In a nutshell

- Budapest-based PastPay, a B2B payment solutions provider, secured €12M in a Series A funding.

- The round was led by Platina Capital, including MBH Bank, Advance Global Capital, Quantic Financial Solutions, STRT Holding, and BNL Start Partners, as well as several high-profile private investors, such as Jared Schrieber and Mark Ransford.

- The funding will be used for new offerings, focusing on B2B transactions and financing across Europe.

Backed by strategic Series A investment

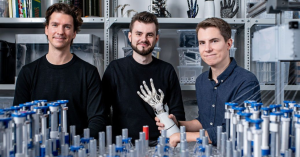

PastPay aims to provide B2B payment solutions and offers Buy Now, Pay Later (BNPL) services, targeted towards flexible payment terms for business transactions. The startup, founded by Benjamin Berényi and Bálint Réti, is based in Budapest but operates across CEE.

PastPay announces a Series A round, totalling €12M. It was led by Platina Capital, a global private equity and venture capital company. Other investors included MBH Bank, Advance Global Capital, Quantic Financial Solutions, STRT Holding, BNL Start Partners, and private investors like Jared Schrieber and Mark Ransford.

Their round is currently the largest B2B BNPL raise across CEE.

PastPay sets sights on European expansion

The company’s future goals include the development of new B2B transaction and financing solutions across Europe. Their coverage includes Italy, Germany, Poland, Czechia, Slovakia, Romania, and Hungary.

“In terms of expansion, historically we have focused on the CEE region, however, our goal is to become a pan-European provider and a reliable payment and financing partner for all transactions within the European Union and EEA. The past years can be considered a less supportive environment for fintech startups, this raise showcases the quality and resilience of our product and team. Our partnership with these new investors aligns with our vision of making financing accessible to as many SMEs as possible,” shared Bálint Réti, Co-Founder and COO of PastPay.

According to their data, the company has enabled over 170 merchants to offer flexible payment terms, allowing customers to pay later on more than 15K occasions.

Mark Ransford, a private investor who participated in the Series A raise, shared, “I decided to invest in PastPay on account of the company’s high-quality team and their very efficient overhead structure. The founders’ ambition to expand into Western Europe is also particularly compelling and something that will be greatly bolstered by this significant raise.”