In 2025, global VC remained highly selective, with capital continuing to concentrate around AI. The sector accounted for nearly half of global venture funding, with funding reaching about $211 billion, more than double vs. 2024, according to Crunchbase data. Investors leaned in, not just to the promise of AI, but to the details: what truly differentiates each company and whether the fundamentals beneath the story are solid enough.

So what comes next? To understand how these dynamics are playing out regionally, for a third consecutive year, The Recursive surveyed 22 leading VC firms across Central and Eastern Europe, revealing how investors are thinking about sector priorities, risks, and opportunities shaping the 2026 investment landscape.

Due diligence has never been more important

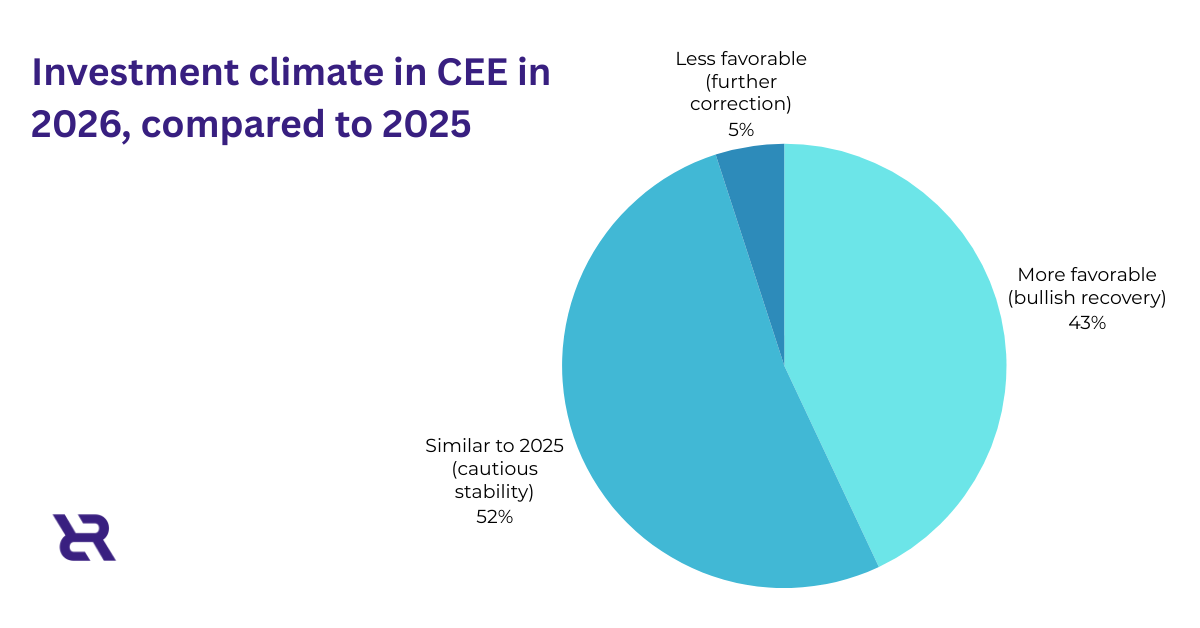

This year, our inventors survey showed that the predictions for capital deployment are more cautious compared to the previous two years. Less than half of the surveyed investors answered that this year’s investment climate would be more favorable, compared to 62% in 2025.

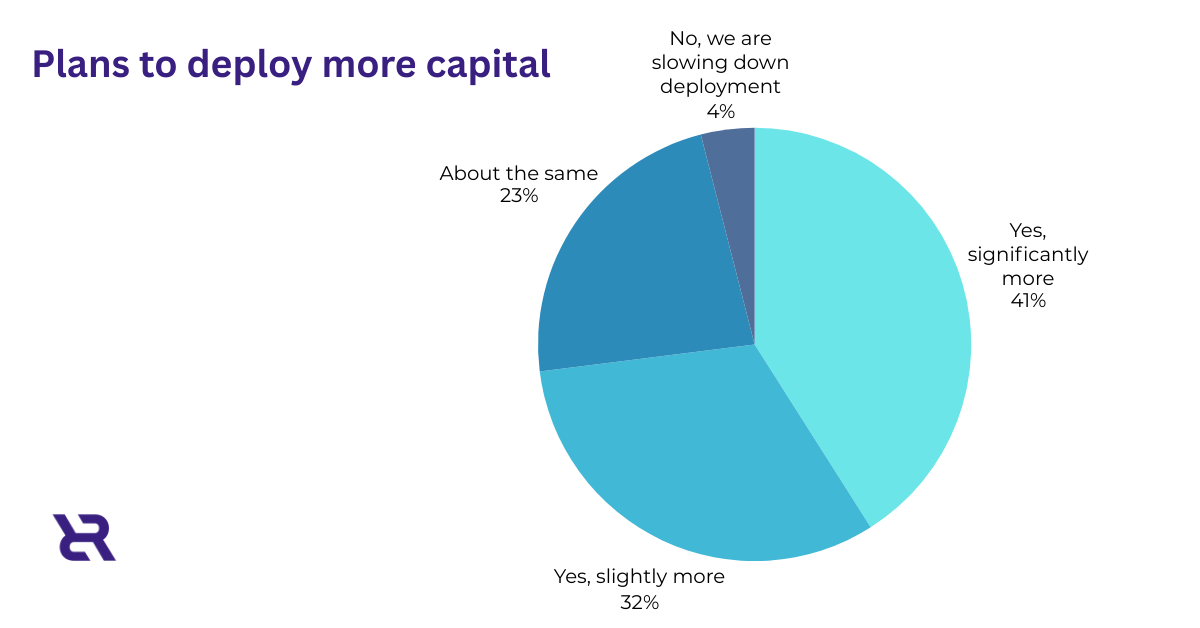

Nevertheless, more than 70% of them shared that they are planning to deploy more capital in 2026 with new investments mainly.

“Founder quality and global ambition across the CEE region continue to improve, and teams are building with greater capital efficiency and focus. For early-stage investors, this creates opportunities to back strong founders early and support them in building global-first companies from the region,” shared from Silicon Gardens.

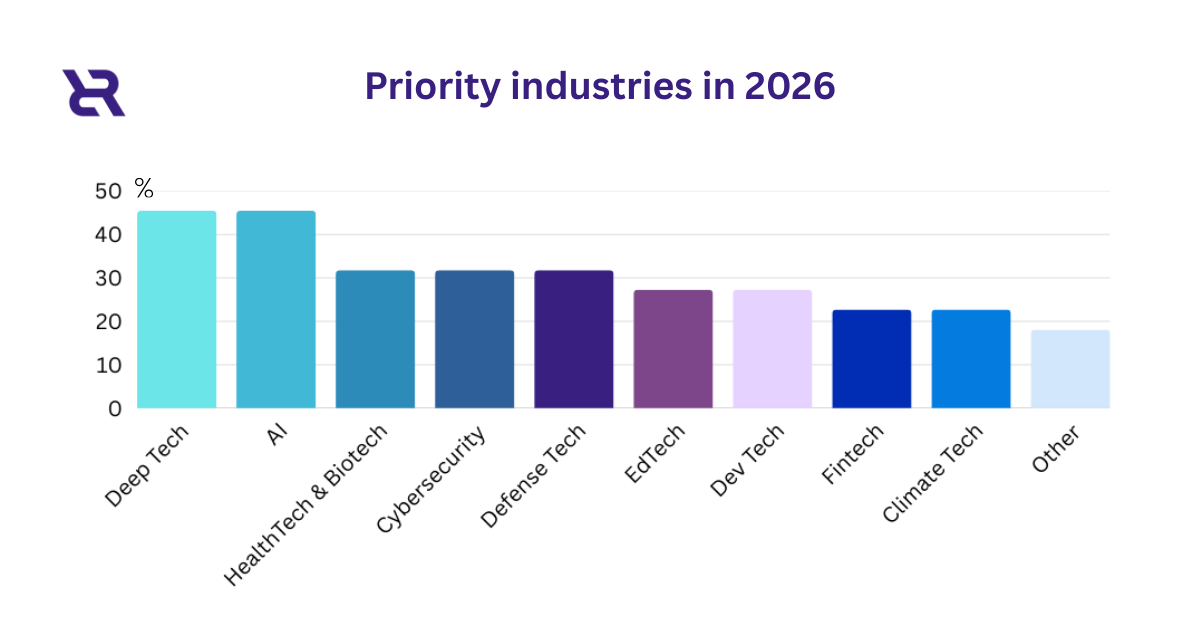

Most of the surveyed VCs point out that in 2026, there are opportunities for innovation, particularly in sectors like Deep Tech and Robotics, as well as AI. HealthTech, Defense Tech and Cybersecurity come right after as preferred sectors for capital deployment.

Tichomir Jenkut from Presto Tech Horizons shared that “2026 will further transform the startup economy under the pressure of rapidly advancing AI. We’re moving closer to a concept that felt like science fiction only a few years ago: a billion-dollar company built by a single founder with a minimal team. Productivity per employee is rising sharply, and AI is increasingly becoming a true co-founder, not just a tool.”

At the same time, investors are also warning that parts of the AI landscape, particularly in CEE, may face increased scrutiny, with growing selectivity around differentiated teams and clearer alignment between capital deployed and value creation.

“It’s a strange time, a new age. We are seeing a structural break in the VC world. There are the regular aspiring unicorns with regular economics, and then there are “mega rounds” with the potential to be $10B+ companies, where everything has an extra zero (ticket size, valuation) and ownership targets need to be adjusted accordingly,” said Andrew Gray from Tilia.

Looking ahead, CEE investors expect continued pressure and selectivity across multiple sectors, with particular concern around areas perceived as overhyped or structurally challenged.

“We expect continued selectivity across all sectors. Companies without clear differentiation, distribution, or a well-defined path to sustainable growth may find it more challenging to raise capital. As a result, founders across sectors are expected to be more focused on fundamentals, customer value, and long-term scalability,” shared from Silicon Gardens.

Non-AI and non-mission-critical software, including parts of B2B and enterprise SaaS, marketplaces, e-commerce, and capital-heavy business models, are also expected to struggle amid higher financing costs and demand volatility.

Additionally, investors foresee ongoing fundraising challenges and consolidation in climate and sustainability-focused sectors, as well as continued decline in Web3 and gaming, increased friction in PropTech, and pressure on AdTech platforms that lack AI-native capabilities.

Defense Tech in 2026

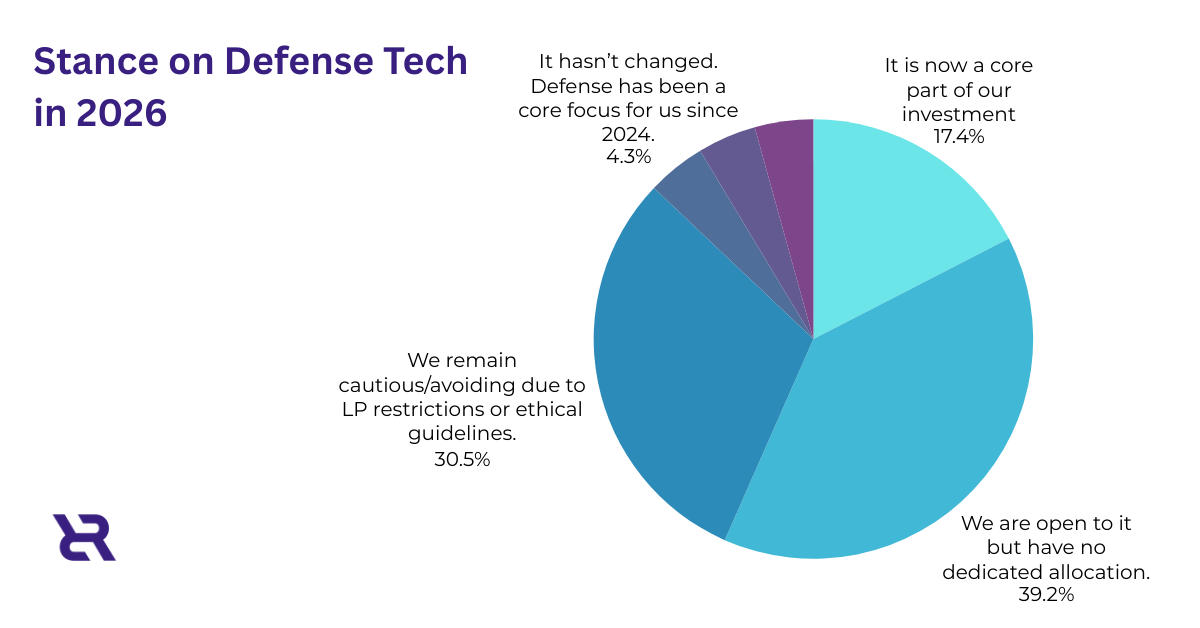

In response to the evolving geopolitical environment, investor views on Defense Tech in 2026 remain mixed. Some respondents indicated that Defense Tech is becoming a more important part of their investment approach, with a few noting it has been a focus since 2024.

Defense tech now accounts for an estimated 6.2 % of total European venture capital funding, up from less than 1 % before 2020.

“CEE is building its growth on Defense Tech investments whether we like it or not. Because of the Eastern threat most of the investors look in the direction of Defense Tech or related industries,” shared Tomas Cironis from Ilavska Vuillermoz Capital.

Since Russia’s 2022 invasion of Ukraine, the number of defense and related technology funding rounds in CEE has tripled, with local investors and funds increasingly backing dual-use and security-oriented startups.

However, the majority remain cautious, citing LP restrictions, ethical considerations, regulatory realities, or the perceived narrowness of the domain as limiting factors. Many others fall in the middle; open to Defense Tech on a case-by-case basis, but without a dedicated allocation.

“It’s critical to realize Europe is still largely playing catch-up when it comes to its own defense and security technologies,” shared Tichomir Jenkut.

“Substantial defense budgets have been announced and will need to be deployed over the coming years, creating strong revenue potential for startups developing technologies that strengthen European security and sovereignty.”

Geopolitical risk remains the dominant concern

Beyond general market volatility, investors point to geopolitical risk as the most significant factor shaping the CEE investment landscape, particularly the ongoing war in Ukraine, the potential for broader regional escalation, and political instability within parts of Europe.

Delays in regulatory harmonization, including slow implementation of EU-wide frameworks, alongside fiscal pressures, governance challenges, and increasing regulation, are seen as additional sources of uncertainty that could impact capital flows and investor confidence.

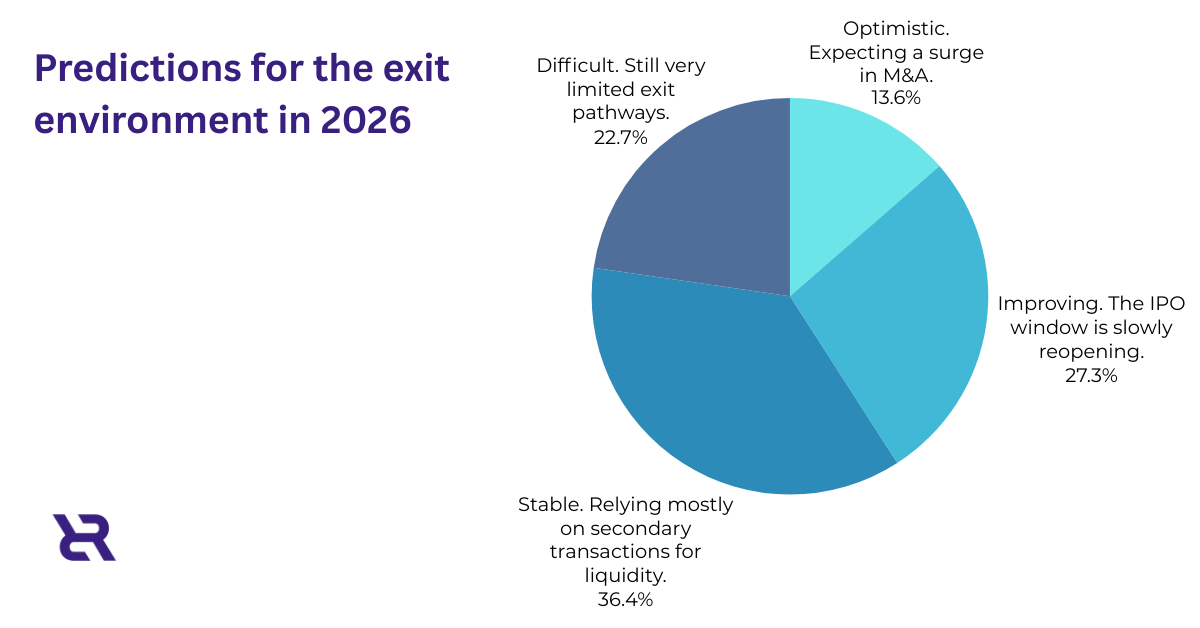

Overall, investors hold a cautiously balanced view of the CEE exit environment in 2026. While several respondents continue to describe exits as difficult, citing still-limited pathways, the prevailing opinion points to a stable but constrained market, with liquidity largely driven by secondary transactions rather than traditional exits.

At the same time, optimism is building: many investors see signs of improvement, including a gradually reopening IPO window and growing expectations of increased M&A activity.

How are their portfolio companies optimizing for 2026? Respondents highlight specific structural challenges such as talent shortages, limited early-stage and follow-on support for scaling companies, and a bifurcation in the ecosystem. “Older startups face stagnation due to past funding gaps while newer ventures may see an influx of capital from fresh regional mandates,” shared one of the surveyed investors.

Despite these risks, some VCs observe rising global attention toward CEE founders and increased involvement from international funds. “Discovery is becoming easier for all funds. This means that more international funds will invest in Europe. On the other hand, I believe that more startups will choose to stay in Europe rather than flip to the U.S. early on,” shared Andrew Gray from Tilia Impact Ventures.

As Flyer One Ventures, a Ukraine-based fund, noted: “CEE is under pressure from fiscal and governance issues, slow reforms, and weaker external demand. At the same time, top deals with CEE founders are highly competitive, with US and European funds chasing the same companies. CEE funds have to be more creative, move faster, and work their hardest to get in and prove their value.”

Collaboration across local and global funds

In terms of co-investing, VCs largely view it as a net positive for 2026, with many describing it as a core part of their strategy. Respondents highlight opportunities to partner with trusted local, regional, and international funds to raise larger rounds, support faster scaling, extend runway, and bring deeper sector expertise; particularly in areas such as energy, cybersecurity, and defense.

“Co-investing is core to our investment strategy, and in recent years we have seen a growing number of co-investment opportunities with both local and regional funds as the ecosystem has matured. This has brought clear benefits, including the ability to raise larger rounds, support more aggressive scaling, and provide deeper follow-on capacity and longer runway for portfolio companies,” shared Alina Georgescu from Catalyst Romania.

As the CEE ecosystem matures, collaboration between regional and global VCs is expected to increase, especially around internationally ambitious founders. That said, some investors note emerging complexities in a more syndicate-driven market, including longer decision-making cycles, tighter alignment on valuation and governance, and the need to coordinate across funds with differing strategies and timelines. Even so, many see these issues as a natural part of increased collaboration rather than a major obstacle.

“It has always been safer and more secure to co-invest with your trusted co-investors / VC funds. Once you build your network of co-investors you are broadening your network as well as potential lead base,” shared Tomas Cironis.

Most VCs keep LP strategies steady in 2026

Most respondents indicated that diversifying their LP base is not a priority this year, largely because they were not actively fundraising or already had a well-balanced mix of family offices, HNWIs, founders, and institutional investors. For these fund managers, the focus remains on maintaining an engaged, value-adding LP network rather than reshaping it.

That said, a smaller group reported a need to diversify due to tighter capital conditions, reduced appetite from private investors, and capital already being largely deployed. In response, they are broadening their LP strategies by engaging institutions, select family offices, and new sources of private wealth to offset slower traditional commitments.

More than half of investors report no noticeable increase in friction in the LP diligence process compared to their previous fund.

Great founders matter more than location

That being said, over 80% of the investors are optimistic that they see at least one or two emerging unicorns from the CEE in 2026. Investors also see select geographic and thematic pockets of growth emerging in and around CEE in 2026 rather than a single standout market. Poland is most frequently cited, alongside Romania, Greece, the Czech Republic, and the Baltics, supported by large domestic markets, maturing tech ecosystems, repeat founders, and continued EU funding.

At the same time, some investors note that growth potential is increasingly less about geography and more about founder quality, execution speed, and access to global networks, with broader optimism that CEE will continue to benefit from its long-term economic growth cycle.

“2026 will reward founders and investors who operate close to infrastructure, sovereignty, and scale. Public funding, procurement policy, and AI-driven productivity are converging in ways that will fundamentally change how European startups are built – and how quickly they can mature” explained Tichomir Jenkut.