In a nutshell

- Austrian Elevator Ventures, the venture capital arm of RBI, announced the launch of its €70M new fund, EV II.

- The fund will pose opportunities for startup founders from the DACH and CEE regions.

- With the participation by Raiffeisen Bank International (RBI), Raiffeisen-Holding Niederösterreich-Wien, and Raiffeisen-Landesbank Steiermark, Elevator Ventures aims to bridge financing gaps and foster innovation.

Get the details

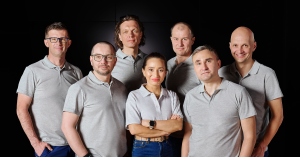

Under the leadership of the two managing directors, Maximilian Schausberger and Thomas Muchar, Elevator Ventures have already invested close to €50M in European startups and built a successful initial portfolio with 15 companies and 3 exits.

EV II aims to support startups through co-investments with local and global investors. The average investment volume will be of €1 to €3M, focusing on Series A & B rounds.

Elevator Ventures’ goal is to solidify its position in the FinTech industry and to expand into other sectors beyond banking, including AI, Cybersecurity, Green Transformation, and more.

Some of the previous investments of Elevator Ventures among CEE include Romanian Finqware, Polish Autenti, Bulgarian CloudCart, Czech Twisto (exited).

In their own words

“With a fund volume of €70M, we double our resources to support startups. The increased commitment of RBI and the entry of Raiffeisen-Holding Niederösterreich-Wien as well as Raiffeisen-Landesbank Steiermark confirms our strategy and enables us to use their strong networks of expertise and business opportunities for our portfolio companies”, empathized Maximilian Schausberger, Managing Director at Elevator Ventures.

Michael Höllerer, CEO of Raiffeisen-Holding Niederösterreich-Wien, adds, “Entrepreneurial ideas require courage and adequate financing. Through our collaboration with Elevator Ventures, we provide the fuel for innovation and value creation, fitting well with our commitment to contribute to societal challenges with banking products and solutions and position ourselves sustainably as partners in all life situations.