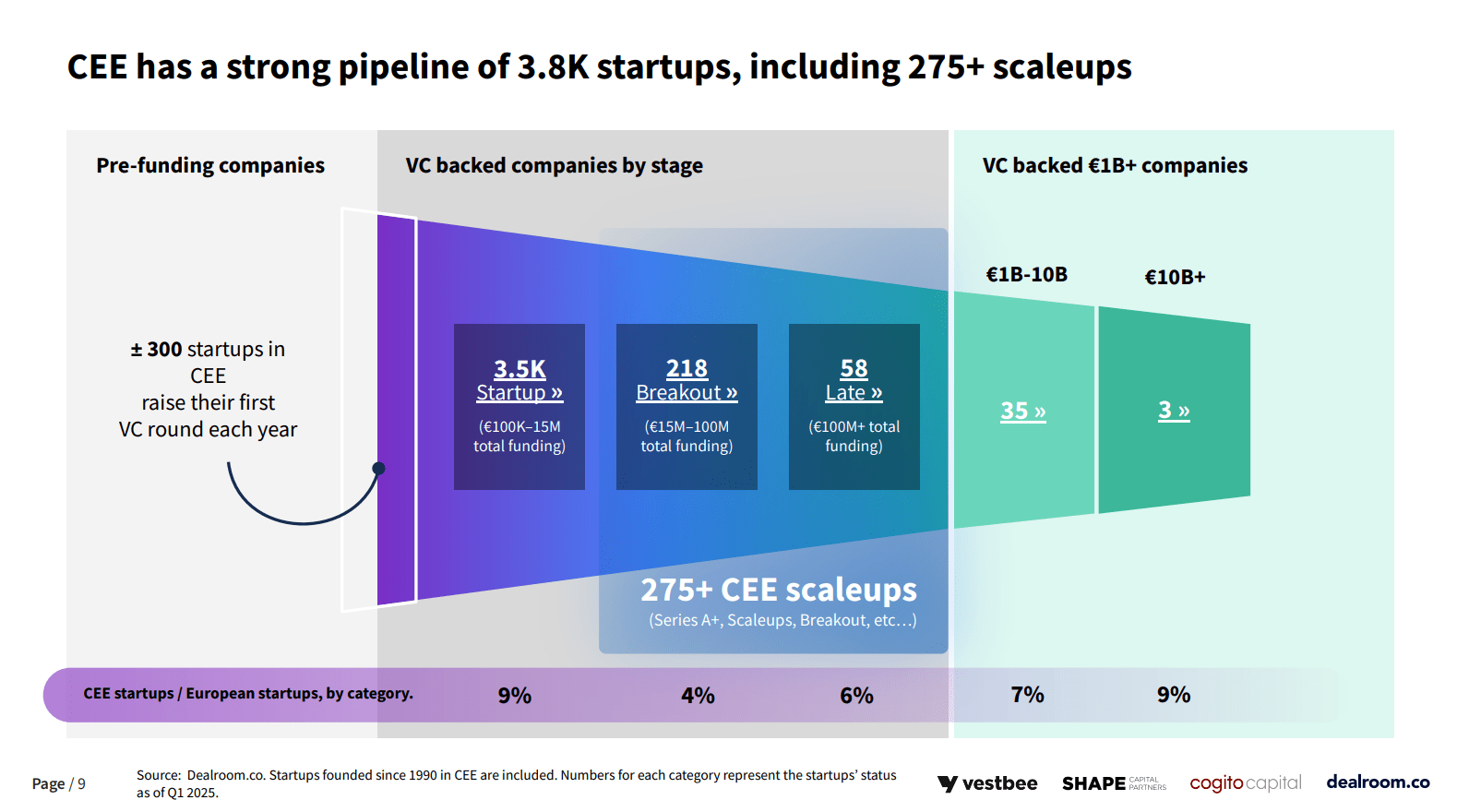

According to Dealroom’s latest report, CEE has 3,800 VC-backed startups, representing approximately 41% of Europe’s total 9,190 startups. The region has seen substantial growth compared to its incipient years, with 275+ scaleups and 38 startups valued at over €1 billion. Among these, 57 have reached unicorn status, with Poland (18), Estonia (14), and Ukraine (8) leading in numbers.

This report includes 20 CEE countries: Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czechia, Estonia, Hungary, Kosovo, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Serbia, Slovakia, Slovenia, Ukraine.

The good news is also that between 2015 and 2025, the CEE startup ecosystem expanded 15.5x, significantly outpacing Europe’s average growth rate of 7x. This rapid expansion has been fueled by increasing investment, a maturing funding landscape, and a rising number of high-value companies.

Investment trends and capital allocation

In terms of investments, the report shows that in 2024, CEE startups raised €2.3 billion, compared to €2.1 billion in 2023. The funding distribution across different stages was as follows:

- €764 million allocated to early-stage rounds

- €703 million directed toward breakout-stage companies

- €818 million invested in late-stage startups

This trend follows the one of the previous years when, between 2020 and 2024, most funding—41%—was concentrated in late-stage companies, while breakout-stage companies received 33%, and early-stage startups secured 26%.

Regional performance and developments

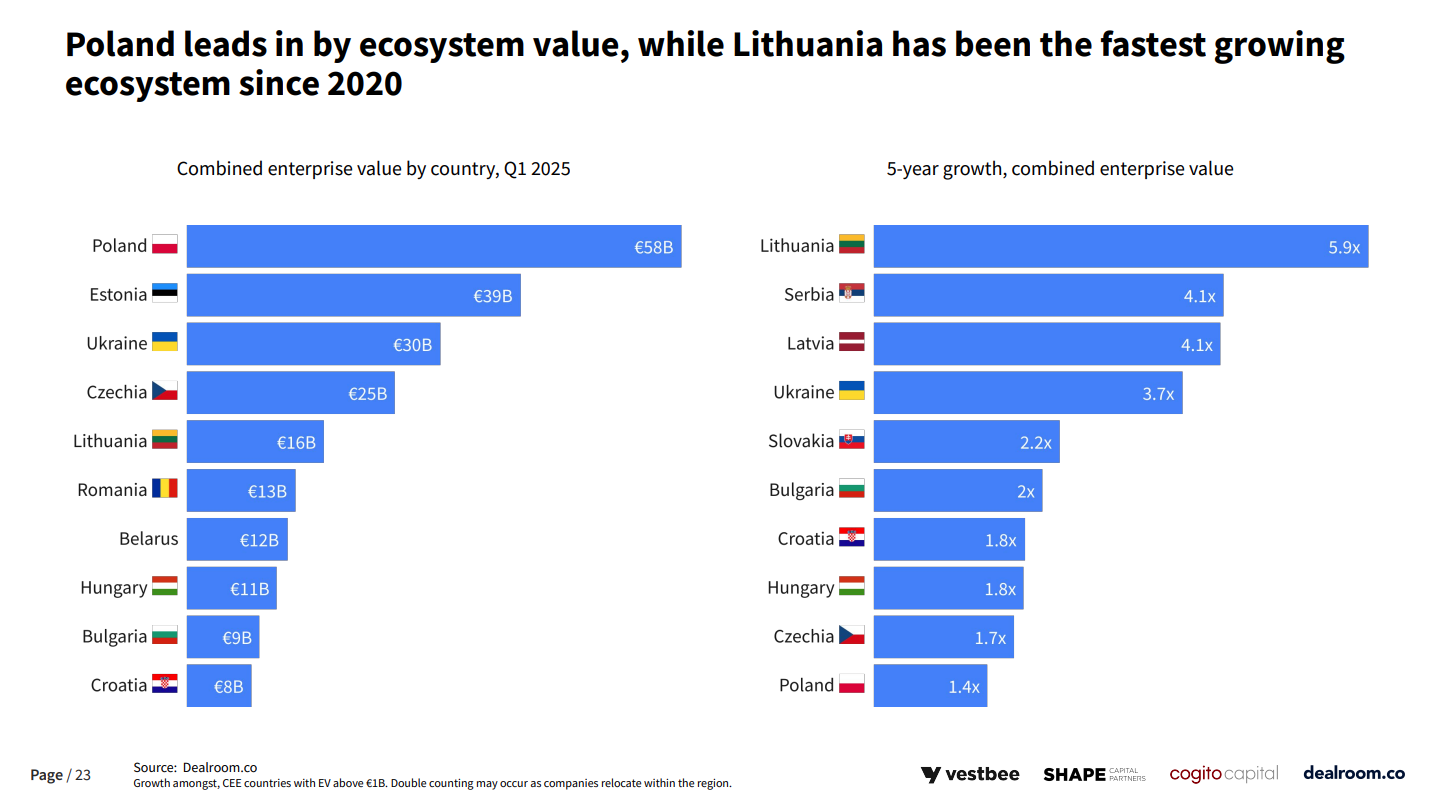

The Baltic states continue to demonstrate strong performance in startup creation and scaling. Estonia, Latvia, and Lithuania have contributed significantly to the region’s total enterprise value, which reached €243 billion as of Q1 2025.

Additionally, the report highlights Serbia’s emergence as a growing startup hub, with a 4.1x increase in enterprise value since 2020.

Outlook

The data indicates that CEE’s startup ecosystem is expanding, with increasing investment flows and rising enterprise valuations. If the current trajectory continues, the region is expected to see further expansion in startup activity and a stronger role in the European technology sector.