Despite their relative novelty compared to industrial robots, service robots – which assist human workers in completing tasks and in turn save them time for more valuable work – are quickly becoming an essential part of business for service-focused companies across industries, from healthcare to hospitality, logistics, and retail. The European service robots market is expected to reach $8.37 billion by 2023, or 70% of the total robotics industry.

This is the space where Adapta Robotics plays with solutions for critical device testing and retail inventory operations, both areas that have been formally challenged by inefficient and error-prone manual methods.

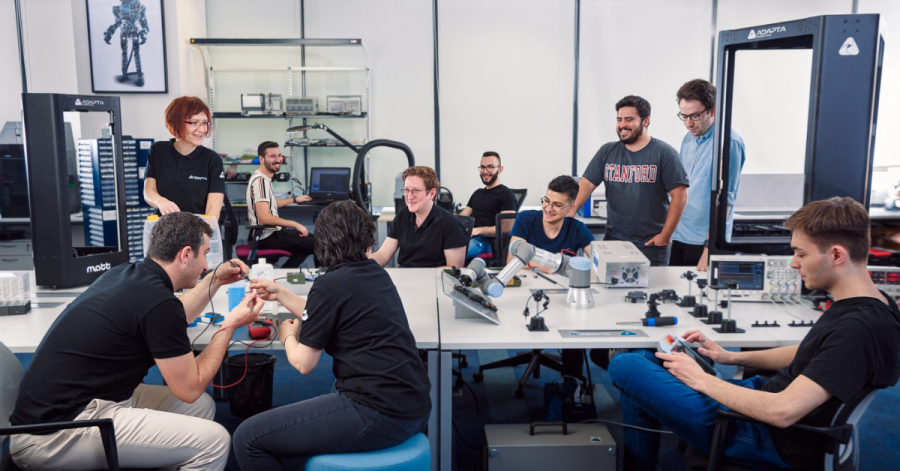

After having won numerous global competitions (including Robotchallenge Vienna) with his robotics team inside Bucharest’s most prestigious engineering university, Mihai Craciunescu and his colleagues (co-founders Diana Baicu and Cristian Dobre) pondered what route to take next. They took the entrepreneurial way, starting to think about building MATT, their flagship robot for testing touchscreen devices and applying for funding.

In 2017, they joined rinf.tech, a customer software development company, as the robotic division and started building MATT and bringing it to market, using EU funding. Later on in 2021, they spun off into a standalone robotic brand of rinf.tech.

For years, we’ve been hearing that Europe is struggling to scale its deep tech startups, despite launching many of them and committing increasing amounts of capital over the past five years.

So today, we look at the journey of a deep tech company from Romania, through thick and thin.

The Recursive: Can you tell us more about the founding story of Adapta Robotics and what motivated you to start the company?

Mihai Craciunescu: It all started with our passion for robotics. Our robotics team inside the Polytechnic University of Bucharest aimed to develop robots using cutting-edge technology, from hardware to AI. We participated with our robots in different competitions around the world, and in a 10-year span we won all the major global titles.

At some point, we wanted to move to the next level of our carriers, and we had the same choices as most of the robotics enthusiasts’ teams:

- To continue R&D inside a university lab (which requires an already existing infrastructure and that sadly for us was not an option),

- To focus on one side of robotics – it’s a multidisciplinary field, so you can choose a position in a company with one well-defined domain (e.g. embedded programing, hardware, AI),

- Or to start a robotics company where we could apply our knowledge and passion for robotics and come up with products that are not yet on the market, to solve existing problems (the ideal one for us).

How does Adapta Robotics differentiate itself from other robotics companies in terms of intended use, product design, and customization?

Here the answer is tightly related to the first question. Due to our experience in robotics and our way of doing things, we are determined to solve problems from the ground up (or as much as this is possible). We start from scratch and are building up a solution using different technologies that already exist on the market or that we develop. So, one key differentiator is the flexibility that we have due to developing solutions from zero. Yes, we are choosing the tougher path but, in this manner, we are ensuring adaptability down the line.

Being in control of every aspect of our products and having in-depth knowledge of every single component inside our robots, allows the optimization of technology for a specific use case and easy customization. As a startup we’ve built this into an advantage because now we can very easily adapt our products to diverse needs and, of course, we can design new solutions very quickly.

We are also requesting a lot of feedback from our clients. As an engineer, you tend to lock yourself in a room and spend too much time optimizing some aspects of the robot that nobody is asking for – we want to avoid that. As part of our designing process, we are including feedback coming from as many clients/ potential clients as possible, so that, from the very beginning, we are focusing on what is important to them or optimizing things that are relevant for that industry.

Could you provide some examples of how MATT, your device testing robot, has brought efficiency and value to industries it has worked in so far?

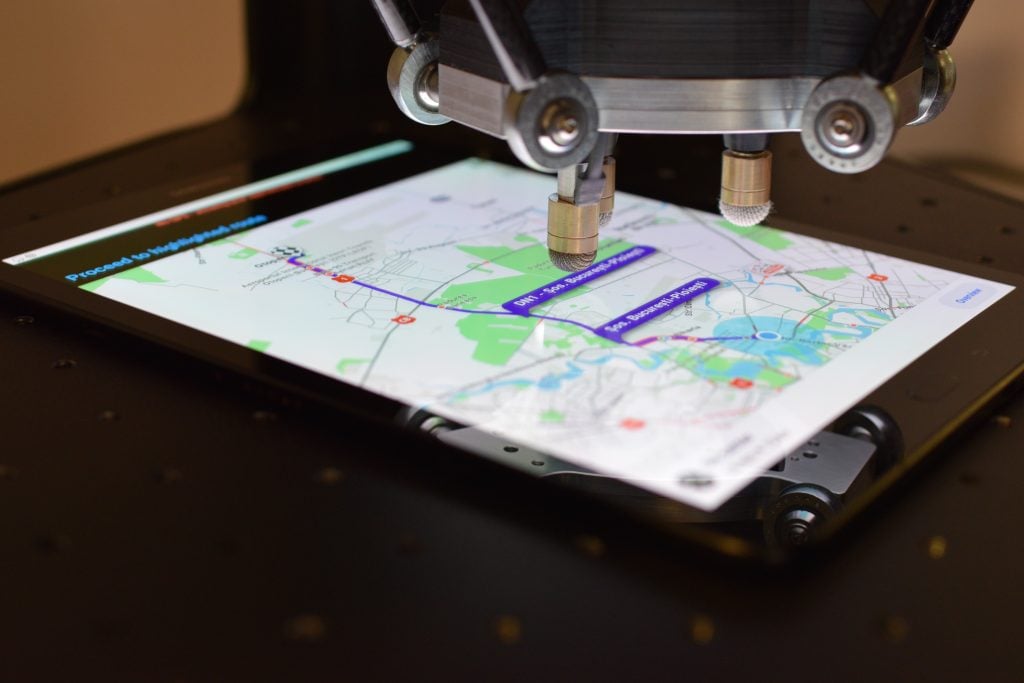

MATT is used in two ways. Firstly, as a measurement tool, being a staple instrument for measurements on devices with touchscreen or with physical buttons, aided by additional sensors (e.g. pressure sensors), cameras and so on. And one way in which this can be done is by having the robot provide insights into the performance of the device.

We as consumers have gotten used to a certain response time when utilizing a device (be it smartphone or car infotainment system). We want apps to run fast and we don’t care if they run on a phone or in-vehicle-infotainment system, we just want the same level of responsiveness all around.

Therefore, there’s a need for a tool that on both mobile phones and automotive infotainment (for example) can measure the same types of parameters. MATT is the tool to offer this type of insight.

The second use case of the robot is to automate tasks that are currently done manually. The impact and the use that the robot brings to the market is that you can have a standardized tool that fits in multiple different industries from medical to automotive, to consumer electronics to measure KPIs that, in a way, are generic throughout those fields.

This second use case brings added efficiency (to those utilizing MATT) that can be very easily determined (as compared to the first use case where efficiency is not easy to calculate but it offers results that otherwise would be very hard to obtain). MATT helps with repetitive tasks, so, for example, in the case of a company or plant efficiency, it can mean outputting more devices in one day.

From what we saw, usually the robot works alongside humans even in a factory environment, testing more devices and obtaining less errors. When it comes to manual operations, the test cases and interactions are usually prone to human errors, which MATT can spot much quicker or avoid them altogether.

Additionally, working 24/7 MATT protects human staff from tiring, repetitive, boring tasks, and saves the company the effort of finding and retaining employees.

Can you share some insights into the opportunities and challenges you have encountered while expanding MATT’s presence on three continents? What have you learned from this experience that you can share with CEE founders?

MATT is used as a performance measurement tool or as a testing automation tool, so it all starts from here. Both R&D and manufacturing processes have applications for MATT and some use cases forced us to approach specific geographies.

We mostly look for geographies that have industries with touchscreen devices at core. In Europe we were able to expand quite easily in multiple countries. Our first initial success came from the automotive industry where we expanded (and still expand) to different tier 1 suppliers or OEMs around EU space.

Then, we’ve been approached by US-based manufacturers and R&D labs needing a tool like MATT, and with most R&D and development of products happening in the States, the expansion there came naturally.

It’s a trend for the big players of the US market to have testing teams located in other countries, with a part of the testing being done in the States and part of it overseas (India being the most common example we stumbled upon). And so, our expansion to India was fueled by the US clients that also have operations there and slowly we were approached by other companies/ prospects from that region.

The main aspect that propelled us to have a global presence is the quality of the product, the support that we offer, the customizations and the tasks that the robot can perform. With those features and MATT’s functionalities, we were able to deploy solutions to multiple departments inside of the same company and even have MATT recommended as the “go-to solution” by one team to another.

One key takeaway from this experience is to focus on delivering good products and services to the end customer. Especially for first time customers, you’ll have to put in a lot of effort, sometimes you’ll not break even, but it’s important to have the first patrons on your side, the first clients that are not only vouching for you but also help you gain a lot of insights into that specific industry.

So, be patient and try to solve the client’s problems. Ultimately, if you are taking care of the client, the client will take care of you.

Some of the challenges we faced are referring to regulations and how business is conducted in different geographies. Approaching new markets outside the US and Europe requires the client’s support to help you navigate the local waters. The process can get very expensive if you hire a lawyer or a specialized team that tells you exactly what you need to do. Most of the information is already with the client so if you’re asking for help, most of the time they’ll provide everything you need because it’s also in their best interest to have your product as soon as possible.

What are the key features and capabilities of ERIS, the Effective Retail Intelligent Scanner, and how does it address the specific needs of the retail industry?

Our DNA as a company is to solve difficult, challenging problems, and repetitive tasks regardless of industry, that are currently done manually. In retail, we saw the need for a tool that employees could use to audit the shelves and see if in-store situations correspond to the reality at the checkout.

Almost every day, employees must scan the shelves or the price tags manually, making sure that the prices displayed on the shelf are the correct ones and there are no discrepancies with the store’s systems. Furthermore, staff needs to restock the products, making sure that on-shelf-availability is optimal, otherwise it can lead to customer dissatisfaction and overall loss of business caused by the clients not being able to find the product they are looking for.

This type of work is intertwined with other tasks that the employee must perform in-store: working with clients, answering questions, work in the warehouse, price tagging, shelf labeling, price changes, product placement, stock rotation, product facing, shelf maintenance, planogram execution, product information updates, sales and promotions.

In the end, most of the time, in-store shelf-scanning is postponed, leading to less-than-ideal situations.

And even when the scanning is done, subsequent operations are still heavily reliant on manual audit and not delivering the expected results. For example, the replacement of the labels is done manually and there are a lot of distractions that may appear and bring errors into the operation.

ERIS is prepared for the retail ecosystem to solve 3 problems:

- Look for wrong labels or labels that are showing the wrong price,

- Look for out of stock products, detect soon to be out-of-stock products,

- And create a panoramic image with the scanned shelf that can be later used for reporting and planogram compliance verification.

ERIS is an audit tool used to make sure that the shelves are arranged in the right way, the labels show the correct prices, and the in-store stock is up to date, while all this is executed with minimum effort by employees.

From your experience, what are the challenges with developing and funding deep tech in Europe?

The situation in Europe has not been friendly to deep tech startups and scaleups. Due to the nature of the market, Europe is losing a lot of businesses, startups having to move to the US, and not because they want to, but because it’s the only way they can find the right venture/ investor that will help them grow. Overall, this is a loss for Europe in general, and for individual countries in particular.

I’m not saying there aren’t investors or specialized investors; they exist but they are very rare. There are not enough VCs that can see the value of the products or enough incubators that focus on hardware businesses. It’s a challenging time to try and raise capital, especially today when the overall global economy is not doing so well.

I believe this is happening because, firstly, the VC ecosystem is mostly focused on SaaS platforms (which in the past were very successful, this type of business being easily scaled up compared to hardware focused companies). It’s a double-edged sword: that funding is going predominantly in one direction (software) reflects Europe’s dominant industry; on the other hand, because Europe doesn’t have much hardware industry left, there is little funding going into that area.

From my experience by participating in different European events, it’s very hard, almost impossible to find a VC that is willing to work with companies that produce hardware and even when they are willing to do so, they are looking for a business model that is mostly simulating SaaS. They are looking for recurring revenue and aspects that sometimes, yes, show the maturity of the business but that are very hard to impose. Unfortunately, VCs are mostly looking at the startups with this SaaS lens, and they are evaluating hardware companies from a perspective that is not adapted to their characteristics.

What are your funding plans for Adapta Robotics?

We are following two directions. One is finding a VC that will help us scale up. The other, more focused on R&D, refers to finding European grants that will boost the development of our current solutions and allow us to experiment with new ideas that are a bit riskier. We are looking for experienced investors that can help us with our current business strategy, with overall experience and mentorship in the business world, contacts from different companies, that will lead us to scaling up the company.

Looking ahead, what are Adapta Robotics’ plans for future product development and expansion into new industries or markets?

In the near future, we will work on expanding our two product lines, MATT and ERIS. We are noticing a lot of needs appearing across different industries that require different functionalities. For example, for ERIS, we can easily repurpose it for logistics or warehouses where the use case is pretty much similar to what we are doing right now in retail. Therefore, we are looking for opportunities to penetrate different markets.

For MATT, we already address around 8 different industries, and we are planning to expand further into those. We plan to focus on targeting high volume projects where multiple robots are required within a facility or plant, in order to test a large number of devices and we see MATT, therefore Adapta Robotics, becoming an industry leader for the physical testing automation of devices.

And, of course, our R&D is continuously in the back of our minds. We are working on new ideas and new products, new robots that will bring added value across industries, especially in the B2B space.