Crypto markets have taken a beating throughout most of 2022, culminating with the recent collapse of FTX, one of the biggest global crypto exchanges. Last week, the Bahamas-based exchange went bankrupt after it had lost its liquidity, saw its CEO Sam Bankman-Fried resign, and left a lot of customers scrambling to withdraw their funds.

With its valuation also plummeting from $32 billion to zero in a few days, the FTX fiasco is just another blow in a series of crypto crashes this year, including the Terra/LUNA collapse and the Celsius Network meltdown.

This time in 2021, crypto markets and many investors were touting Bitcoin, which had reached a value of $69,000, as the future of the financial system. A year later, Bitcoin is worth around $18,000, and investors in the crypto markets have suffered a loss of more than $2 trillion.

- Does the FTX crash spell the end for crypto markets as we know them?

- Or will the crypto industry bounce back and become stronger than before?

According to the experts that The Recursive talked to, all options seem on the table. However, one matter is obvious: the trust that people had in the crypto industry is severely shaken.

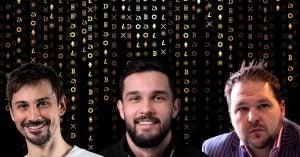

“The whole idea of crypto was not to be dependent on centralized exchanges. Which means we took a wrong turn somewhere. I usually look forward to bear markets for this very effect of cleansing the market of bad actors. I am a bit more cautious this time because the economic turmoil in traditional markets requires us to pay closer attention. We must remind ourselves that crypto from its inception never went through a serious financial crisis, so relying on past experiences may not be a good basis for making decisions,” Vlaho Hrdalo, lawyer and chairman of the Croatian Union for Blockchain & Cryptocurrencies (UBIK), told The Recursive.

The trust in the industry had already suffered a heavy blow with the previous crashes. Right now, caution is a must for most crypto investors, Eva Jovanova from the Swiss blockchain data intelligence platform Glassnode says.

“If you’re a crypto investor affected by this, I highly doubt you’d settle for anything but self-custody of your coins at this point. So, in the short and long term, I predict serious investors will forgo being seduced by high yield or staking rewards on centralized exchanges at the cost of cold wallets,” Jovanova tells The Recursive.

Next: Regulators must step in

The FTX developments open up another debate: crypto platforms need to be regulated or prove they have a backup plan. The crash of the crypto exchange reportedly ended up with at least $1 billion worth of investors’ assets missing, which further advocates the need for some type of regulation.

For Viktor Kochetov, founder of Kyrrex, a global crypto exchange with R&D in Ukraine, regulators can prevent a potential collapse in several ways.

“First, they don’t allow using assets behind the user’s back. A transparent interaction with a platform is what the majority of clients require nowadays. Second, each regulated company has to pass inspections and prove it is not using tokens for personal profit. FTX could avoid the collapse by following such simple rules,” Kochetov tells The Recursive.

According to him, another issue is that crypto exchanges such as FTX got on top of the hill quickly, primarily thanks to giants like Binance.

“When a big problem occurs, the only way to get out of this situation is to sell illiquid tokens. Binance is dumping FTTs worth more than 500 million and creating an even bigger rabbit hole. The FTX collapse shows that you can take the top position, and then all of your ambitions break within two days because you haven’t established your inner processes,” Kochetov points out.

According to Jovanova, it is inevitable that regulators will now become even more active in the industry as a whole.

“I expect regulators worldwide to take an even more active role in crypto. While financial scams and companies going bankrupt and leaving thousands of people in financial shatters have happened outside of the crypto world, regulations will soon take place to mitigate and prevent situations like this. The EU’s MiCA provisions, which will be fully in force at the end of 2024, require centralized crypto exchanges to keep their customers’ funds in separate accounts, which wouldn’t be affected in the case of bankruptcy,” Jovanova adds.

The unregulated nature might indeed be cause for the downfall of the crypto giants so far, Arvin Kamberi from DiploFoundation notes.

“It started with the fall of ‘Celsius’ network, continued with the demise of the ‘Luna’ token, and finished (or maybe not yet) with the bankruptcy of the FTX exchange and the related company Alameda. In all three cases the unregulated nature of centralized exchanges pushed their owners into a greedy play to invest users funds into a financial market and leveraged trades. And it backfired spectacularly,” Kamberi, who is also the Vice President of Serbia’s Bitcoin Association, tells The Recursive.

The light at the end of the crypto tunnel

While the FTX bankruptcy is a shock for the whole crypto ecosystem, the regulation and individual safety measures could become the end of the tunnel of a very cold crypto winter, Jovanova points out.

Kyrrex’s Kochetov also expects that regulation will bring a new era for the industry after the markets stabilize from the shocks they have been through this year.

“The market will stabilize in 2-3 months after the FTX collapse. The new era of regulated cryptocurrencies is incoming. I believe it will affect only a part of the market since many holders value the freedom of crypto assets. Also, regulations will lead to mass cryptocurrency adoption. It is something many institutions have been waiting for a long time. In this scenario, banks or businesses can process crypto assets without harsh restrictions,” Kochetov points out.

No mater what, there will always be bad actors in the industry as well, Kamberi adds.

“Security in this industry is built around the myth of unhackable encryption and blockchain immutability. Anyhow, the blockchain does not protect anyone from the bad actors, inside trading, financial fraud, and plain scams that are overpopulating the cryptocurrency industry,” he tells the The Recursive.

For crypto traders, while the issues with FTX seemed to have surfaced during the last week, they may have been there for a while. Now, it remains to be seen what is the extent of the harm that the FTX crash has caused.

“With the latest events, I believe we have taken a step backward, maybe even a few years. The cryptocurrency ecosystem will grow gradually rather than in giant leaps. I’m worried that Bitcoin will reach a price range of $10,000 to $12,000. Regulators will examine this sector of the economy much more closely and harder, which is probably for the best, to be honest,” 38-year-old crypto trader Daniel tells The Recursive.

Others, such as Skopje-based trader Stefan Angelovski, who has been trading crypto for the past few years, are more optimistic, primarily due to the past experiences that they’ve had with the crypto markets.

“The future of crypto is bright because people like me had the same experience with Cryptsy in 2014-2016. Then I bought DOGE and was left with nothing afterward. However, I think the industry needs to be regulated so there will be more transparency and people will know that the funds they have deposited are secured,” Angelovski tells The Recursive.

As he explains, previous developments, such as the Binance hack in 2019, have only contributed to the industry becoming more resilient, and the FTX collapse can have a similar effect.

“After the 2019 Binance hack, they made the SAFU fund which covers anything related to hacks in Binance. Additionally, Binance is the only exchange showing proof of funds, with many others following this practice in the future. So, I do think that we will see a new beginning in these dark times,” Angelovski concludes.