We hear a lot these days that we’re on track to miss the biggest climate action goal humanity has set: limit global warming to 1.5°C, in line with the Paris Agreement, which requires reducing carbon dioxide emissions to 18 gigatons per year by 2030. Where were we in 2021? At a hot-record of 40.8 Gt of CO2.

And on our way there we’re missing all these other supporting milestones, from the rate of decarbonisation, which needs to be 30 times higher, at 15.2% per year, to carbon intensity, which needs to drop to 77% by 2030, to global green investments, which need to reach $2 trillion by 2030 and then double again by 2050.

Among others, we need to take full advantage of the opportunities climate tech presents in reducing emissions. Building new, low-emitting assets and technologies is one of the four strategic areas of action recommended by the International Energy Agency to accelerate the net zero transition.

But for that, we need to put our money where our mouths are. Climate tech investment remains a key challenge. Yes, 2021 has been a record year with $755bn spent on carbon mitigation technologies. And between 2013 and 2019, total venture funding in climate tech jumped by more than 3,750%. The EU Green Deal, REPowerEU, and the new climate bill in the US, are all going to push investment in climate tech investments further.

However, PwC’s research shows that VC investment is heavily concentrated in just a handful of sectors and countries. In 2021, 60% of investment went to mobility and transport startups, while 65% went to the US. The result is a carbon funding gap, where the technologies that could support decarbonisation in specific industries and across different regions lack the funding opportunities for deployment at scale, which is required to deliver impact.

Shedding light on this sectoral and regional climate tech investment gap, and pointing to innovators with potential to accelerate decarbonisation from Central and Eastern Europe are the two goals of PwC’s Net Zero Future50 report, CEE edition, The Recursive summarizes and reflects on the report’s finding below.

State of the climate tech ecosystem in CEE in 6 graphs

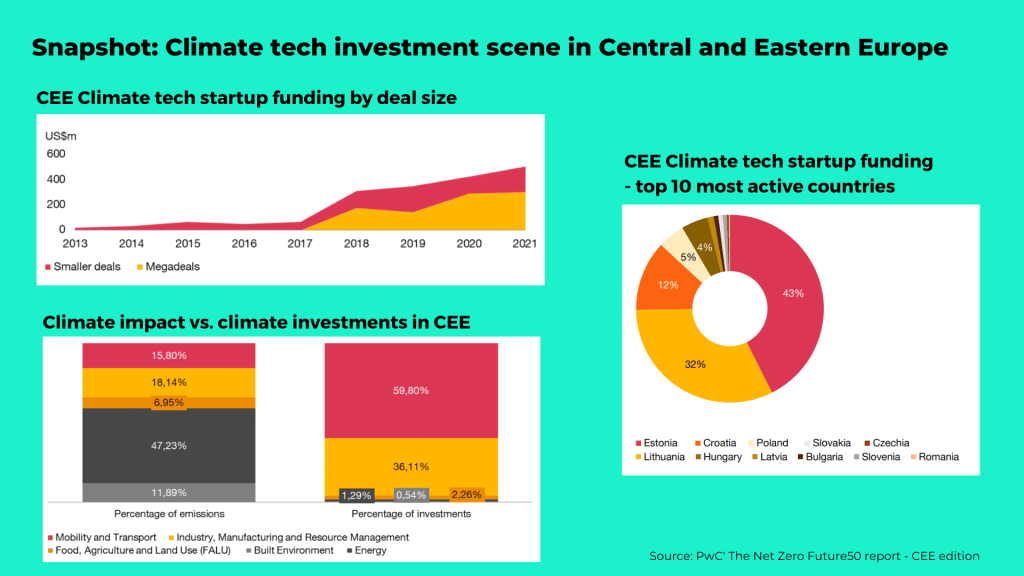

In CEE, climate tech investment is following the upward trend at the global level, at circa 57% compound annual growth rate (CAGR) between 2013 and 2020, reaching a total of USD $1.758 billion over the period 2013 – H1 2021.

This funding was directed at more than 170 startups, with most active investment hubs being Estonia, Lithuania, Croatia, Hungary, and Poland. Yet no climate tech startups valued at $1 billion+ in CEE, yet.

The growth in funding was mainly driven by the rise of megadeals (deals valued at more than $100 million) in sectors including mobility and transportation, industry, manufacturing, and resource management.

Notably, even though the region contributes around 3.73% of global GHG emissions, and is showing signs of future economic growth, its share of global climate tech investment stands at 0.79%.

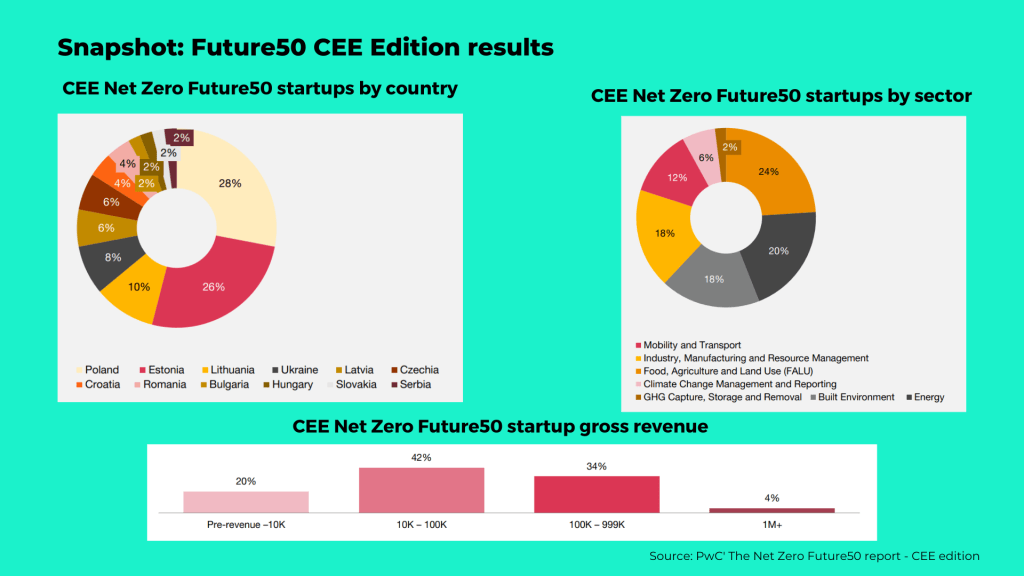

Out of the 170+ startups identified, PwC selected 50 startups as part of the Future50 top, based on their maturity stage, scalability, and climate impact.

These innovators are spread across 12 countries: Poland (14), Estonia (13), Lithuania (5), Ukraine (4), Latvia and the Czech Republic (3 each), Croatia and Romania (2 each) and Bulgaria, Hungary, Slovakia and Serbia (1 each). Most startups operate in food, agriculture, and land use (12), energy (10), built environment (9) and industry, manufacturing, and resources management (9).

Most startups selected are in the early stages, with only 20% having raised Series A or Series B rounds. The other 80% either are bootstrapped or have received seed funding or grants.

Finally, 17 companies are generating between €100K and €999K in annual revenue, suggesting they have found a commercially viable business model. Two companies reported more than €1 million and both operate in the solar panel rooftop industry.

The report concludes that the ecosystem is in its early days, and less mature than other startup hubs, although it does not have a shortage of technically minded founders, capable of solving important challenges.

What is lagging, however, is access to climate tech investment to develop commercially viable solutions. A mix of grants and venture funding are further needed at national and regional levels. Southeast Europe, for instance, has plenty of innovators in fields such as green mobility, food and agriculture, the built environment, and circular economy, however, funds that are specialized in or event targeting climate tech investments in the region are scarce.

Climate tech companies, including SaaS, are usually capital intensive, requiring heavy upfront costs, while development times can be lengthy and payback from revenues is slower than for other products and services. They are also more likely to be subject to regulations and require approvals from various parties.

Going forward, more effort is needed in demonstrating the commercial and impact opportunities of climate tech solutions, introducing specialized VCs, accelerator programs and grant schemes, and educating the general public on making more sustainable choices.

Under the spotlight: Startups from Southeast Europe

Name: RongoDesign (Ed.note – website coming soon)

Location: Cluj-Napoca, Romania

Founders: Gabriel Barta (CEO)

Vertical: Biotechnology

Solution: A biotech that uses organic waste, including coffee grounds and residues from crops such as hemp, hops and sunflowers, to build safe and durable interior design products with biophilic features. The company claims the solution provides 40% better thermal insulation and 70% better sound insulation vs. polystyrene materials.

Impact: The company estimates their manufacturing process is carbon-negative, based on the fact that mycelium captures twice its weight in CO2 during cultivation, while the products are 100% biodegradable, preventing waste creation.

Highlights: Funding from EU programmes including the COSME program and Start for Future.

Name: Svelte

Location: Brasov, Romania

Founders: Octavian Richea (CEO)

Vertical: Constructions

Solution: Svelte designs, develops and manufactures machines that produce construction elements and architectural surfaces with an optimized topology, to speed up production by up to 40 times.

Impact: The company claims its systems can save up 2.74 million tonnes of CO2 per year, reducing use of raw materials, and emissions including nitrous oxide and methane.

Highlights: SME Instrument and EIC Accelerator grants from the European Commission’s Horizon 2020 programme.

Name: Atfield

Location: Serbia

Founders: Vukasin Pejovic (CEO), Srdjan Tadic (CTO)

Vertical: Agriculture

Solution: Atfield’s flagship product winessense® provides data on the microclimates of vineyards, based on a dense solar-powered sensor network.

Impact:This data can be used to help winegrowers save spraying. The company estimates that the reduction in spraying cuts CO2 emissions by 50 kg per hectare per season, based on a 45 kW tractor.

Highlights: The company reports that sales and the number of customers have grown four-fold year-over-year.

Name: Nasekomo

Location: Sofia, Bulgaria

Founders: Xavier Marcenac, Marc Bolard

Vertical: Food

Solution: Nasekomo is CEE’s largest producer of high-quality insect protein for the feed and aquaculture industries, offering an alternative to soy and wild-caught fish.

Impact: The company estimates that one tonne of insect protein meal saves 2.5 tons of CO2 emissions, using 1/13th of the water and 1/150th of the land for the same amount of protein.

Highlights: Most recently, the company received a ~€325K grant from Innovation Norway to scale their production.The company raised over €5M in total from venture funding and grants.

Name: Miret

Location: Croatia

Founders: Domagoj Boljar, Hrvoje Boljar

Vertical: Consumer goods

Solution: Miret is designing bio-based footwear that aims to produce compostable, recyclable shoes from renewable, bio-based, non-toxic, and sustainably grown materials, such as hemp.

Impact: The company estimates that the sneakers help save 4.88 kg of CO2 emissions per per, compared to an industry average of 14 kg.

Highlights: Equity crowdfunding of $723.8K.

Name: Makabi Agritech

Location: Zagreb, Croatia

Team leader: Associate Professor Marko Vinceković

Vertical: Agriculture

Solution: The project is building encapsulation technology that provides plant protection and nutrition, and controlled release of bioactive components, reducing pollution and the use of chemicals. Makabi seeks to transfer knowledge and technology to other companies, as a bridge between the private sector and research institutions.

Impact: The company estimates that the microcapsules can reduce the use of agrochemicals by 30%, leading to higher food production.