The European tech ecosystem has experienced remarkable growth over the past decade, as highlighted in Atomico’s 10th edition of the State of European Tech. While the overall picture shows significant progress, disparities remain between Western Europe and Central and Eastern Europe. By examining investment trends, growth rates, and ecosystem challenges, this article compares the two regions to understand their unique trajectories and shared obstacles.

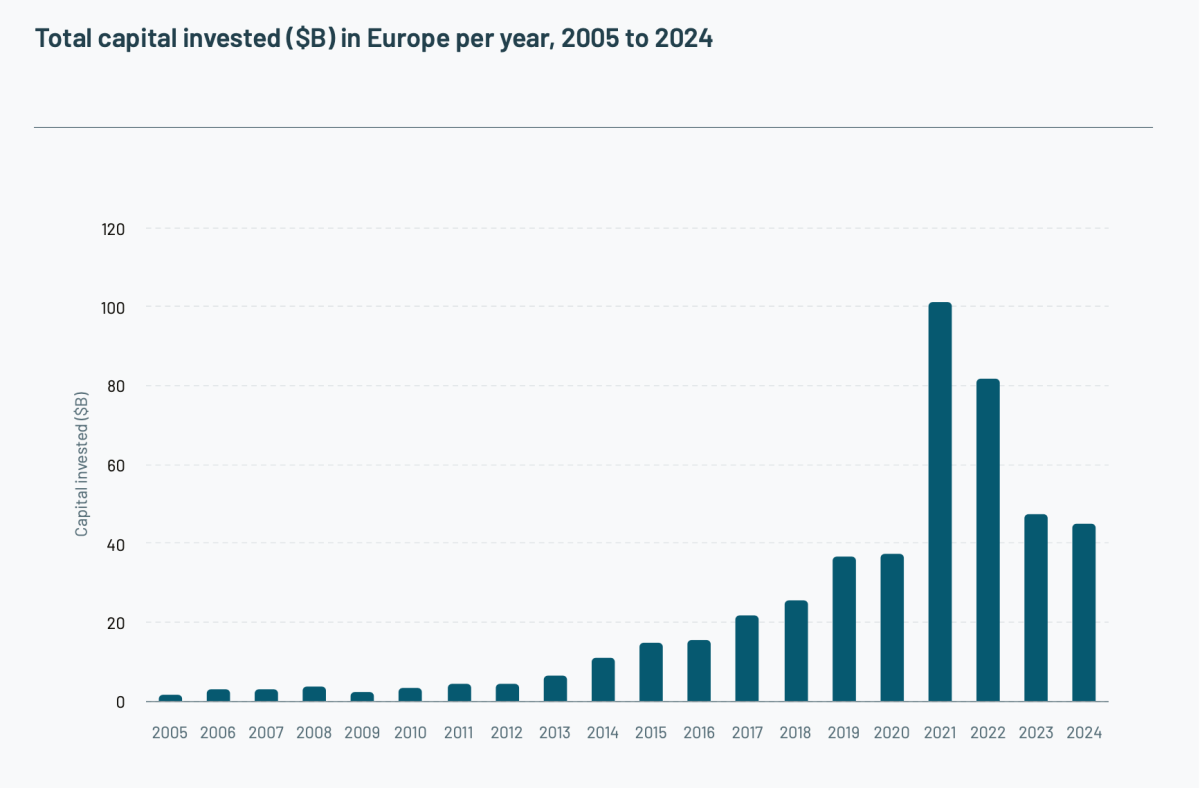

Europe’s tech investment levels have surged from €13.8B ($15B) in 2015 to an estimated €41.4B ($45B) in 2024. While this represents a threefold increase, CEE lags behind, with AI startups in the region expected to attract 50 times less of Europe’s total AI funding this year (CEE data are extracted from the State of AI in CEE 2024 report). This disparity is underscored by the stark difference in unicorn creation: Europe boasts 358 companies valued at over $1B, with just four of this being from CEE in 2024.

Among CEE’s standout achievements mentioned in Atomico’s report is UiPath, the Romanian automation giant that has become one of Europe’s most celebrated success stories in the past decade. However, such cases remain exceptions rather than the rule in the region, highlighting the need for further investment and support.

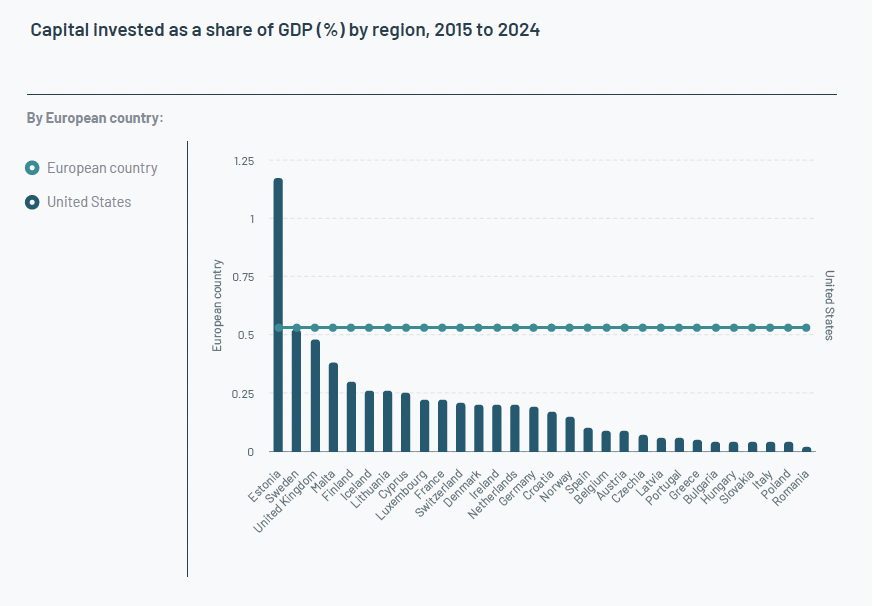

Investment as % of GDP shows uneven growth across the continent

The Atomico report also sheds light on tech investment as a percentage of GDP, providing context for regional disparities. Over the last decade, the US invested 0.53% of its GDP in technology. While this figure may not represent a universal benchmark, it highlights Europe’s potential for growth.

Among European nations, Sweden and the UK lead with investments of 0.52% and 0.48% of GDP, respectively, cementing their status as innovation hubs. In contrast, larger economies such as Germany and France, despite higher absolute levels of VC funding, lag on this metric. Smaller nations like Malta and Cyprus punch above their weight, benefiting from favorable tax and regulatory environments that attract tech companies.

CEE nations, including Poland and Romania, are at the lower end of the spectrum, investing less than 0.10% of GDP in technology. This gap underscores the need for targeted efforts to support tech growth in these regions, enabling them to close the distance with Europe’s leading hubs.

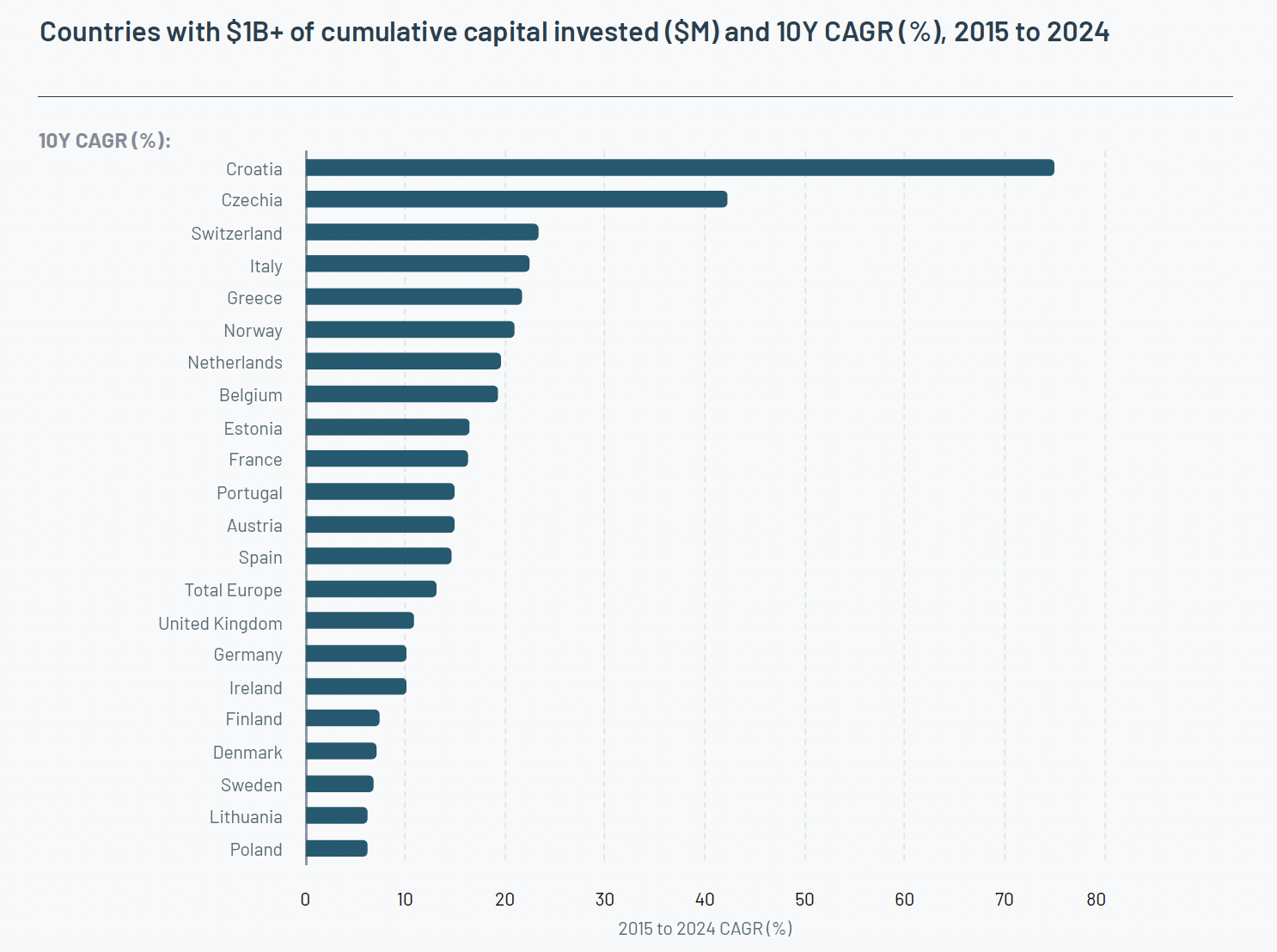

Europe CAGR is growing fast, but where are the investments?

Europe’s compounded annual growth rate (CAGR) of 13% over the last decade is the fastest globally, outpacing the United States (8%) and China (2%). Yet, year-over-year comparisons paint a more challenging picture. While US funding is set to grow by 16% in 2024, Europe faces a decline. Notably, large funding rounds ($250M+) account for 44% of US investments this year, whereas Europe struggles to compete at this scale.

Smaller European economies, however, are showing exceptional growth. Croatia and Czechia, for example, have seen average annual growth rates of 75% and 42%, respectively, far outpacing Europe’s average. Such figures demonstrate the potential of underrepresented markets, including many in CEE, to contribute more significantly to the continent’s ecosystem.

Slim Seed and Series A+ rounds

Seed-stage investments in Europe have grown nearly fivefold since 2015, with median sizes increasing from $300K to $1.4M. Series C rounds have also expanded, with median sizes reaching $55M compared to $18M in 2015. Despite these gains, the US continues to lead in funding size. Seed rounds in the US are now more than double those in Europe, and Series A rounds remain about 40% larger.

This gap is particularly pronounced in AI, a field that has captured the global imagination since late 2022. Although European startups have made strides, much of the momentum remains concentrated in larger Western markets, leaving regions like CEE struggling to keep pace. The result? CEE startups leaving the region for better support.

Regulations come before innovation

While Europe has made impressive strides, challenges persist, with regulation and market fragmentation cited as key barriers. Nearly half (47%) of respondents in Atomico’s survey identified regulatory hurdles as a significant impediment to growth. The bureaucratic complexities of navigating multiple jurisdictions deter founders and investors alike, raising concerns about Europe’s long-term competitiveness.

CEE faces additional challenges, including access to capital and talent retention. Although 20% of European founders find it easier to raise capital today, the region’s reliance on smaller investment rounds often hampers its ability to grow fast.

The future is bright, isn’t it?

Europe has undoubtedly made remarkable progress, with a decade of rapid growth and increasing global influence. Yet, the divide between our continent and the rest of the world remains a pressing concern. By aligning investment levels with GDP benchmarks, simplifying regulations, and fostering inclusive policies, Europe can ensure its tech ecosystem grows equitably.