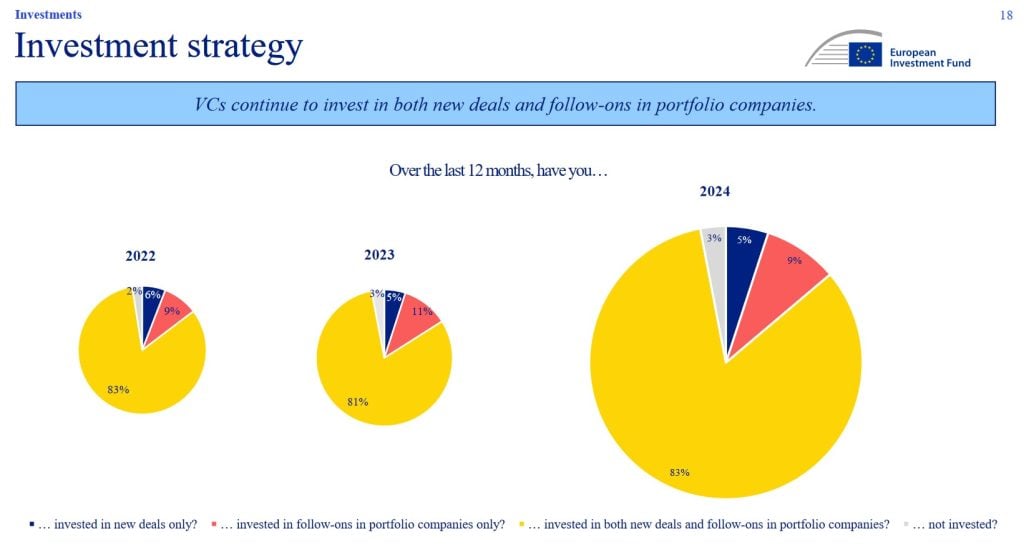

Despite the prevailing challenges, there are signs of emerging optimism within the VC community. As investment activity begins to accelerate for the first time in three years, many fund managers are witnessing an uptick in incoming proposals.

Sectors such as AI, Deeptech, and Cleantech (Environment) are being highlighted as promising areas for future investments. Many fund managers have active companies in these areas, which are expected to remain vital in future portfolios. This renewed interest may indicate that the VC landscape is on the brink of recovery.

Confidence in the long-term growth of the European VC industry has also slightly improved, remaining well above the average on the confidence scale. Will that confidence help them overcome these difficulties, time will tell…

For more valuable insights get the full report.