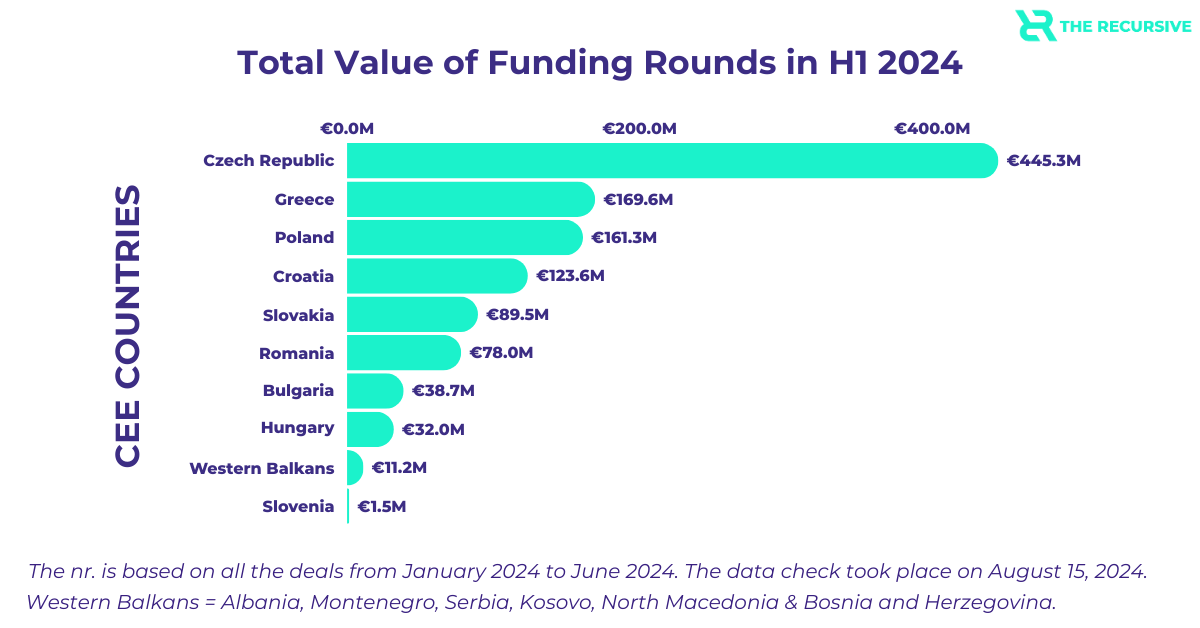

Our analysis for the first half of 2024 reveals that funding in the Central and Eastern Europe (CEE) region, has surged to over €1.15B, with the Czech Republic leading in funding value.

Despite challenges such as the pandemic, rising geopolitical tensions, shifting macroeconomic conditions, inflation, electoral activities, and a lagging European economy, the tech startup ecosystem from the CEE region is witnessing a resurgence.

Who is Generating the Impact in CEE in H1 2024?

In the past quarters, the rise of AI and other advanced technologies has driven substantial capital expenditures, reflecting patterns seen in the telecom industry of the past, which was characterized by high capital intensity and low marginal costs.

Moreover, the absence of private investors such as pension funds—a notable issue for the CEE region compared to the US and Western Europe, where these funds are essential for startup innovation—continued to constrain the region.

However, the effect was counterbalanced by a significant boost in deal flow within the CEE region, driven by European organizations and national and international investors, contributing to the birth of three unicorns: Eleven Labs (Poland), Mews (Czech Republic), and Blueground (Greece).

Building on previous years, European and government organizations had a pivotal role, with the Czech Republic and Slovakia receiving significant backing.

For example, the Czech Republic’s high-value deal flow in H1 2024 is mainly due to a €170M round from major investors including Index Ventures, European Investment Bank, European Bank for Reconstruction and Development (EBRD), Quadrille Capital, TCF Capital and Sofina Ventures also smaller rounds such as €200K funding round for Mewery from the Government of the Czech Republic.

Other countries follow such as Bulgaria (EIC Fund), Greece (EIC Fund, ESA BIC Greece, HDBI), and Slovakia (European Commission, European Innovation Council, and SMEs Executive Agency (EISMEA).

Bridging Horizons: A Snapshot of CEE Tech Startups Deal Flow in H1 2024

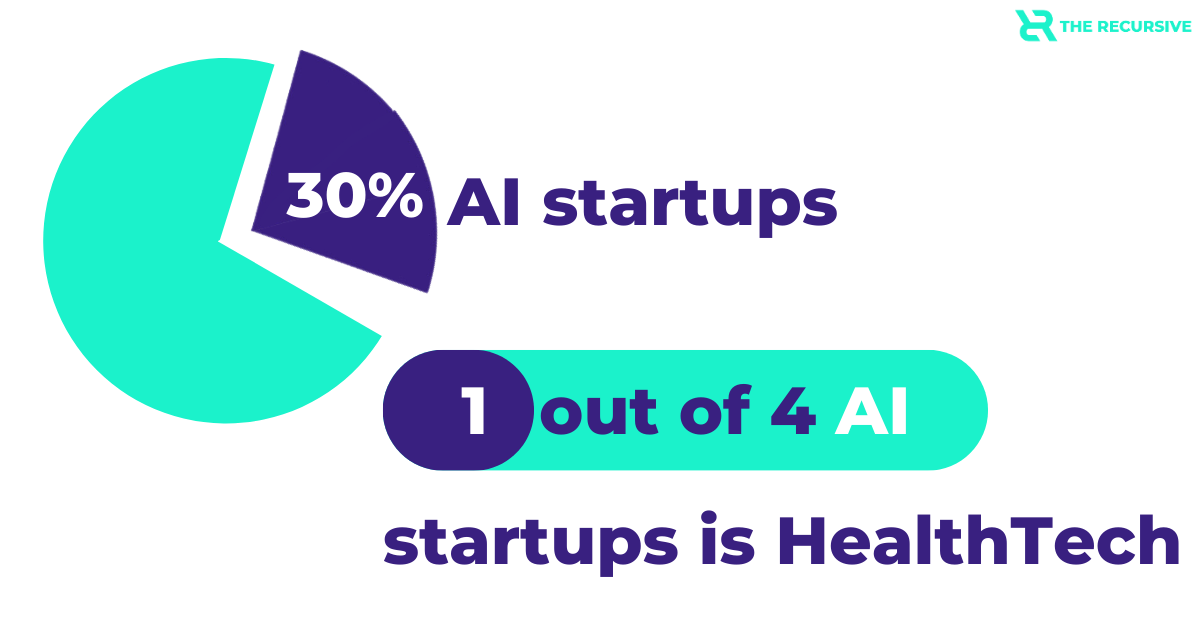

From our analysis of over 200 transactions in H1 2024—encompassing tech funding rounds—AI startups represent a significant portion of the ecosystem, with 1 in 3 startups either developing AI technologies or offering AI-related services. HealthTech remains a prominent vertical, comprising 1 in 10 startups.

When we examine the intersection of AI and HealthTech, we find that 1 in 4 AI startups operates within the HealthTech vertical, reflecting the growing alignment between industry demands and technological innovation.

Among these 200 funding rounds, we estimate that 27-30% of the transactions remain undisclosed. This percentage likely reflects the number of transactions, ranging from stealth startups securing private funding to publicly listed companies keeping their rounds under wraps or postponing the announcement. Read the Analysis Limitations section at the bottom of the article for more detail.

Tech Deals Value in CEE in H1 2024

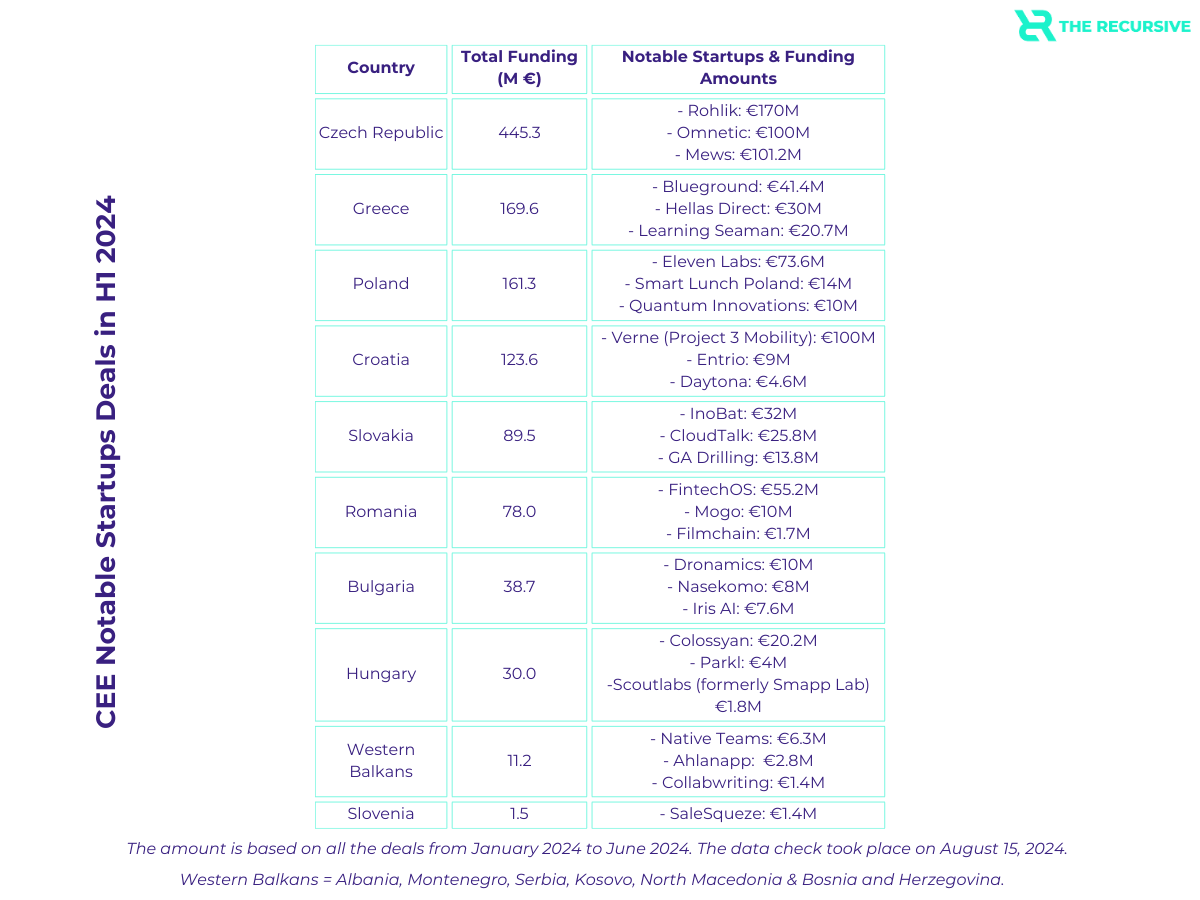

The Czech Republic’s high total reflects a mature investment climate, strong investor confidence, and numerous high-value startups. In contrast, although Greece and Poland show robust funding, they do not match the Czech Republic’s scale but have diversified investments across smaller rounds.

The hefty rounds from outliers like Croatia’s Verne and the Czech Republic’s Rohlink underscore how significant governmental investments can influence a country’s total funding.

According to Startup Blink, Poland’s startup scene remained stable at 33rd globally in 2023, while the Czech Republic dropped three spots to 36th. Greece climbed two positions to 46th, following Bulgaria (38th), Romania (42nd), and Croatia (44th), with Slovenia at 48th and Hungary at 50th.

Romania, Hungary, Bulgaria, and Slovakia remained active compared to the previous period, but have registered recurring smaller funding rounds than the top-funded countries.

Slovenia and the Western Balkans reflect early-stage markets with less capital injected than in the other countries.

However, a good sign of progress comes from the fact that we see funding rounds for startups such as Native Teams (€6.3M) present in 13 countries already, Ahlanapp (€2.8M), and Collabwriting (€1.4M), catching the attention of investors in the ecosystem.

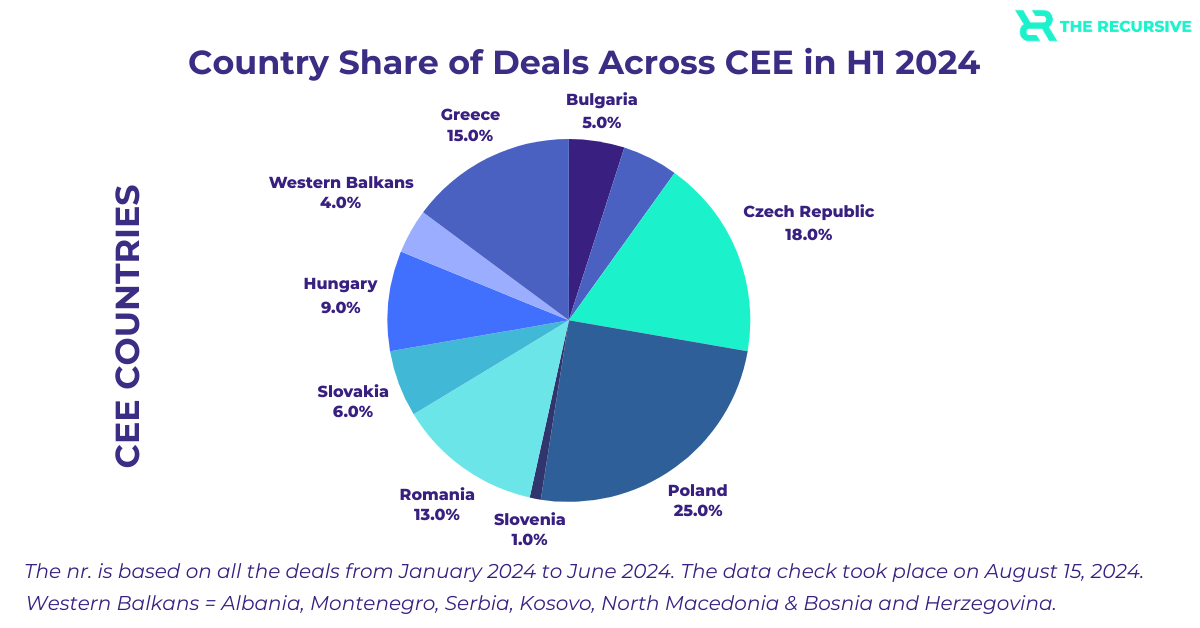

The Distribution of Tech Deals in CEE in H1 2024

Poland continues to lead in the number of deals, driven by its robust entrepreneurial history, substantial size, and strategic focus on early-stage startups. This approach, which supports accelerators and funds VCs, has created a dynamic investment ecosystem.

The diverse range of deals, from major investments like Eleven Labs (the latest unicorn) to numerous smaller rounds, highlights Poland’s prominent position as a hub for entrepreneurial activity and investment in the CEE region.

Following Poland, the Czech Republic stands out as the most prolific country after the total value of the funding rounds. It is ranked 6th globally, in terms of economic complexity and sophistication, reflecting its advanced investment environment. Romania, Greece, and Hungary furthermore exhibit significant growth in economic complexity. Hungary, in particular, has made a substantial leap, now ranked 11th globally in the Economic Complexity Index (ECI), up from 23rd in 2000.

International Investors Involved in CEE Transactions

In terms of investors among the analyzed funding rounds, we observe that for more than 60% of the startups, the money came from local VCs/ angel investors and European organizations, yet, for the rest, there was a mix of money from institutional investors and VCs/ angel investors outside CEE (NYC, San Francisco, California, Taiwan, etc.).

Investors from the USA were involved in rounds across multiple countries, particularly in Central and Eastern Europe, focusing on the Czech Republic, Poland, Hungary, Slovakia, and Greece. Of the total number of deals, 30% involved investors from the USA.

Below are a few noted international investors involved in the CEE H1 2024 transactions:

- Sequoia and Andreessen Horowitz (USA) invested in Eleven Labs (Poland);

- Goldman Sachs Asset Management (USA) invested in Mews (Czech Republic);

- Morgan Stanley together with WestCap and Susquehanna Private Capital (USA) invested in Blueground (Greece);

- Y Combinator (USA): invested in TrueClaim (Czech Republic) and Wondercraft (Greece);

- Techstars (Colorado) invested in Flowpay (Czech Republic), Voovo (Hungary), and Plain (Poland);

- Interactive Venture Partners and Two Sigma Ventures (USA) invested in Vizzu (Hungary).

Money in Money Out: The State of M&As

CEE has achieved 10 significant milestones, including 8 mergers and acquisitions and 2 exits. Financial details were disclosed for only 2 of these transactions. Below is the full list with all the relevant information.

Romania

February: One of the largest companies in textile management, MEWA Textil-Service, acquired the Esenca App founded by Cosmin Gabriel Ciocirlan and Eduard Cojocea. Esenca is an AI body measurement solution that uses state-of-the-art technology to give your customers instant sizing recommendations and provide you with insights into their needs.

April: PDQ, an international software asset management company, acquired CODA Intelligence. This marks the first 2024 exit of Early Game Ventures.

May: The third M&A is marked by Pluria, a B2B SaaS solution connecting distributed teams with nearby workspaces, which acquired Bili, a menu ordering and payment solution.

Besides the Early Games Venture exit mentioned above, the Romanian VCs landscape had recorded the second successful exit by Catalyst by selling off its remaining shares in SmartBill, a Romanian provider of cloud-based invoicing, inventory, and accounting services for SMEs, to the Norwegian Group Visma.

Czech Republic

May: Inventoro, a forecast of future sales and managed inventory was acquired by Cin7, an all-in-one, cloud-based solution with fully integrated inventory management based in Auckland.

Poland

May: Perfect Gym, an all-in-one gym membership management software system made for gyms and health clubs of all sizes, was acquired by Sport Alliance located in Germany.

Greece

March: Endix, an experience designed for gamers by gamers, was acquired by Heaven Media, a marketing agency specializing in the gaming and technology industries with an HQ in the UK.

Hungary

May brought two acquisitions for the Hungarian tech ecosystem:

Omixon, a player in transplantation diagnostics, dedicated to providing histocompatibility laboratories with cutting-edge technologies to enhance transplant outcomes, has been acquired by Werfen, a Barcelona-based medical equipment manufacturer, for €23M.

Ultinous, an AI-based technology company using deep learning to provide intelligent video analytics, was acquired by Irisity, a provider of AI-powered video analytics software for €3.9M.

Total Funding Round Values by Country and Contribution of Top 3 Deals

Below you can read about the total funding round per CEE country with the top 3 funding rounds and their contribution to the overall performance of each country.

Analysis Limitations

Despite the undisclosed deals (including some significant outliers to smaller rounds), the data still provides sufficient representativity at the CEE level, with nearly 70% coverage.

Most of these undisclosed rounds come from Poland—the player with the highest startup pool from the ecosystem, followed by rounds from Greece, the Czech Republic, and Romania.

If we are missing something or you want to share your thoughts, let us know at [email protected].