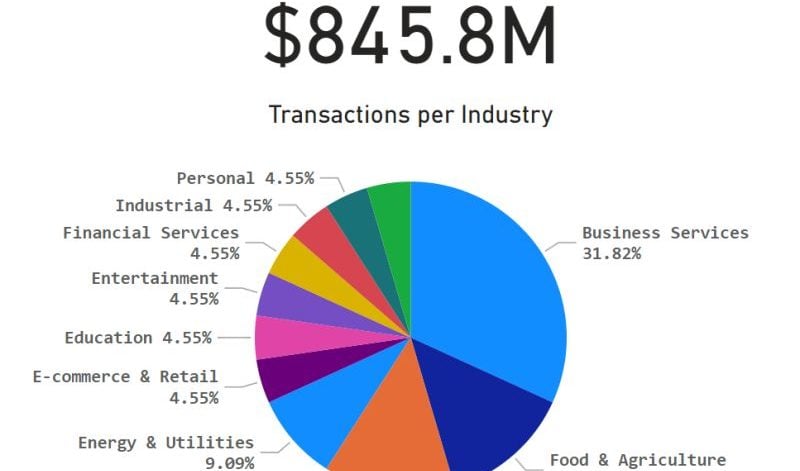

As we closed another year, Croatian startups saw $845.5M in combined investments during 2022, representing a YoY increase despite funding decreasing in North America and Western Europe. Business Services, Food & Agriculture, Transportation & Mobility, and Energy & Utilities occupy top industry spots for the number of deals closed.

Notably, in 2022, foreign investors such as Index Ventures, Coatue, Goldman Sachs, Dawn Capital, FJ Labs, Moving Capital, Nauta Capital, OMERS Ventures, SoftBank Group International, Swisscom Ventures, TCG, Porsche Ventures, Investindustrial, Ischyros New York and Viking Global Investors have all recognized potential RoI in companies with roots from a market that has just entered the Eurozone in 2023.

What can you do with $750 000? You can buy approximately 35.7% of the last year’s standout EV supercar, Rimac Nevera. However, according to our tremendously thorough calculations, this would not get you past a few independently motorized wheels and the front bumper.

Coincidentally, $750 000 was also the average funding amount Croatian startups received in 2022 (excluding the Rimac Group Series D transaction valuating the company at over $2B).

The Croatian startup ecosystem has shown its potential to produce high-value winners through unicorns Infobip and the aforementioned Rimac Automobili. Nevertheless, in 2022, this modest but emerging country has yielded 70% of its funding transactions across early funding rounds (Pre-Seed, Seed, and Series A), illustrating a growing talent pool of new-generation startups trying to follow suit and penetrate the wider market.

So why not take advantage of these undervalued opportunities and seek the next company that plans to disrupt global markets?