How can SMEs use embedded finance as a tool for growth?

With the support of one of the leading SEE early-stage venture capital funds Eleven Ventures and Visa Innovation Program, The Recursive worked on a series of explainer articles that demystify how startups in the region can approach their growth plans. These Visa Innovation know-how articles aim to help regional founders benefit from the wide knowledge generated by the team of Eleven Ventures.

Think about the following: as a small business owner you are able to help your clients finance their purchases so that they can afford purchasing your products and services without applying for loans. Thanks to embedded finance solutions this is already possible and has been for the past 10 years. Such solutions allow SMEs to tap into the products and services of banks with simple plug-ins and API integrations.

Embedded finance appears to be an untapped vertical with great potential to help SMEs and creators start offering their clients payment and lending opportunities through simple plug-ins. The technology can entirely transform the traditional buy-and-sell processes.

The growing market of influencers and Gen Z-iers is also a major opportunity for businesses to start using embedded finance to meet the needs and expectations of younger consumers. What is more, embedded finance solutions that are developed by tech companies are stealing the opportunity from under the nose of banks.

The key principle of embedded finance ‘Consume it when you need it’ places the focus on convenience and flexibility. That is why such solutions are especially well suited for retailers, e-commerce businesses, SMEs, and workers in the gig economy.

What does it mean to embed finance solutions?

Embedded finance is all about using banking-as-a-service solutions and API-driven payment and banking services as a non-banking institution. From the perspective of business owners, this means that they can lease their customers access to financial tools without having to develop anything in-house.

Therefore, by using embedded financial services every brand would be able to integrate a wide range of financial services within its existing products. Simply said, solutions such as that of the banking-as-a-service platform OpenPayd, allow every business to become fintech.

The use cases are definitely there and there are already a couple of very successful examples of businesses that have recognized the advantages of embedded finance. For example, only a couple of years after integrating add-on solutions for payments, lending, and bank accounts, Spotify now makes half of its revenue from financial services. Other players, such as Amazon, have also started to offer buy-now-pay-later options.

What does it look like to build banking features on top of your product?

The best part of embedded finance is that it allows for full customization without a single line of code. When using embedded finance solutions as a business owner or a content creator, you are offered a variety of choices depending on how you want to help your customers pay and finance their purchases.

For instance, businesses can start issuing their customers virtual IBANs and cards or even provide them with a web banking app. Here are some examples of no-code financing solutions, which embedded finance providers offer SMEs and content creators.

Set up accounts for your customers

Depending on your business model, you can choose for the account holder to be an individual customer or a legal entity.

Have peace of mind about ID verification and fraud

Embedded finance solutions providers usually entirely manage compliance and fraud risk. Therefore, as a business owner or a content creator, you don’t have to be a banking expert to provide banking solutions.

Add IBAN to your accounts

Usually, IBAN is assigned automatically to all the accounts that you set up, but some embedded finance solutions allow you to issue virtual IBANS as well.

White-label the banking experience or fully customize the UX

For the more tech-savvy businesses out there, embedded finance offers the potential for full customization through API integrations.

How to create value for your business using embedded finance solutions?

Avoid falling into the under-selling trap

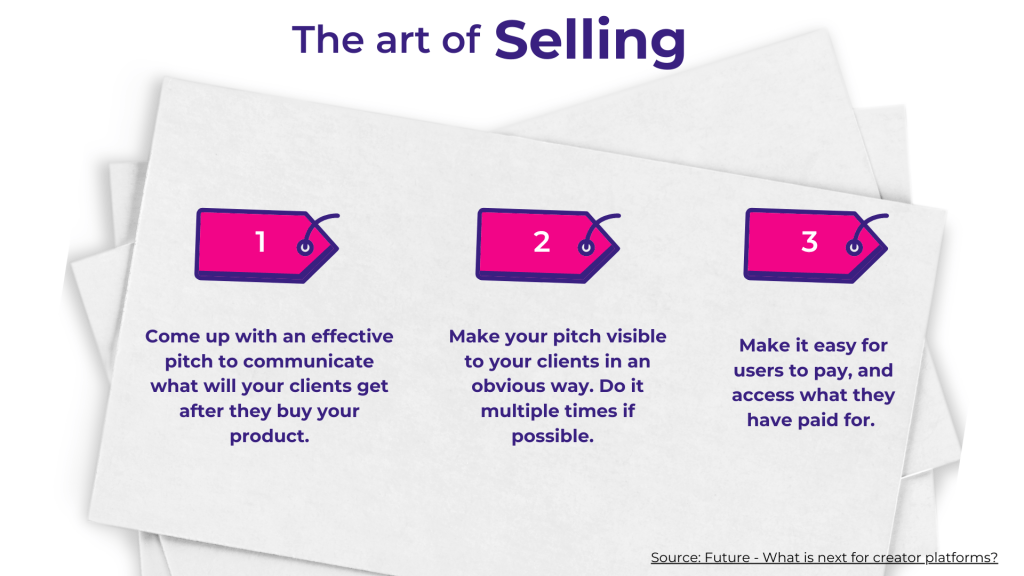

Have you already managed to build significant engagement with your customers? Do you have enough free content, a catchy value proposition, and effective marketing messages? All of these are essential elements of your sales strategy, but they are not the most important part. In order to get the most out of your sales, you need to seamlessly convert your leads into paying customers.

In the simplest terms, the art of selling is equally connected to having a good product and putting your product in front of your target audience.

Direct pitches do not have to be gaudy

Content creators should always keep this in mind and should seek ways to show audiences that they do sell their products and services. Think about the creator communities in all social media platforms. From e-commerce and graphic design to writing and video production, digital content creators do not always maximize the selling tools that are available to them.

Sometimes this is because of fear not to look too pushy in the eyes of their customers. However, integrating a “Buy” button is only a way to alert your audience that they can sign-up for premium content or seamlessly buy your products.

Deliver finance where and when your customer needs it

Imagine how many times a consumer looked at that pair of shoes on your website but did not buy them because they could not afford them at that particular time. But what if your business was able to offer that customer a small loan so that he/she can purchase the pair. Such capabilities would provide SME’s customers with options such as getting a loan or opening an account to make payments.

Take advantage of the data that will come to you

The ability to interact and gain insights from transaction data is essential for SMEs as it allows them to get to know their customers better. To help you grasp the idea better just think about the possibilities ahead of Spotify: the app is in a great position to start offering its customers loans based on the behavioral data it has about its customers.

Maybe in the future, it will become normal and expected for businesses to offer loans to help customers cover the purchase costs, offer opportunities for insurance and blockchain integrations to secure the entire process.

The next steps?

Everything so far sounds interesting? If you are ready to explore further and find the provider for your business case, here are some examples of international embedded finance providers opening in Europe:

- Starling, a UK-based digital bank, will be expanding its banking-as-a-service offering to Europe after securing regulatory approval in H2 of 2022. “Starling as a Service” will allow European businesses to build their own financial products including savings or current accounts, integrated digital wallets, kids’ cards, and debit cards.

- OpenPayd is a London-based payment and banking-as-a-service platform that has offices in Malta, Turkey, Bulgaria, Amsterdam, Singapore, Hong Kong, and Brazil. The services of the platform include IBANs, open banking, e-money accounts, local and international payments, and more.

- Mambu is a SaaS cloud banking platform that has developed a marketplace ecosystem with integrations across credit decisions, payment processing, AML, KYC, regulatory, CRM, accounting, customer experience, and more.

- Visa aims to combine efforts with fintech startups to drive more momentum for embedded finance. A recent example is the acquisition of Currencycloud in August 2021.

Some limitations to keep in mind

Usually, most embedded finance providers do not allow your customers to have a negative balance. Neither does it allow them to have interest-bearing saving accounts and to deposit cash and checks.

Additional considerations for business owners and creators are that embedded finance providers may have limitations in terms of the geographical location of the individual and business clients.

Resources:

https://content.sifted.eu/wp-content/uploads/2021/09/21093710/Embedded-finance.pdf

https://future.a16z.com/creator-platforms-neglect-the-sell/

https://www.openpayd.com/uk/blog/what-is-embedded-finance

https://www.openpayd.com/uk/blog/what-is-banking-as-a-service

https://www.finextra.com/blogposting/19478/opportunities-within-embedded-finance