As private wealth in Central and Eastern Europe continues to grow, so does the sophistication of how that wealth is managed. One model is quietly reshaping the region’s investment landscape: the Single Family Office (SFO)—a private structure dedicated to managing the complex financial and personal affairs of a single affluent family.

Long common in Western Europe and the United States, SFOs are now gaining traction in CEE as more ultra-high-net-worth individuals (UHNWIs) seek control, privacy, and tailored strategies for succession, investment, and legacy-building.

Our latest part of the Money in Motion report explores this emerging trend in depth—drawing on exclusive survey data, regional insights, and interviews with key players.

This project is brought to life thanks to a strong group of backers: ROCA Investments and Vertik Group as sponsors, together with a group of strategic partners – Innotechnics, CEE Wealth Summit, FBN Bulgaria, FBN Hungary, Endeavor, VC Leaders, ROPEA, Bulgarian Angels Club, BAC, BVCA, BBCC, CVCA, 0100 Conferences, , Money Motion and Growceanu.

Why SFOs are taking root in CEE

While the region’s wealth is relatively new—largely created after 1989—it is maturing fast. A growing number of founders are shifting their focus from managing liquidity events to building lasting legacies. SFOs offer a centralized structure to manage everything from capital allocation and tax strategy to philanthropy and generational wealth transfer.

Global momentum supports this shift: the number of family offices worldwide tripled between 2019 and 2023, with forecasts expecting more than 10,000 by 2030.

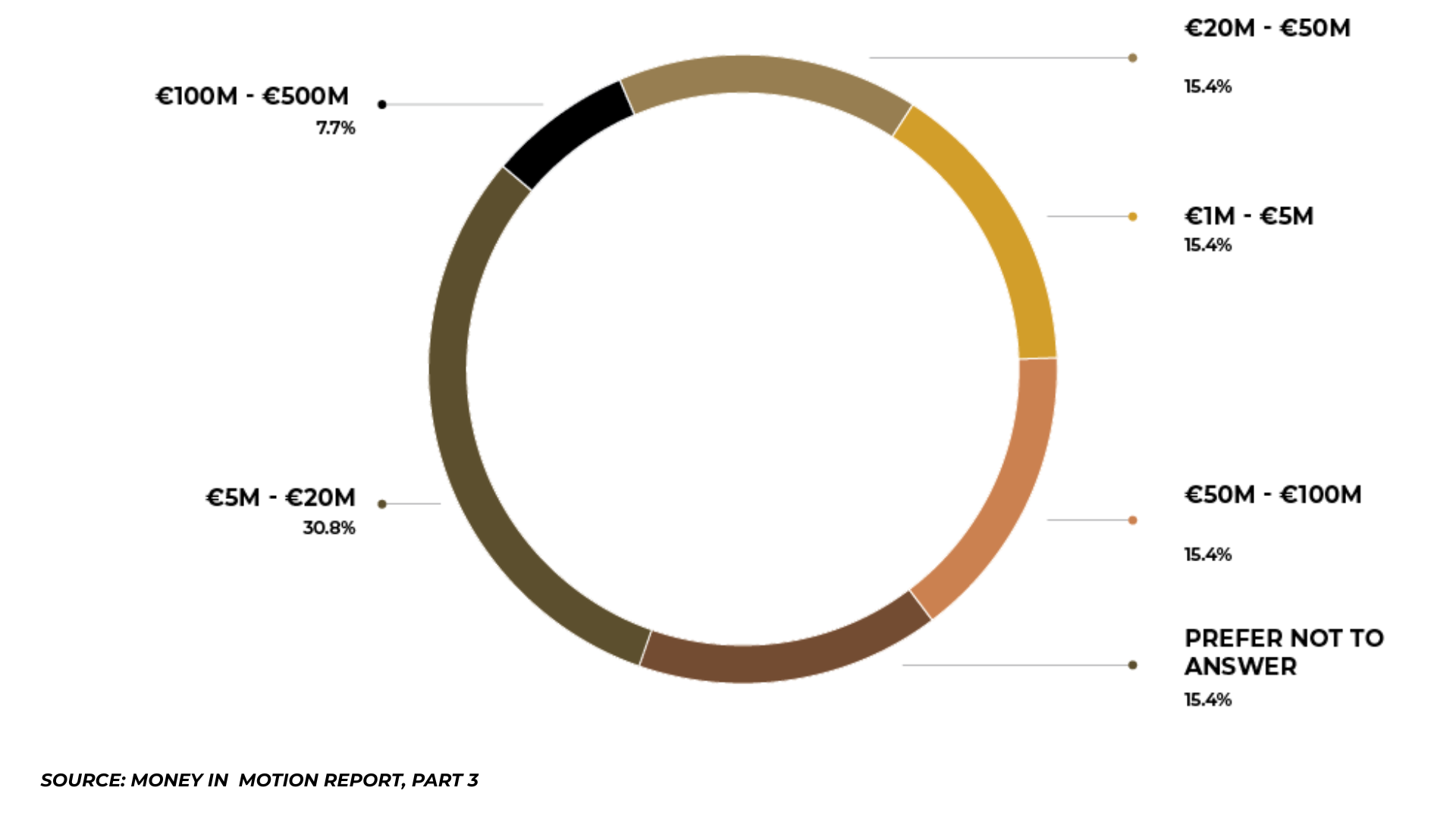

In CEE, the model is adapting to local realities. Families often opt for leaner structures than in Western markets, with many managing portfolios well below the typical €250M threshold. In fact, over 30% of respondents in our survey reported SFO portfolios in the €5M–€20M range.

A new generation of wealth management

Single Family Offices in the region vary widely in structure, but most combine family involvement with professional management. Almost half operate under a hybrid governance model, reflecting a gradual institutionalization of first-generation wealth.

External advisors still play a key role—particularly for specialized deals—but are used selectively. When it comes to due diligence, most families rely on a mix of in-house and external resources.

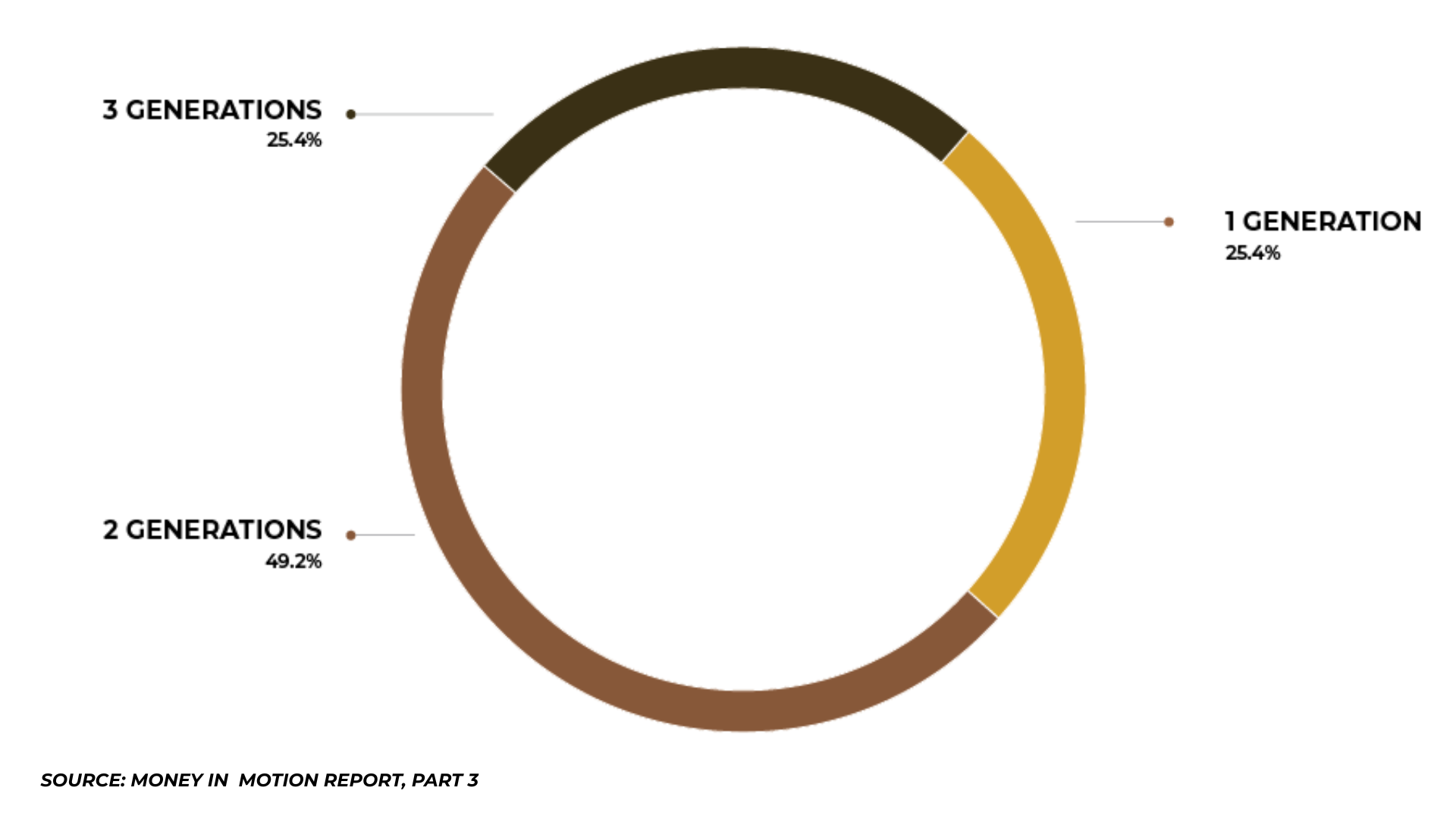

Notably, nearly half of SFOs in the region already involve two or more generations in active management. As David Grammig, Founder of Grammig Advisory, puts it:

“The region sees a tidal wave of wealth transfer, succession, and liquidity events coming towards it. This calls for strategies and action plans.”

Investment preferences and challenges

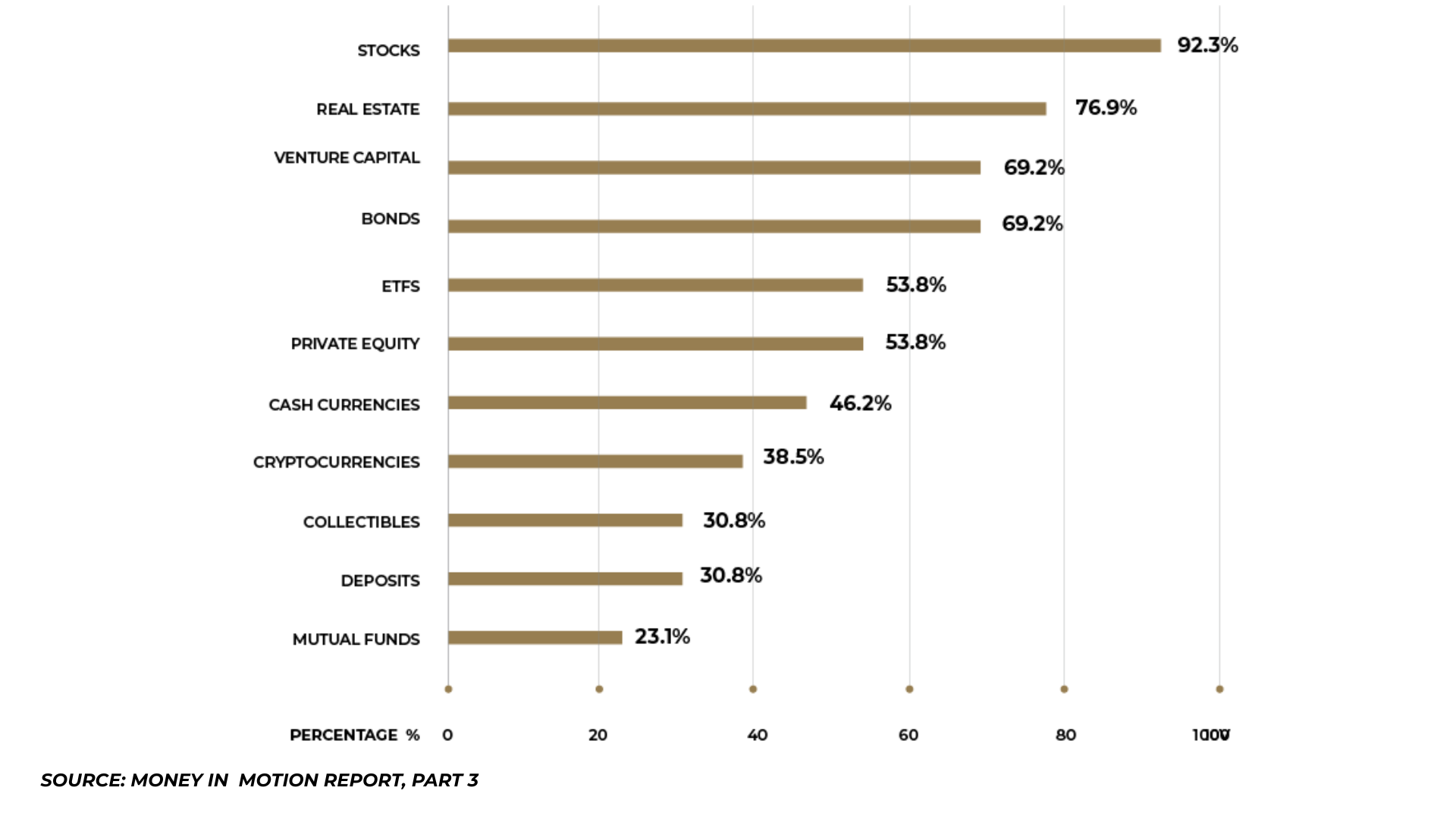

CEE SFOs demonstrate a clear appetite for diversified, long-term investment strategies. According to our survey:

- 92% are exposed to public equities

- 77% invest in real estate

- 69% include venture capital

- 54% back private equity

While capital growth and income generation remain top priorities, wealth preservation is gaining importance amid global uncertainty.

However, the path is not without friction. SFOs cite tax efficiency, lack of quality deal flow, and political instability as top challenges—underscoring the need for more robust infrastructure, regulation, and local advisory expertise.

Succession and the future of CEE Single Family Offices

Succession is a defining challenge. While 41% of next-generation members are already working in the business, only 31% of families have a formal succession plan. This gap could leave many vulnerable to fragmentation as generational transitions unfold.

Legal innovations are beginning to help. Poland’s Family Foundation Act, for example, offers a promising vehicle for succession planning, while favorable tax regimes in Austria, the Baltics, and parts of the Visegrad region offer additional tailwinds.

Want to dive deeper into the numbers, quotes, and insights?

Download the report to discover how a new generation of investors is influencing the future of the region’s capital markets.