Just one month in, and 2025 is already proving to be anything but dull for the tech and startup world. In January 2025, the global venture capital landscape was significantly influenced by (not surprisingly) the AI sector. This trend mirrors the substantial growth observed throughout 2024, where AI startups captured a record 46.4% of the total $209 billion in venture capital funding.

Could this trend potentially harm the innovation environment by inflating valuations and creating a bubble? Is the investment landscape opening up to new sectors?

CEE venture capitalists have their perspective on the 2025 investment landscape, rationalizing it from a regional point of view. The Recursive surveyed 24 leading VC firms, revealing insights into their investment strategies and industry trends.

Read further for insights into the factors affecting their decision-making process.

CEE VCs are eyeing opportunities in AI, Cybersecurity and Deep Tech

The combined enterprise value of startups in CEE has experienced significant growth, increasing from €89 billion in 2019 to €213 billion in 2023, which marks a 2.4-fold rise over five years.

The majority of the surveyed investors view the CEE region as still holding significant long-term potential, despite current economic challenges such as inflation, geopolitical tensions, and conservatism in the market. А clear distinction in their answers is made between the non-tech economy, which usually faces more challenges, and the tech sector – more globally connected and less affected by local economic fluctuations.

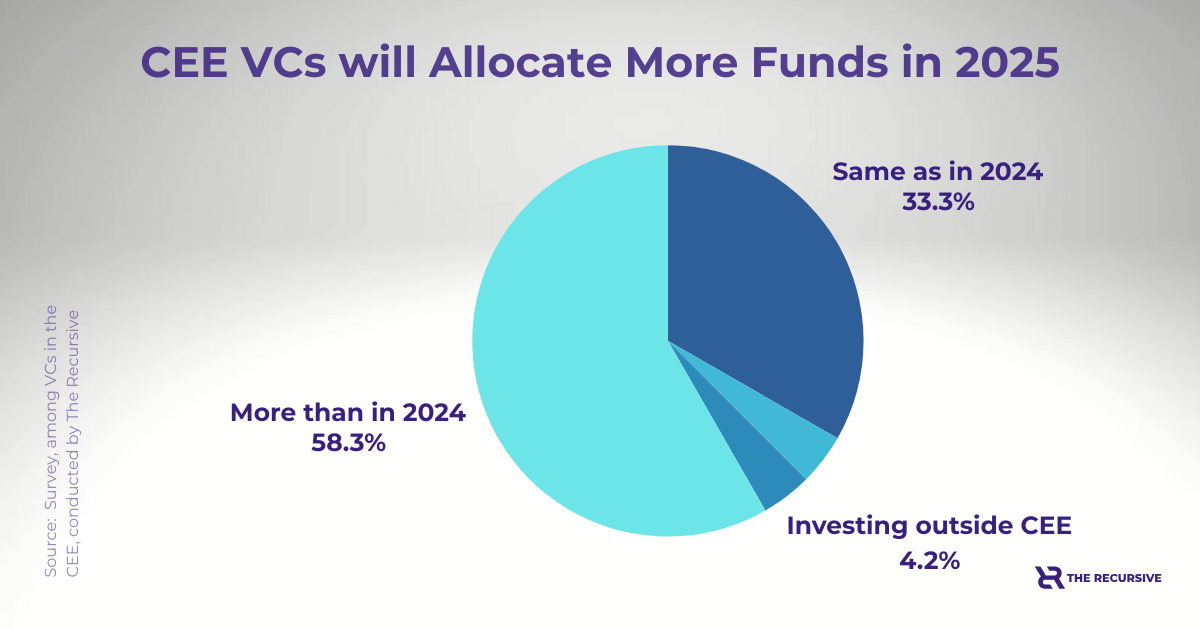

62% of surveyed investors answered that they foresee the investment climate in CEE in 2025 as more favourable than the previous year. Therefore, more than half of the VCs share that they are willing to allocate more funds this year.

Fil Rouge Capital summarizes that they see this period as an “inflection point, where short-term hurdles coexist with promising long-term growth.”

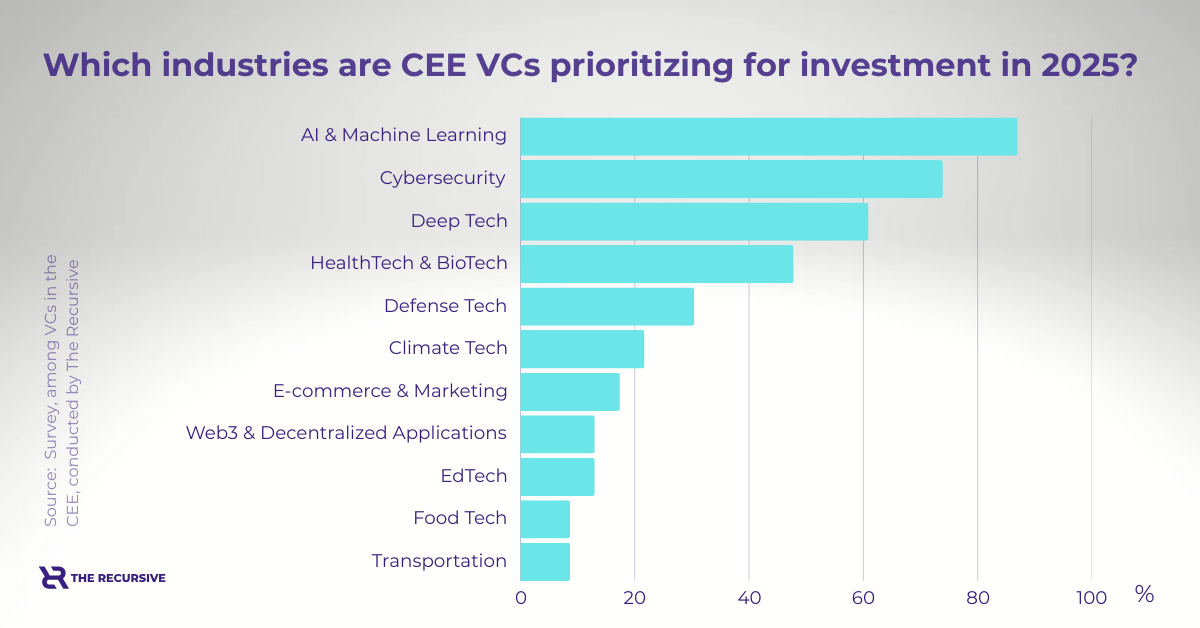

Most of the surveyed VCs point out that in 2025, there are opportunities for innovation, particularly in sectors like AI, Cybersecurity and Deep Tech. For example, the Health Tech sector has demonstrated remarkable growth, with projections indicating a substantial increase in market value from $175 billion in 2019 to approximately $660 billion by 2025. On the other hand, over-concentration in specific sectors could expose portfolios to risks if these sectors face downturns or regulatory challenges.

The early-stage investment environment remains cautious

The caution in the market has led to a “flight to quality” trend, where the best companies attract more capital, but this reduces opportunities for less-established entrepreneurs.

Andrew Gray, General Partner at Tilia Impact Ventures, highlights why this is important: “Fewer founders get a shot at building something big, and meanwhile there appears to be somewhat of a bubble forming with company valuations in the AI space (which ultimately harms those working in the space).”

The capital environment is described as challenging, with LPs being more conservative, especially in regions like CEE. Despite this, new VC funds continue to emerge, for example, Poland’s largest institutional investor, PFR, becoming more interesting for foreign investors.

Navigating uncertainty in 2025

According to the survey, economic slowdowns, including inflation, interest rate volatility, and potential recessions, are viewed as risks that could weaken investment activity, particularly in the CEE region.

Geopolitical instability, consistently highlighted by the VCs, remains a significant threat to investor confidence and business operations, potentially impacting the broader investment climate and leading to new market niches like Defense Tech.

The funding environment may tighten, especially if there is a global contraction in VC funding, which could limit follow-on opportunities for CEE startups.

Changes in regulatory frameworks (such as data privacy laws, taxation, or M&A rules) pose a risk, especially for startups looking to scale internationally. Talent retention could become more challenging as global competition for tech talent intensifies, threatening the CEE region’s cost advantage.

Investors also say that there’s always a sense of caution regarding unforeseen events, such as Black Swan occurrences, which could dramatically alter market dynamics.

How to balance out the potential challenges? Some surveyed investors are taking proactive steps such as portfolio diversification across sectors, hands-on engagement with portfolio companies, and early identification of high-potential startups to mitigate risks.

In terms of sectors, investors highlight cybersecurity and defense as the most resilient ones. Moreover, B2B vertical applications of generative AI and automation continue to gain traction.

“Defense has become very attractive, though most investors don’t know what to expect. Deep tech, in general, has the potential to generate VC returns in CEE,” says Petr Sima from Depo Ventures.

AI and Deep Tech remain preferred sectors for investment

According to the surveyed investors, AI adoption is seen as a crucial factor driving productivity and growth, which is expected to improve the economic climate and investment opportunities. However, concerns about overvaluation, especially in the AI space, are also present.

Several sectors might face challenges in the coming year, including traditional SaaS and non-AI enterprise software, Web3 and blockchain, consumer goods, climate tech, and hardware development due to factors such as market saturation, shifting investor priorities toward AI, regulatory pressures, economic uncertainty, and the need for more scalable, impactful solutions.

Yet, one of the surveyed investors, remaining anonymous, shares that “investing in AI in 2025 is nothing new, I would be rather curious about the next wave of emerging technologies.”

Deep tech sectors like quantum computing and robotics are favored for their long-term potential, while climate tech driven solely by regulatory mandates may face funding challenges, according to the survey.

Unicorns in 2025? Maybe not myth

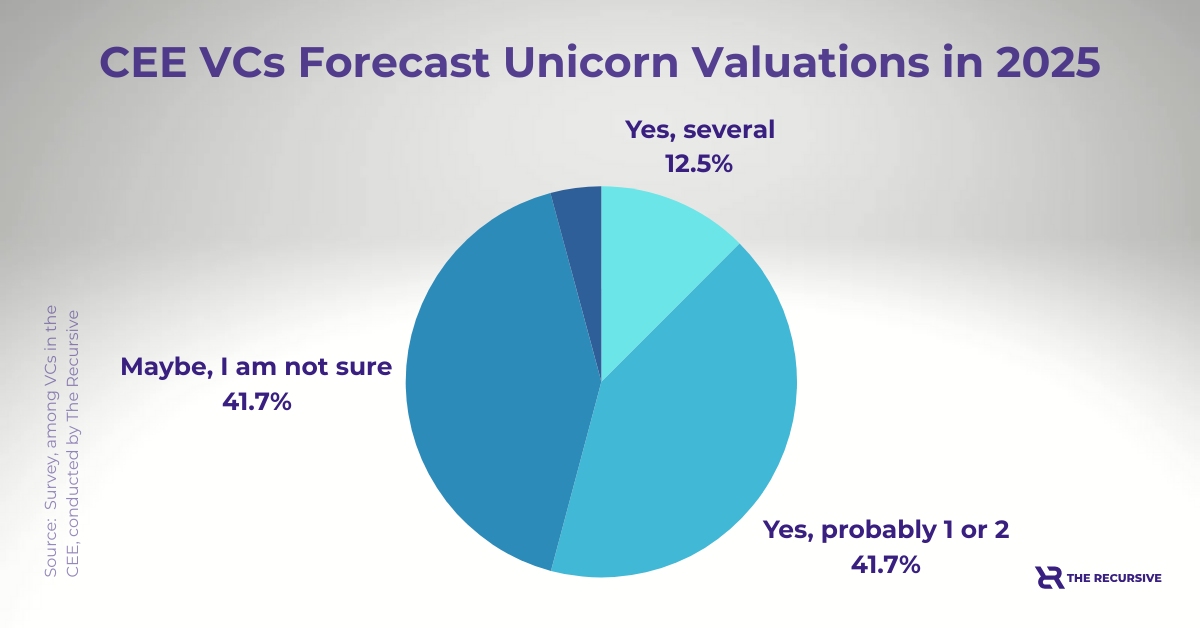

Last year, four CEE-founded companies reached unicorn valuations, including Polish Eleven Labs and Greek Blueground. According to our survey, investors remain optimistic about startups reaching a billion-dollar valuation in 2025; however, CEE startups must navigate several significant obstacles.

Limited access to late-stage funding and the regional focus of many startups could make scaling more challenging.

“Since LP funding is becoming concentrated into fewer, larger, VC funds, they become the gatekeepers of which companies can raise large rounds. We expect a more drastic ‘tiering’ to emerge whereby the companies in those spaces, which the large VC players are focused on (such as AI agents, productivity replacement, deeptech), will raise more money than ever and reach higher valuations than ever; whereas companies that do not fit this mold will likely only be able to raise smaller Series A, B rounds and will slow their growth,” shares Andrew Gray from Tilia Impact Ventures.

Emerging Markets: from Southeast Asia to Africa

Besides CEE, Southeast Asia continues to rise due to its young, tech-savvy population and strong government support for digital transformation, as investors point out. The region has stayed relatively resilient compared to other parts of the world, with the digital economy on track to hit $600 billion in gross merchandise value (GMV) by 2030.

In Africa, mobile adoption and a growing middle class create opportunities in Fintech, AgriTech, and mobile solutions. The Middle East and North Africa (MENA) benefit from oil wealth diversification, with strong growth in sectors like EdTech and Health Tech. Additionally, Latin America and India are gaining traction with their maturing startup ecosystems and government support for innovation, particularly in AI and digital solutions.

For instance, companies like Microsoft have announced significant investments in India’s AI infrastructure. Microsoft plans to invest $3 billion in cloud and AI infrastructure over the next two years, including new data centers and skills development programs.

Local VCs as a “discovery engine” for international funds

In 2025, collaboration between funds can help expand networks and improve deal flow, particularly in emerging markets like CEE. “It’s always good to co-invest,” shares Tomas Cironis, Investment Manager at Ilavska Vuillermoz Capital. “You diversify the risk; you collaborate. And also startups benefit from that too.”

A growing presence of international funds investing in Central and Eastern Europe (CEE) reflects the region’s potential but also increases competition for local firms. “It is both a blessing and curse to have an increased presence of international funds investing into the CEE region,” says Andrew Gray from Tilia. “We are responding to this by investing earlier into a company’s life, to become a kind of discovery engine and trampoline for local founders to be propelled to the global stage quickly,” he concludes.