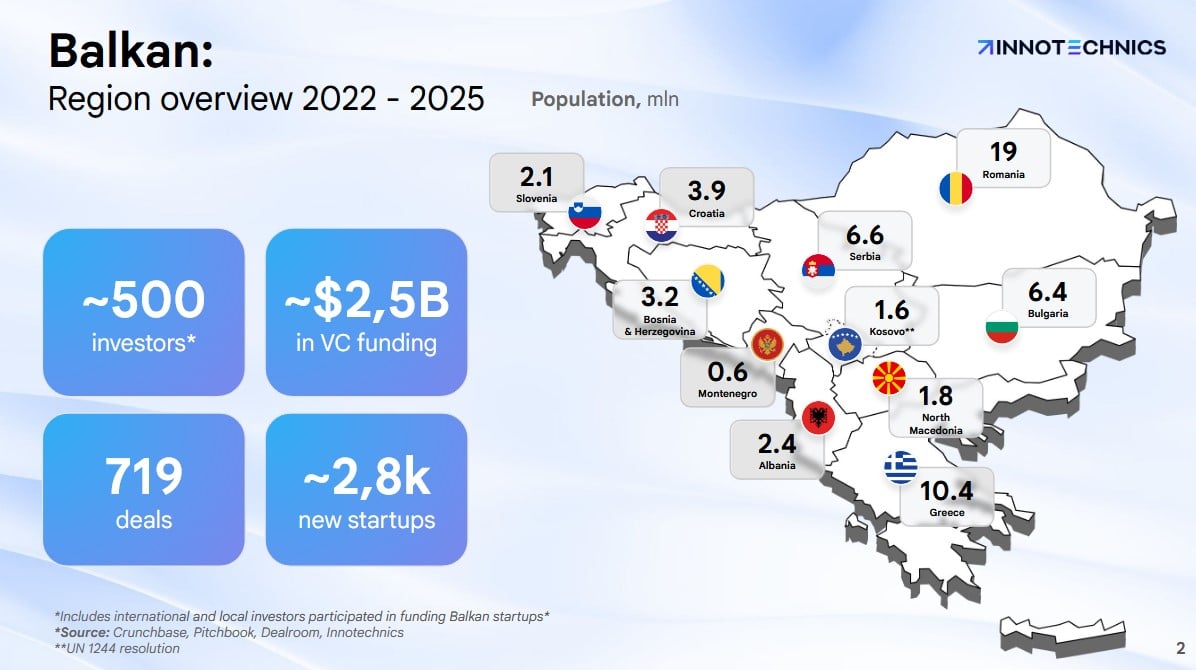

According to the newest report from tech market intelligence company Innotechnics, the Balkan startup ecosystem has entered a new phase of maturity.

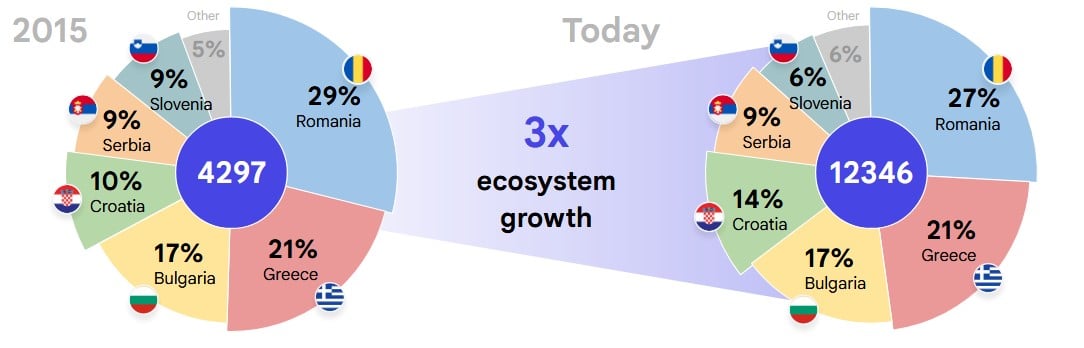

Over the last decade, the total number of startups in the region tripled, reaching approximately 12,000 by 2025. However, growth in 2024–2025 has plateaued, signaling a possible shift toward quality growth and sustainability.

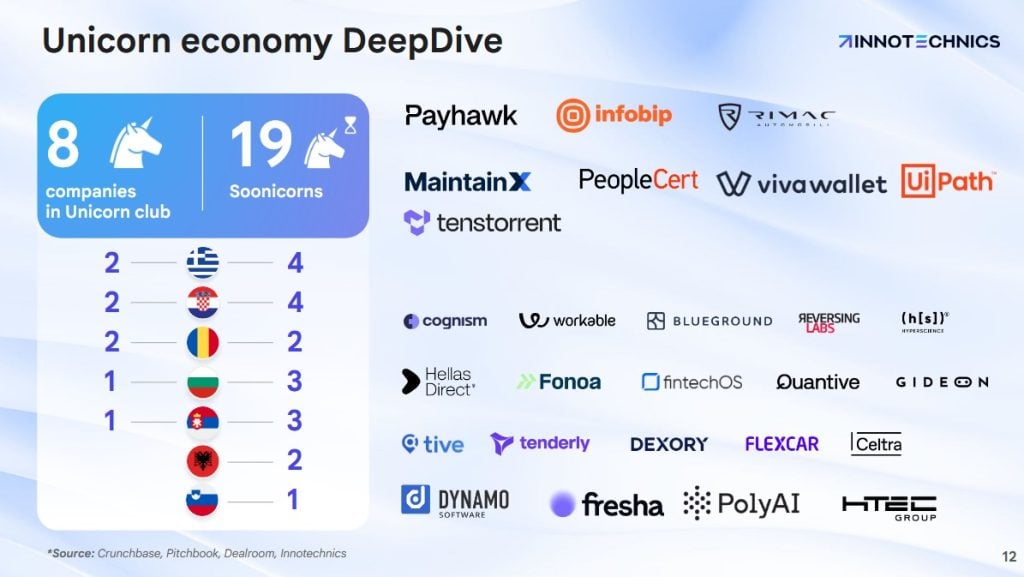

Geographically, Serbia and Romania are the primary drivers of new startup generation. At the same time, the market is dominated by the B2B SaaS and Enterprise Solutions model, which accounts for 70% of all startups. Innotechnics report further supports the ecosystem’s maturity, as evidenced by its 8 Unicorns and 19 Soonicorns.

However, when we talk about money flow, there is a bit of a stand-still (that isn’t connected just to regional variables). The global VC market is currently experiencing contraction, with deal volume and count shrinking post-COVID.

The Venture Balkans Report mapped out startups, deals, and investors in the CEE region. The period tracked was January 1, 2022, to September 30, 2025. If you would like to know more about the report and methodology, feel free to contact [email protected]

Maturity and diversification of the Balkan Startup Ecosystem

Between 2015 and 2025, the Balkan ecosystem experienced 3× growth. Despite the high total, the report indicates that “the era of exponential startup expansion is concluding”. The market is now entering a growth plateau, evident by a lower rate of new projects in 2024-2025. However, new projects did not come to a complete halt. The new generation of startups is actually heavily concentrated in a few key nations, with Serbia and Romania collectively driving over 50% of all new projects that emerged in 2024-2025.

Additionally, when examining the general distribution of startups, the ecosystem is pretty well diversified. Startups are relatively evenly distributed across nations (in proportion to their size): Romania (27–29%), Greece (21%), and Bulgaria (17%) are leading the pack, with Croatia following closely. Serbia’s recent growth could be a natural correction, so we hope to see it continue to climb up. The other Balkan countries are seeing a little bit more progress, although in Slovenia things are not as dynamic as 5+ years ago.

The regional VC market is still volatile

In contrast to startups rapidly emerging in the region last couple of years, after an expansionary period during 2020–2022, the VC market contracted sharply. Between 2022 and 2025, the number of active venture deals fell by nearly threefold.

Bulgaria led the region in deal count, followed by Greece and Romania. At the same time, Croatia and Greece dominated by deal value, partly due to several large outlier transactions. In general, overall investment volumes remained uneven, reflecting volatility and an immature market structure.

Since the beginning of 2024 till Q3 2025, most regional countries faced lower capital inflows. For example, Bulgaria and Romania each experienced notable declines, while Serbia maintained modest but steady investment activity.

Investor Landscape

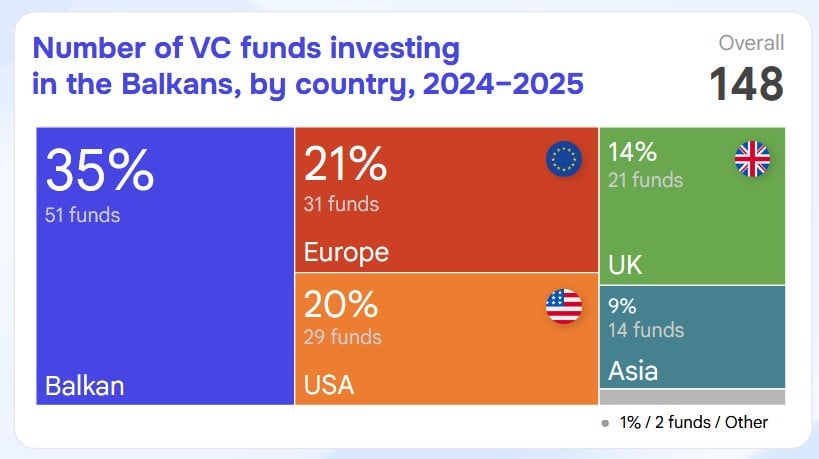

Local investors have become pivotal to the ecosystem, playing a key role in early-stage funding. Between 2024 and 2025, 148 venture funds were active across the Balkans.

Greece, Bulgaria, and Romania collectively account for 82% of local investment activity. At later stages, international investors — especially European funds — are most active, often targeting DeepTech and high-capital industries. This dual structure reflects a healthy mix of local seeding and global scaling support, although recent sentiment is that Europe should take more care to keep its scaleups from moving abroad.

For that matter, report highlights how the region has started to attract international capital in advanced technology domains. Prominent multi-million-dollar success stories include Verne, Eldrive, and Spotawheel, with participation from leading global investors like Andreessen Horowitz and Lightspeed Venture Partners.

In 2024–2025 alone, $643 million worth of deals in the region originated from 37 different countries.

Industries fueling the unicorn economy

A defining characteristic of the Balkan startup scene is its B2B orientation. Over 70% of startups adopt B2B models, focusing on predictable and scalable economics. This orientation has positioned the region as a growing source of corporate innovation, particularly in SaaS and enterprise-focused solutions.

Sector trends (2024–2025):

-

- SaaS remains dominant in both the number and volume of deals.

- FinTech and HealthTech follow as the most sought-after verticals.

- DeepTech fields (Mobility, Infrastructure, and AI) have accumulated the most capital, with Mobility alone accounting for ~70% of deal volume.

- Emerging areas include CleanTech, PropTech, and Blockchain.

Innotechnics’ analysis of the future Unicorn pipeline in the region also reveals a strong focus on enterprise-facing solutions. The majority of future unicorns are concentrated in Enterprise software (including CPaaS, RPA, CMMS, Sales Intelligence), followed closely by FinTech/InsureTech.

The Balkan ecosystem has successfully produced 8 companies in the Unicorn club and features 19 Soonicorns (companies poised to reach the $1 billion valuation).

What to expect in 2026 and onward

While the Balkans’ startup ecosystem continues to mature, the Innotechnics’ report emphasizes several structural challenges:

-

- Deal volumes fluctuate heavily due to outlier transactions.

- Many startups struggle to raise Series B and beyond without foreign participation.

- Skilled professionals often migrate to Western Europe and US, constraining scaling capacity.

- Differences in regulatory and tax regimes across countries complicate cross-border scaling.

Nonetheless, the underlying trends are positive: regional collaboration is strengthening, local investors are increasing their footprint, and ecosystem diversity is growing.

While the era of exponential expansion is ending, we see another potential bubble (AI) driving the next wave. We can only hope that the next generation of Balkan startups will follow the steady pace of their elders — and emphasize profitability, international scalability, and technological depth over pure quantity.