Over the past 10 years, first as an entrepreneur and now as a Principal at LAUNCHub Ventures, I’ve watched the CEE ecosystem evolve from a ‘timid giant’ of engineers into a breeding ground for global category leaders, alongside a team that’s had a front-row seat to this story for more than two decades.

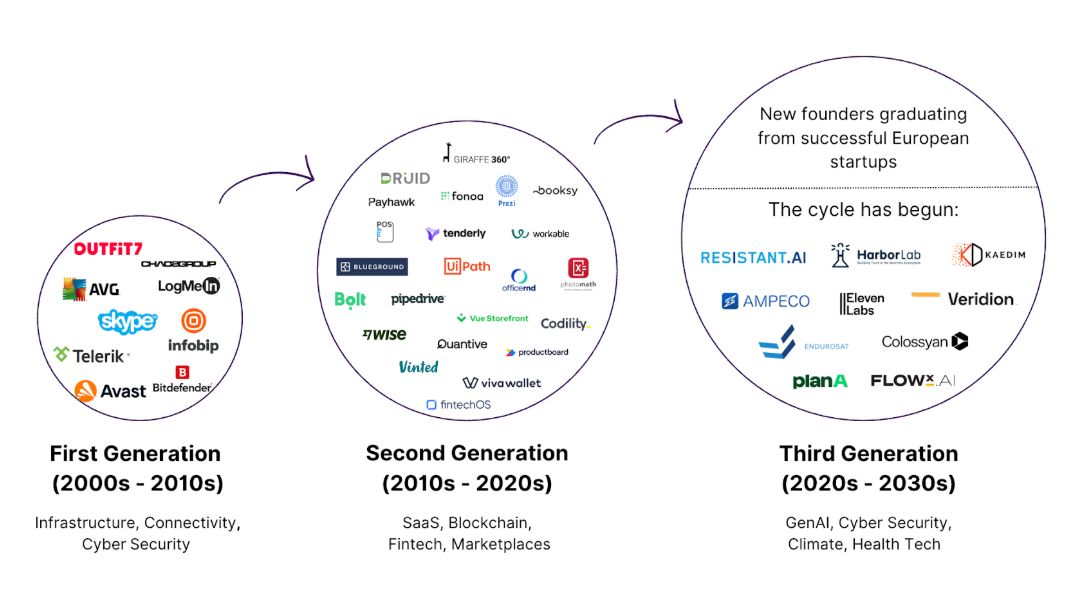

The engineering talent pool started small, with barely any companies daring to venture into the challenging and brutal world of making their own products. Now these select few have grown into household names recognised globally for their innovation and scalability. The likes of Skype, Telerik, Infobip, Outfit7, Bitdefender, and ChaosGroup, to name a few, gave the kick start a region full of highly skilled engineers desperately needed to breed ever bigger and better companies.

We witnessed the second generation of startups emerge and take over the world – UiPath, Bolt, Wise, Booksy, and Blueground. They had a bigger vision, raised more capital, employed more people, and captured a bigger market than their predecessors.

Now it’s time for the third generation of founders to show us what they are capable of.

In this post, I’ll unpack our investment thesis for CEE: why the region is primed to produce many more global winners—and why now is the moment to double down, as we are.

The third generation of CEE founders

We can separate the CEE startup environment evolution into 3 waves:

- The early 2000s laid the groundwork, with infrastructure, cybersecurity, and connectivity being the primary verticals for start-up creation.

- The 2010s brought in SaaS, fintech, and blockchain innovations.

- Now, in the 2020s, we see founders building in frontier markets – GenAI, climate tech, deep tech, and health tech.

Many of these new founders are alumni of successful European tech companies, and they are building upon the groundwork laid by them in putting CEE on the global map. This “startup mafia” effect is compounding, and it’s starting to resemble what we saw in other tech ecosystems: success breeds more success.

A decade of value creation

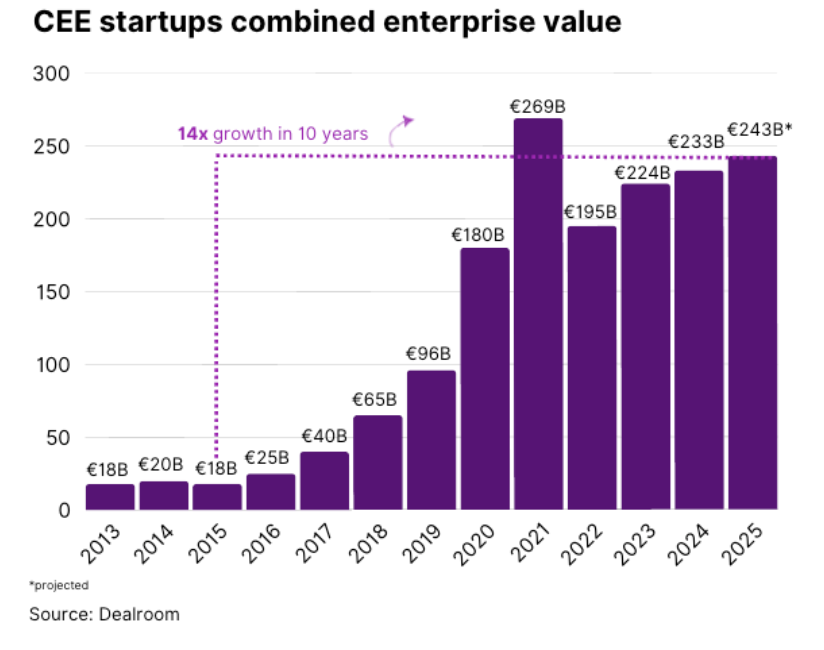

The CEE start-up ecosystem has witnessed remarkable growth over the past decade. In 2012, when our first fund was launched, the total start-up enterprise value in the CEE was a ‘mere’ €18 billion, with the ecosystem being almost non-existent.

Fast forward ten years, and this figure has surged by 14 times, approaching €250 billion, showcasing a vibrant and rapidly expanding market.

When this is compared to the European growth, the CEE region exhibits growth that is twice as fast as the European average, with a rate of 15.5x compared to Europe’s 7x.

This strong market momentum, combined with increased investor interest, positions startups in the region for further growth, which we expect will far surpass what we’ve seen so far.

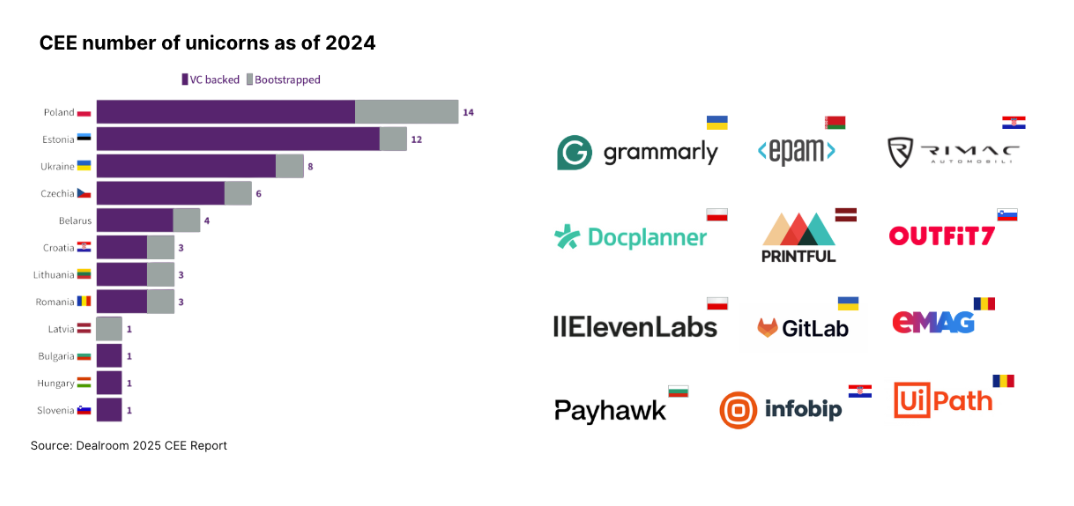

This expectation is further backed by the clear increase in number of unicorns we’re seeing. Up to 2024, the CEE has produced 57 unicorns, with Poland, Estonia and Ukraine leading the way.

This expectation is further backed by the clear increase in number of unicorns we’re seeing. Up to 2024, the CEE has produced 57 unicorns, with Poland, Estonia and Ukraine leading the way.

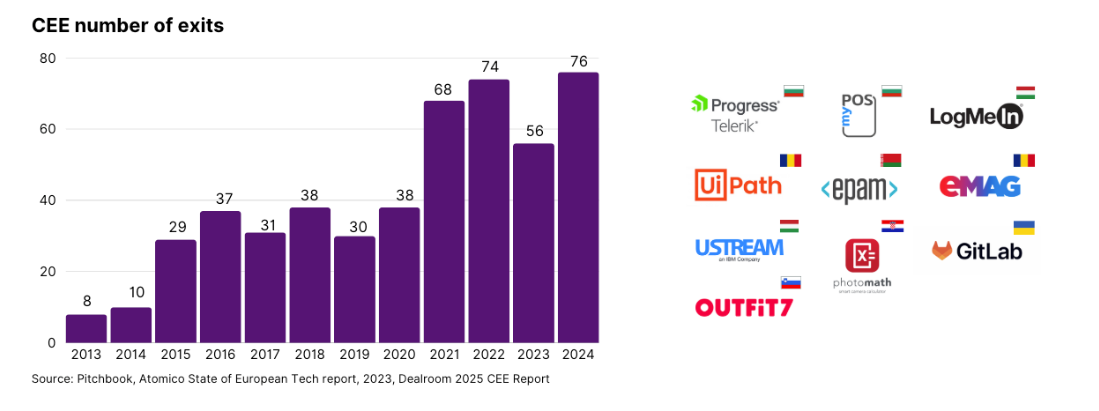

The number of sizable exits are not falling behind as well. Despite being in its early stages, the region has already achieved over 30 tech exits with a valuation exceeding $100 million and more than 10 exits valued at over $500 million. It is only reasonable to expect that this number will go up as most of the regional winners are still young and developing.

For VC funds this presents an obvious opportunity – a growing market with a clear gap in capital availability. This gap will be filled fast by funds who can make fast decisions and partner with founders early, supporting them throughout the initial phase of rapid growth.

Underserved market with asymmetric opportunity

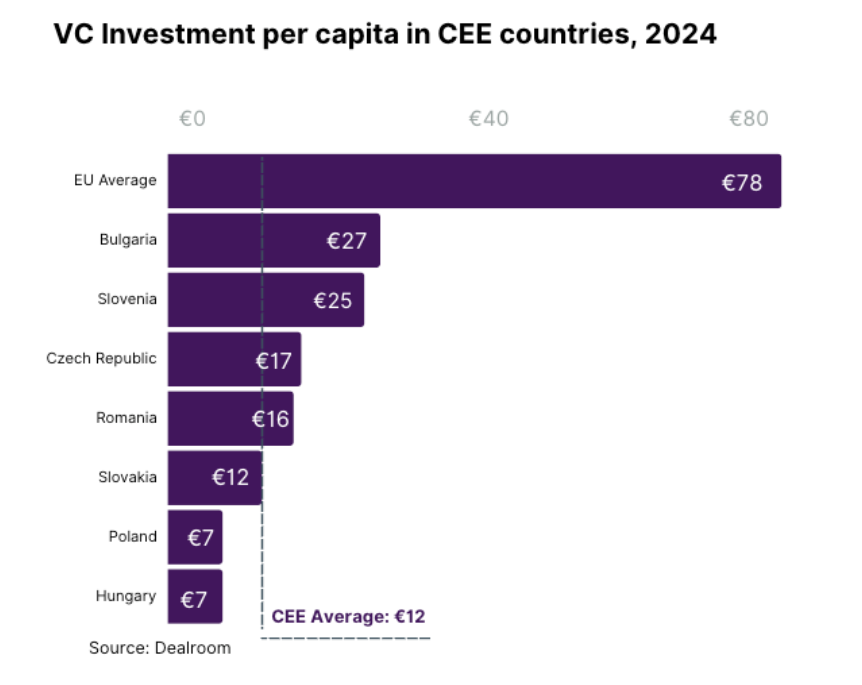

Despite the success stories, CEE remains underfunded compared to Western Europe and the US. The average VC investment per capita in CEE is just €12, compared to €78 across the EU.

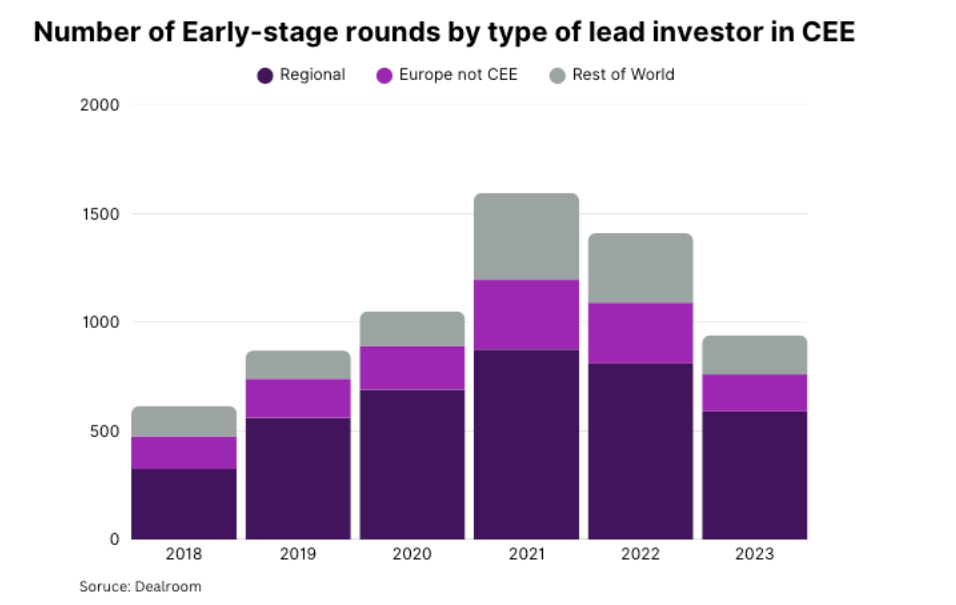

How can investors make these fast decisions? It is our firm belief that being present, understanding the local environment, and having experience in scaling global businesses out of CEE are critical elements for success in finding, picking and winning deals. Funding data backs up this claim, showing more than 75% of early-stage deals are made by regional VCs. As success stories multiple and the region keeps producing more and more high-quality companies, this is bound to change.

Technical depth that rivals the best in the world

Ultimately, as with any early-stage investment, these successes and the future growth in CEE are unlocked thanks to the talent of its people. Countries like Poland, Hungary, and the Czech Republic consistently rank in the top 10 globally for engineering quality (HackerRank).

The region produces a higher percentage of STEM graduates than the US, UK, or Western Europe. That’s why global tech giants, such as Adobe, Microsoft, and Google, are setting up R&D centers here, and why so many founders are building category-defining products.

And it’s not just quantity—AI talent in particular is thriving, boosted by research institutions like INSAIT and a strong open-source culture.

The compounding effect

In summary, several factors are driving this ecosystem forward:

- Engineering talent: home-grown engineers and founders returning from stints at top tech companies are turning their eyes to entrepreneurship, not just as a career path, but as a way of life

- Capital availability: more exits produce more angels and VCs which in turn fund more startups. It’s a self-reinforcing loop.

- Small local markets as a feature: —startups in CEE can’t make it big by selling to their home market alone – they are global from day one.

- Local experience: Investors and founders have now been through full cycles and are deploying that knowledge into new ventures.

We’ve seen this movie before in other regions. And we know what comes next: breakout growth and global winners.

Final thoughts

We believe we’re at a rare inflection point. The fundamentals are in place. The success stories are stacking up. But capital is still scarce, and the best founders are looking for true partners who understand their vision and the regional context.

We are strong believers that CEE is the next tech powerhouse of Europe. Getting in now means participating in the creation of tomorrow’s UiPaths and Bitdefenders early on.

If you’re a founder building from CEE or an investor looking to explore the region, let’s talk.