GROWTH THROUGH M&A

by Etien Yovchev

Mergers and acquisitions (M&A) are not new phenomena in the business world. They have been used for decades by companies of all sizes and sectors to achieve various strategic objectives. But what makes M&A so appealing and effective as a growth strategy? And how can businesses in Central and Eastern Europe (CEE) leverage M&A to gain competitive advantages and create value? These are some of the questions that we will aim to answer in the following research.

Often when it comes to M&A in our region, The Recursive talks about local startups being acquired and achieving a successful exit. Today, we will go the other way around and explore how CEE enterprises can use such consolidations as an effective tool to accelerate growth, expand internationally, and stay competitive in their respective industries.

This text is aimed at business leaders, investors, and analysts interested in understanding the benefits of M&A as a growth strategy, particularly in Central and Eastern Europe. In recent years, with the development of the ecosystem, many companies in this region have started turning to M&A to expand their customer base, diversify their portfolio, and enter new markets.

For example, just before its IPO announcement in 2021, Romanian UiPath, a global leader in robotic process automation (RPA), acquired US-based Cloud Elements to expand its API capabilities.

Around the same time, Bulgarian Bulpros merged with ec4u, a German company that provides customer relationship management (CRM) and digital marketing solutions. The merger created a new company called DIGITALL, which offers end-to-end digital transformation services for various industries. In 2022, two more Bulgarian companies, Telelink Infra Services and euShipments raised funds to fuel growth through M&A.

Looking at Croatia, communications platform Infobip has recently acquired not one but two US-based firms – OpenMarket and Peerless Networks – with the goal of strengthening its global offering and expanding its customer base and revenue.

These are just some of the examples of how M&A can be a powerful growth strategy for businesses in Southeast Europe. But how can businesses find the right partner, conduct due diligence and valuation, and integrate successfully after the deal is done? And what are the challenges and risks involved in M&A transactions?

This deep dive will answer these questions and more, by providing insights and best practices shared by BlackPeak Capital, a Southeastern Europe growth equity fund that has worked on many similar deals in the past decade, including three out of the five examples above.

BlackPeak Capital: The partner of companies looking to grow through M&A

In 2022, BlackPeak Capital closed a €126M growth equity fund, seeking to make €5-15 million investments in already profitable scaleups across Bulgaria, Romania, Slovenia, Croatia, and Serbia.

The firm’s previous fund features industry leaders such as Resalta (energy efficiency), International Power Supply (off-grid electricity management systems), Walltopia (climbing wall manufacturing), Bulpros, now DIGITALL (IT services), and Excitel (Internet provider in India), while in the new one we can see names like Telelink Infra Services (telecom infrastructure), euShipments (logistics integration solutions), and Verdino (plant-based meat).

One of the key components of BlackPeak’s strategy and unique added value is to support the M&A-powered growth of late-stage companies.

The team plays a crucial role in the entire process, from determining whether M&A is suitable for a particular company to refining the strategy and identifying suitable candidates using the fund’s extensive network of contacts.

BlackPeak also participates actively in the structuring of the deal, the analysis of the acquired company’s valuation, and the overall investment process, including negotiations and due diligence.

Subsequently, the buying business takes a leading role in integrating the acquired company, with BlackPeak primarily involved in a strategic capacity, identifying synergies and building relationships between the new and old leadership.

“With euShipments, we initially acquired a company in Croatia. It came as a proposal from the founders, and we conducted an initial assessment of whether such a deal makes sense. We led the negotiation process, due diligence – hiring advisors and lawyers – and helped the target company prepare for this process. Currently, we are actively participating in developing the relationship between the two companies and are looking for suitable additional acquisitions in the future,” shares Angel Stefanov, partner at BlackPeak Capital.

Through strategic M&A, euShipments has already effectively capitalized on emerging market opportunities, strengthening its presence in Europe and the CEE region. The acquisition of the Croatian Pick & Pack at the end of 2022 has provided euShipments with a solid foundation to cater to the growing logistics demands in the region. A couple of months later, in May 2023, the acquisition of Helpship in Romania enabled euShipments to strengthen its position and improve operational efficiency and delivery times. Fostering synergies and knowledge-sharing across borders, these strategic moves have not only expanded euShipments’ market reach but have also fostered synergies and knowledge-sharing across borders, enabling the company to provide innovative and efficient logistics solutions.

What is next? “As part of our overarching strategic plan, we intend to execute an additional several more add-on acquisitions within the investment period. These targeted acquisitions are carefully aligned with our growth objectives and are aimed at further strengthening euShipments’ market position. By strategically identifying and integrating complementary businesses, we aim to capitalize on synergies, drive operational efficiencies, and unlock new opportunities for value creation,” Stefanov says.

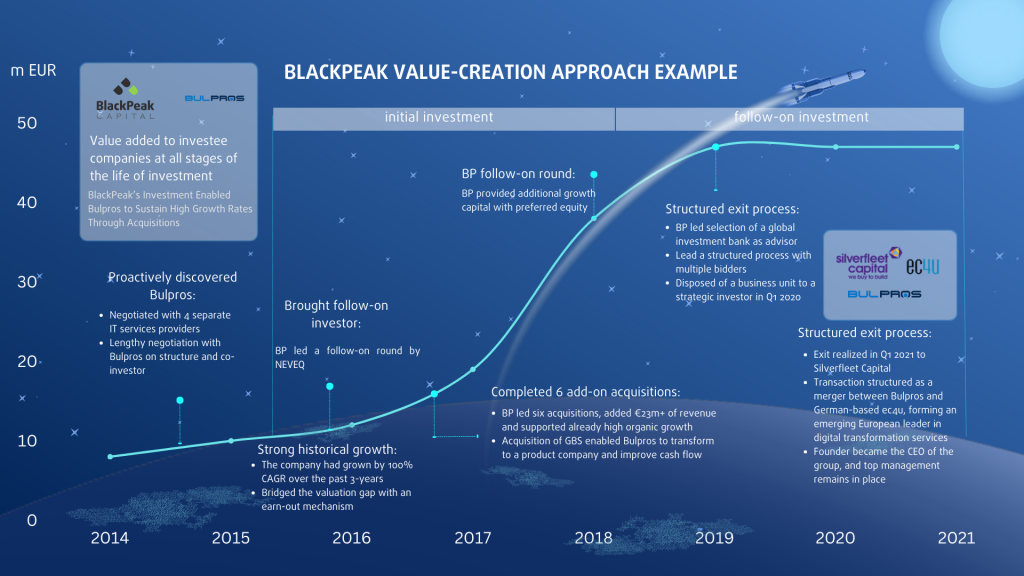

Another great case study is that of Bulpros, with which BlackPeak Capital has completed six acquisitions, including one of a considerably large company listed on the Frankfurt Stock Exchange in Germany. BlackPeak assisted with the structure of the entire deal, including the modeling necessary for financing with leverage from a Bulgarian bank.

Over the years, these acquisitions helped Bulpros sustain high growth rates, add 23 million euro of revenue to its top line, improve cash flow, and transform to a more product-oriented business.

In 2021, the company made an exit to Silverfleet Capital in a transaction structured as a merger between Bulrpros and German ec4u. The new entity – Digitall – emerged as a European leader in digital transformation services.

Last but not least, we have Resalta, an energy efficiency solution provider that has helped over 120 businesses and municipalities save 30, 000 t/y of CO2 emissions. When BlackPeak first invested in 2015, Resalta was only active on the Slovenian market with 7 million euro in annual revenues and 15 employees. Today, the company has over 70 million euro in revenue and has expanded to 7 markets in CEE.

Table of contents

When to start thinking about growth through M&A?

In the early stages of a company’s development, growth comes more easily since it starts from a low base. However, over time and after a few strong years, growth usually slows down. This may be due to market saturation or an inability to scale from a human resource perspective.

In such a situation, a company may consider an M&A strategy for five main reasons: to accelerate growth quickly, improve profits, expand internationally and enter new markets more easily, enhance services with a new technology, or eliminate competition from the market.

Factors to consider are numerous, but the founders’ long-term vision is always key.

The next step is to think about what exactly the company is looking for in an acquisition: market entry, access to customers, new technology, or a team of skilled professionals.

Double-check if you’re ready to grow through M&A

Mergers and acquisitions are a sensible growth strategy for companies that have reached a good level of operational efficiency and maturity, enabling them to take on the additional responsibility of managing another business.

He goes on to explain that M&As can lead to two main types of synergies. The first is revenue synergy, which involves not only taking on the clients and revenue of the acquired company but also having the opportunity to upsell your products to those clients. While this sounds great, it is often harder to achieve.

On the other hand, cost synergies are more realistic. They result from lowered expenses due to increased efficiency of the merged businesses. For example, if both companies have accounting departments, you can optimize the two and create a more efficient accounting team. The same can be applied to other company functions like HR, IT, and Sales.

However, if you don’t have the right structures in place to manage this integration process, the chances of failure increase significantly.

What are the best ways to find good targets for acquisition?

In general, the process is similar to how one would find customers – you go out there and start searching. Provided you’re not already familiar with all the players in the market, one approach is to talk to industry experts to identify companies that fit certain criteria, such as those with complementary products or services, or those operating in a specific geographical area.

Another option is to use professional networks, such as investment funds bankers or business brokers, who can provide information on companies that may be available for acquisition.

An important consideration is the cultural fit. A company’s culture can have a significant impact on the success of an acquisition, so it’s essential to identify targets that have a similar culture and values. This can be done through careful research and analysis, as well as by meeting with company leaders and employees to get a better sense of their culture.

Additionally, it’s crucial to consider the financial and strategic benefits of a potential acquisition. Companies should look for targets that have strong financials, including solid revenue growth and profitability, as well as a strategic fit with their own business objectives. This can involve examining the target company’s market position, competitive landscape, and potential for future growth.

M&A Negotiations

Identifying potential targets for mergers and acquisitions can be a difficult task, but negotiating a successful deal can be even more challenging. While some scenarios involve owners who want to sell their businesses, more commonly, targets are identified without them even considering a sale. This means convincing them that a merger or acquisition would be beneficial for their company and align with their overall strategy.

Selling the idea of a merger or acquisition requires presenting a clear vision and explaining how it will benefit the target company. This is especially important in cases where the target company is not actively seeking a sale. The next step is to understand the strategy of the target company and how it can fit with the buyer’s business.

Valuation is always an important aspect of any deal, but it’s never the first step. Before valuation comes into play, both sides should agree on the overall strategic fit and benefits of the deal. Once the strategic fit has been established, valuation can be discussed in more detail.

When it comes to negotiation, there are several best practices to keep in mind. First, it’s important to establish a good rapport with the other party and to show them that you understand their needs and concerns. This can help build trust and facilitate a smoother negotiation process. It’s also important to have a clear understanding of the target company’s financials and operations, as well as the overall industry landscape.

Another key factor in successful negotiation is having a well-defined and realistic negotiation strategy. This involves setting clear goals and objectives, as well as identifying potential concessions and trade-offs.

Let’s say Company A is interested in acquiring Company B, but Company B is hesitant to sell because they don’t want to lose control over their business. Company A can offer a trade-off to Company B in the form of a stock-swap deal. In this deal, Company B would receive a significant percentage of Company A’s stock in exchange for their own company.

This trade-off would allow Company B to maintain some level of control over their business while also benefiting from the growth potential of Company A’s stock.

Valuation before the acquisition

Valuing a company is a crucial aspect of M&A negotiations, as it determines the price that the acquiring company is willing to pay for the target company. But how exactly do you value a company? There are a few commonly used methods in the industry, each with its own strengths and weaknesses.

The most commonly used method is the market approach. This involves looking at past transactions involving similar companies or examining publicly traded companies and taking their revenue and profit parameters. Then, you calculate a multiple of EBITDA and a multiple of revenue, which leads you to an average value for similar companies in the industry.

However, sometimes there are no comparable companies available for comparison, and that’s when you have to rely on the expertise of the person conducting the valuation to determine how different a given company is from the baseline companies. Ultimately, these multiples are applied to the corresponding parameters of the company being examined to arrive at a valuation.

Another method is the income approach, which involves making discounted cash flow projections for the future. However, this method is not as widely used because valuations based on it are a function of too many assumptions, whether optimistic or pessimistic.

The third method, which is more suitable for valuing startups, is the targeted income approach. This involves calculating how much money you plan to invest in a given company and what kind of return you’re looking for. By reversing the calculation, you arrive at the real valuation that this company needs to have for you.

Valuing a company is a complex process, and it’s important to remember that no single method is perfect. The best approach often involves combining different methods to arrive at a more accurate and comprehensive valuation. Additionally, it’s important to consider factors beyond financial metrics, such as market conditions, competitive landscape, and potential risks and rewards, when evaluating a company for acquisition.

Potential M&A risks

In short – many things can go wrong. Below are just a few examples of scenarios to be aware of. When acquiring a majority stake, sometimes the founder remains and continues to manage the company together with the new owner. In this scenario, it is important for the founder to feel incentivized to continue.

However, there is a potential risk of the acquiring company wanting to control everything and this could potentially ruin the relationship with the founder.

Another risk is not having a unified plan, for example, different sales teams approaching the same client and saying different things.

There may also be unforeseen costs associated with the acquisition. It is important for the deal to make financial sense and not to pay an overly high valuation if the value of potential synergies is lower.

Integration of the two companies and optimization of the number of employees can also be a problem – who leaves and who stays can create dissatisfaction. It may turn out that the business models or technologies are not as compatible with your market as you thought, leading to further challenges.

Outlook for the future of M&A as a growth strategy for CEE companies

With the development of the overall economy and business environment, M&A will certainly continue to rise in popularity as a tool for business growth and international expansion.

Companies in CEE are increasingly looking to expand beyond their national borders through cross-border M&A. This trend is driven by the desire to gain access to new markets, diversify their operations, and increase their competitiveness in the region as well as globally.

Furthermore, there has been a significant level of consolidation in certain sectors in Southeast Europe, such as banking, telecommunications, and energy. In the IT sector, we can see higher growth funding availability for local companies, which would enable more and more scaleups to add M&As to their growth toolbox.