Despite rising geopolitical tensions, inflationary pressures, and a challenging fundraising environment, the tech startup landscape in Central and Eastern Europe continues to thrive. To shed light on the state of AI in the region, The Recursive will release the State of AI in CEE 2024 report on November 12.

Here’s a sneak peek of the seven key findings from the report.

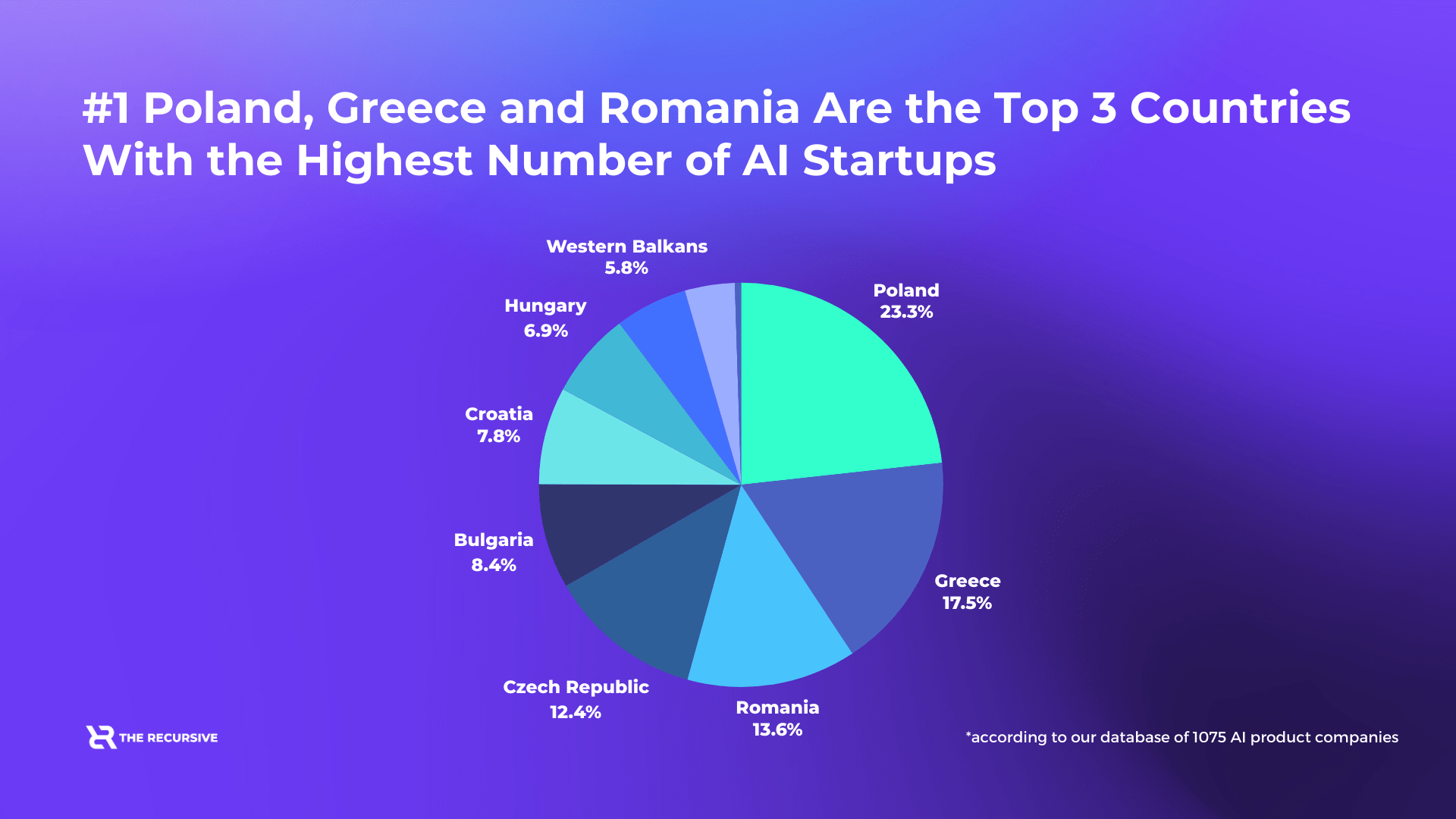

Poland takes the lead in AI startups

Poland stands out as a hub for AI innovation, representing 23.4% of AI startups in the CEE region. Greece follows with 17.5%, and Romania comes in third at 13.6%. These countries are driving AI startup activity and shaping the region’s technological landscape.

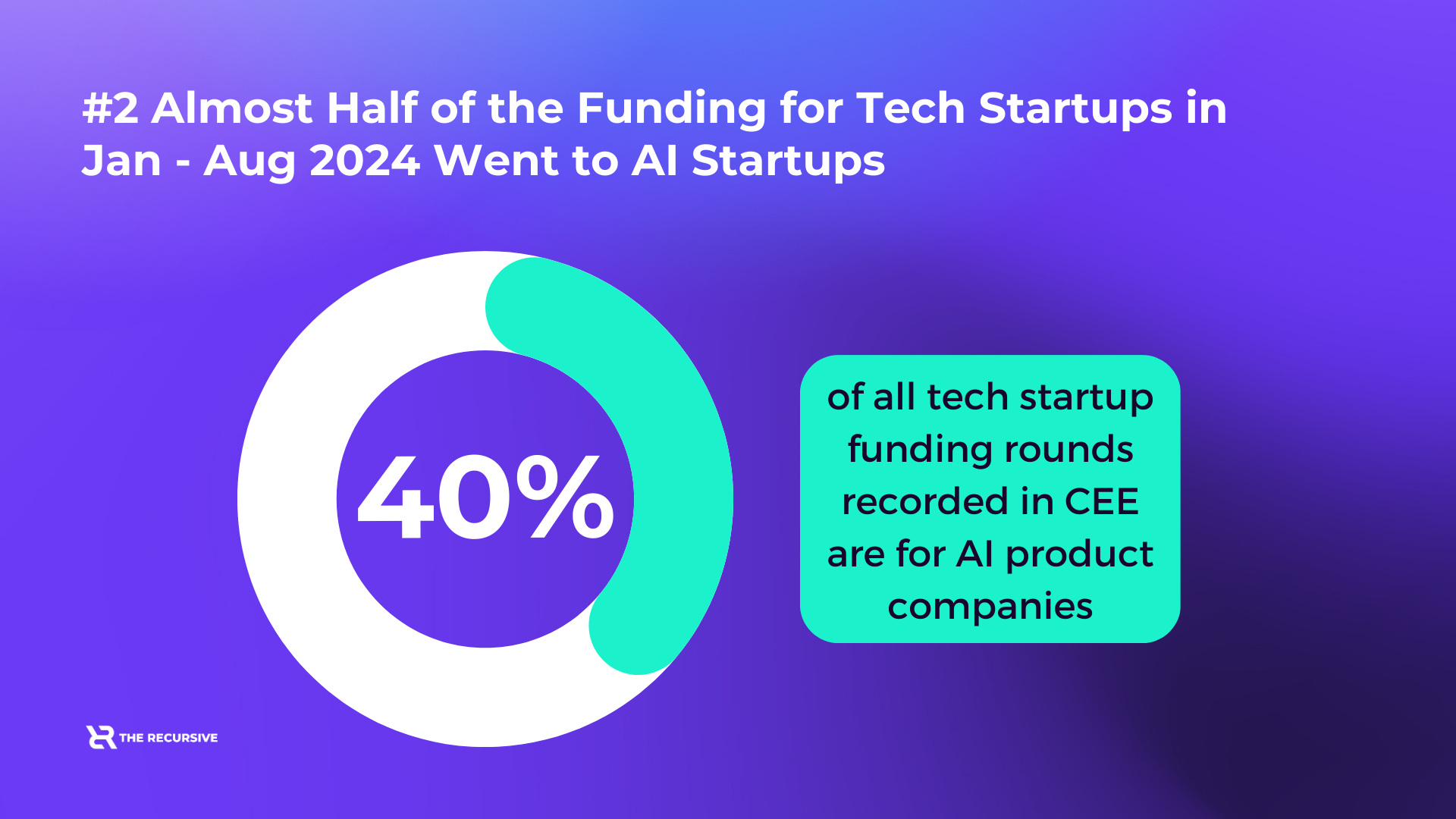

AI funding represents 40% of CEE tech startup rounds

AI startups are at the forefront of tech investment in CEE. Between January and August 2024, AI companies accounted for 40% of all tech startup funding rounds in the region. Despite a general downturn in investment compared to the 2021-2022 boom, AI remains a key focus for investors.

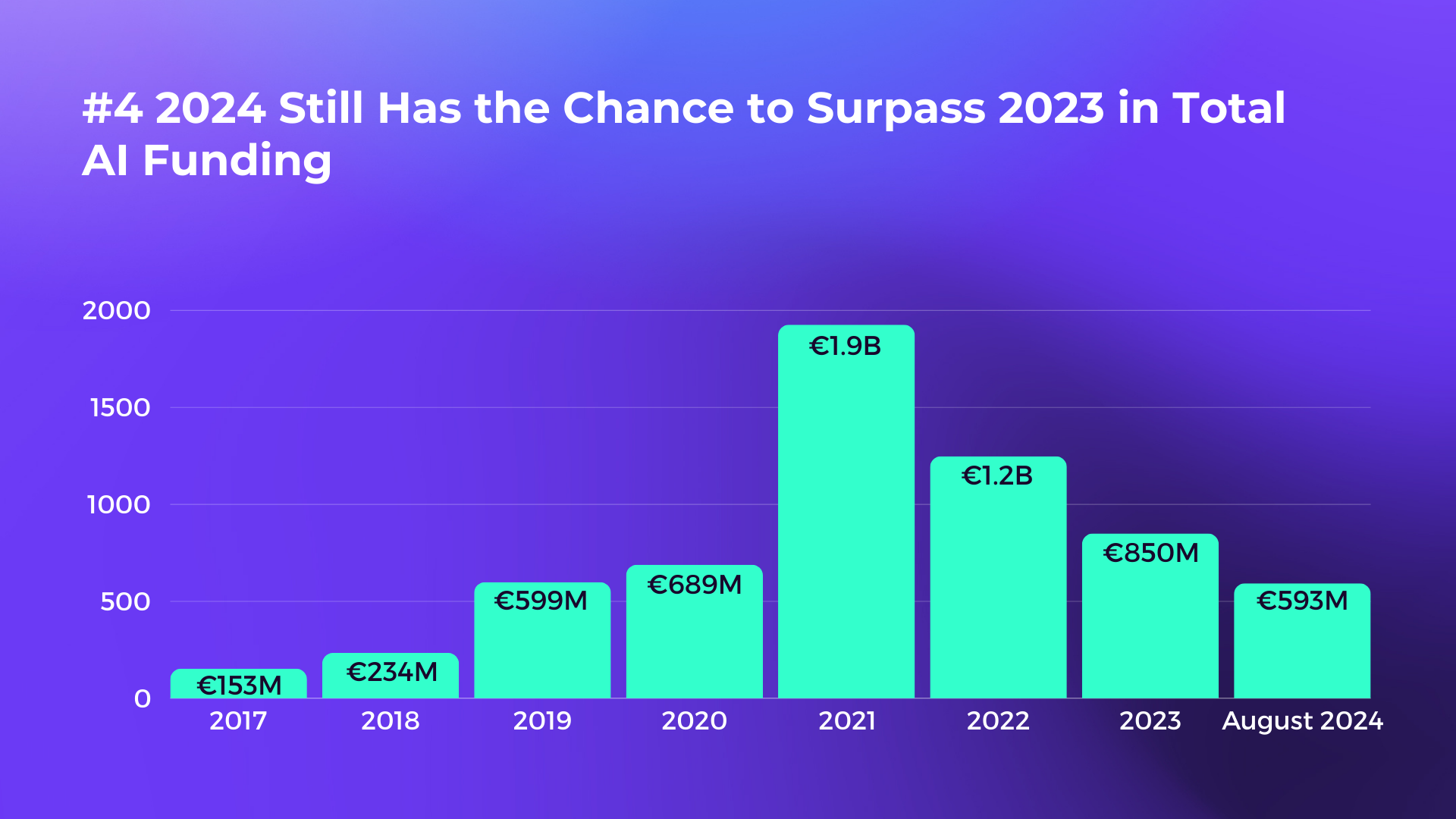

A correction, not a downturn, in funding

The surge in funding during 2021 was driven by private equity, venture capital, and EU support, but investment levels have since normalized. Experts view this shift as a correction, with funding returning to long-term averages. Factors such as geopolitical instability, inflation, and rising interest rates have also impacted the fundraising environment.

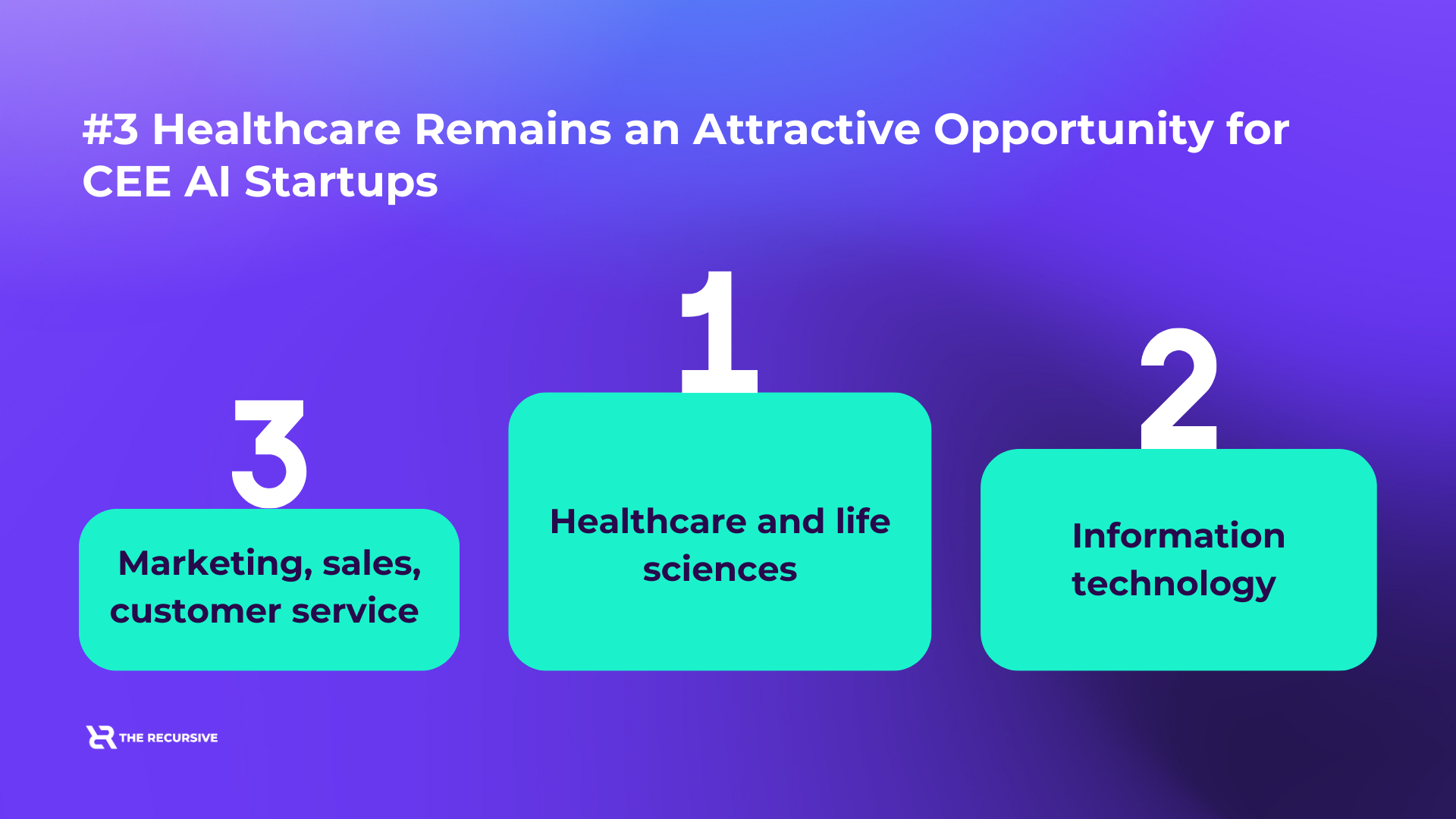

AI specialization reflects global and local trends

AI startups in CEE are aligned with global trends, specializing in machine learning, big data, computer vision, and natural language processing (NLP). However, they are also addressing specific local needs, particularly in sectors like healthcare and life sciences, IT, and marketing and customer service. Generative AI is making a strong impact, particularly in personalized content, chatbots, and recommendation systems.

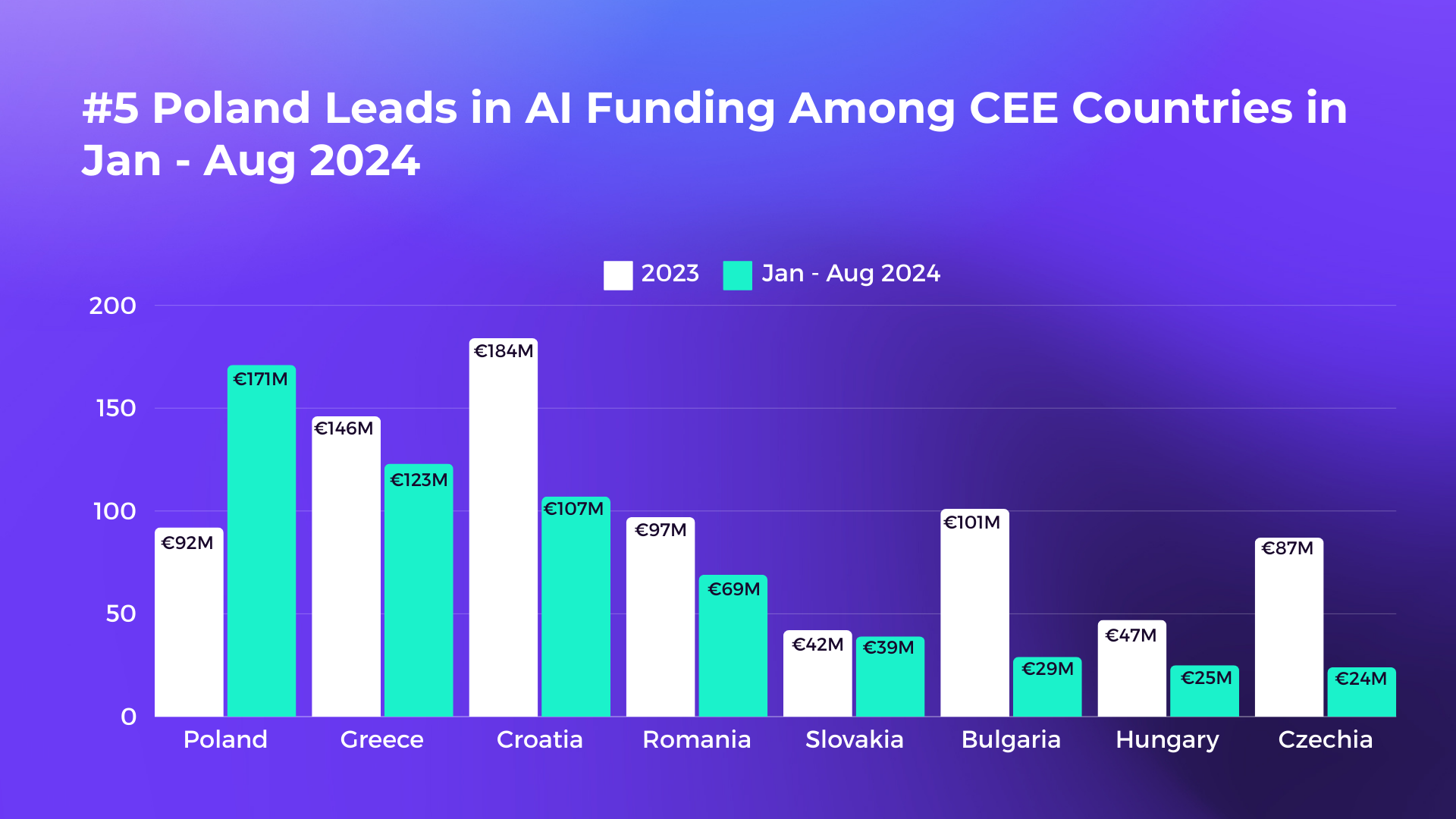

Poland and Greece lead in AI funding

By August 2024, Poland had secured €170M in AI funding, leading the region. Greece followed closely with €123M. Croatia, with impressive investments from Verne, continues to shine, while Hungary is also making significant strides, nearing 50% of its 2023 funding total. In contrast, countries like the Czech Republic and Serbia are seeing declines, though there is potential for recovery by year-end.

VC challenges and new funds raised

Venture capital activity has seen a decline in exits, affecting liquidity and making fundraising more difficult for VC firms. However, 23 VCs in CEE have successfully raised €1.155B in fresh funds, ready for investment. Poland leads in this area, with nine new funds, seven of which are backed by PFR Ventures, Poland’s Development Financial Institution.

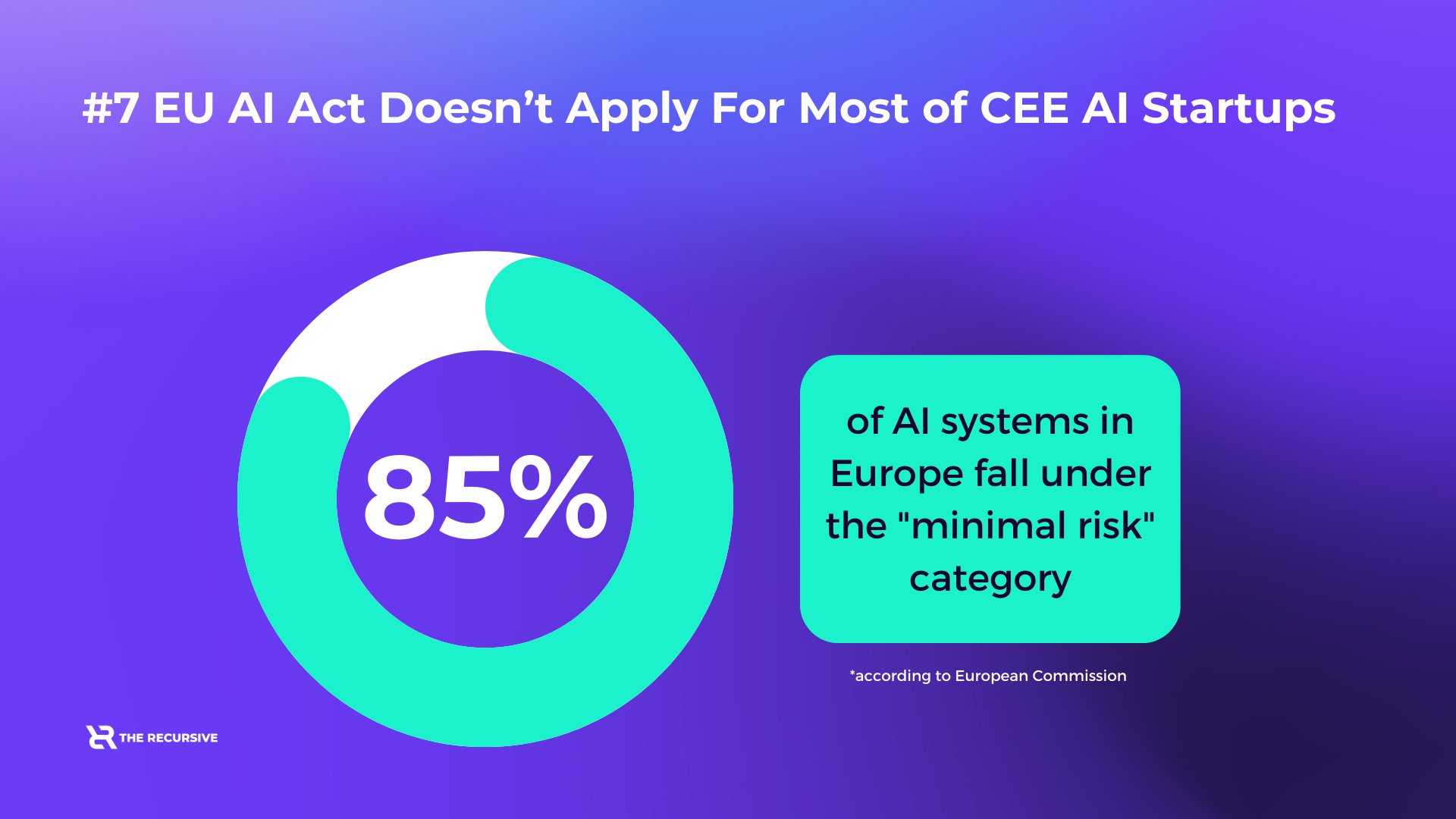

Minimal risk AI systems

According to the European Commission, 85% of AI systems developed by European AI companies are categorized as “minimal risk,” meaning they will face less regulatory scrutiny. This regulatory landscape could favor innovation and help drive AI development in the region.

These are just some of the insights from The Recursive’s upcoming State of AI in CEE 2024 report. For a deeper dive into AI in Central and Eastern Europe, sign up here to receive the full report on November 12.